Retail foot traffic analysis: how many of your customers are shopping around

Analyzing the competition with retail foot traffic data

In today’s highly competitive retail environment, it’s critical that brands regularly analyze their competition to help inform strategic decisions – from retaining market share to winning new customers.

With economic and supply chain challenges causing disruption in inventories, stock, and consumer spending behaviors, brands may have found loyalty is being put to the test in recent months. Some industries always have a large amount of cross-shopping, purely because of the choice of concepts available, others tend to have greater loyalty due to the limited number of operators at a particular price point, the strength of offers, or scale advantages causing high barriers to entry.

Of course, the most successful brands never stand still – because consumers, technology, and markets are constantly evolving.

Today, retailers can leverage a wealth of data and analytical capabilities to help them understand exactly what’s happening in their market in real-time. In this piece, we’ll utilize retail foot traffic data to explore the types of insight retailers can use when trying to understand the level of cross-shop happening in their space.

Cross shopping: in theory

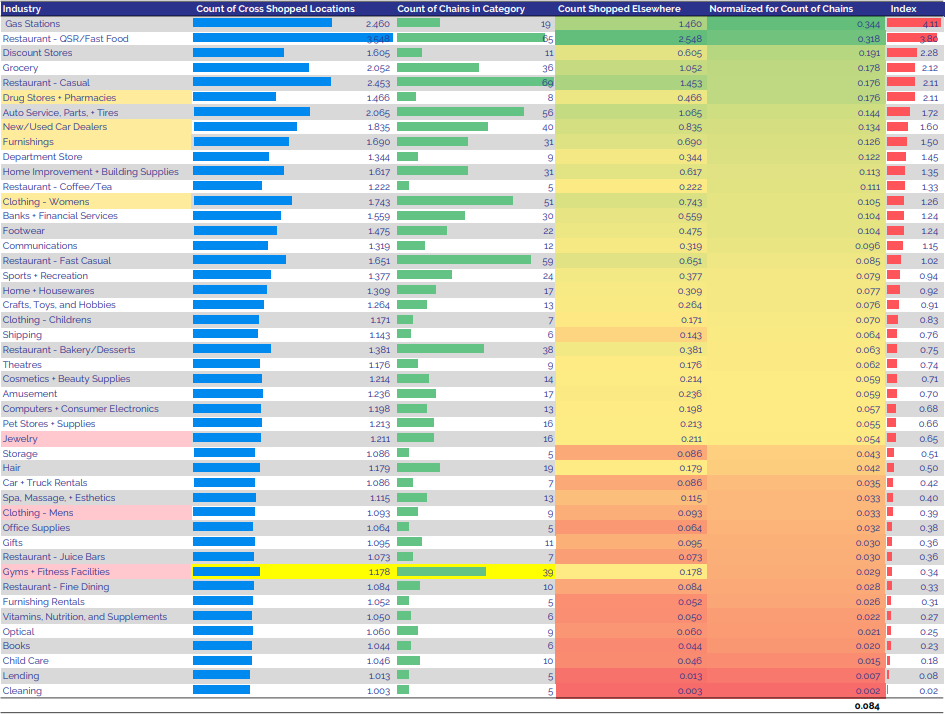

To give some practical examples, we analyzed mobility patterns to see how levels of cross-shop differed across industries. For example, where industries have similar characteristics of chain counts and business models, do we see some verticals where cross-shop is particularly high or others that are surprisingly lower?

Logic would tell us there is likely to be a higher amount of cross-shopping where you have large numbers of brands in a similar space. Consider the quick service restaurant (QSR) industry as an example. In our analysis, we identified 65 different QSR brands, meaning cross-shopping will be far higher than in industries where variety is limited – nobody wants to eat the same burger every single day. To account for this disparity, we applied a level of normalization to identify nuances in the data when working across industries with fundamental structural differences.

The ‘Count of Cross-Shopped Locations’ column refers to the average count of cross-shopped locations customers visit. The ‘Count Shopped Elsewhere’ column refers to where verticals rank based on the average number of locations visited other than the primary store. We normalized this by dividing ‘Count of Shopped Elsewhere’ by the square rooted number of the ‘Count of Chains in Category’. The final column, ‘Index’, shows which industries have an above or below-average amount of cross-shopping based on relative chain count.

Let’s take a look at Childcare – a vertical with very little cross-shop. If parents/guardians are visiting more than one location, they may have multiple children in different age groups, but they’re unlikely to take one child to different locations once they have a childcare option they trust. Loyalty is particularly high because convenience or price point or variety – typical drivers of cross shop elsewhere – are less likely to be an overriding factor when we’re choosing who should look after our children.

Conversely, in the gas station space, we see far higher levels of cross-shop due to the convenience-led nature of refueling. Of course, factors such as raising gas prices or outstanding food/coffee/facilities can drive greater loyalty within even convenience-sensitive verticals. In this instance, brands should look to understand which particular sites within their trade areas are cross-shopped most with their own, the reasons why, and then leverage that insight to capture greater market share. This is where market intelligence derived from cross-shop analysis and retail foot traffic data can become a valuable asset in the toolbox of real estate professionals and marketers alike.

Exceptions

Of course, there are industries that buck the trend – where you may expect to see particularly low or high levels of cross-shop, but instead, we see the opposite. Often, this is due market characteristics unique to that vertical. Understanding levels of cross-shop will tell you so much; the value is understanding why and what action to take.

Above average exceptions

Let’s consider drugstores and pharmacies. We might expect customer loyalty for a health-driven concept to be high – we want to visit a pharmacist we trust. But today many drug stores dedicate significant space to groceries, bringing locational convenience to the fore. This evolution of the drugstore and pharmacy model from a vendor of prescriptions and over-the-counter medicines is a microcosm of the diversification of the core retail offer we see in many industries.

Another example of note is car dealers and furnishings. Although these industries have an average amount of competing chains, the high price points involved mean customers naturally visit more locations both to see the product in the flesh and find the best value.

Below average exceptions

Like car dealers and furnishings, jewelry stores will have high price points with an average amount of competition. So why the exception? It’s about understanding the consumer. From our experience of working with clients in the jewelry space, customers tend to build a personal relationship with their preferred store. When people receive a sentimental item like a wedding ring, they tend to hold a connection to the vendor. When they’re in the market for another piece of jewelry, they’re less price-sensitive and sustaining that connection becomes more important.

In some cases, the number of chains does not affect the amount of cross shopping. While gyms had one of the highest count of chains in our analysis, the level of cross-shop is very low. This is largely due to the business model – gym membership can be expensive; most patrons are unlikely to hold memberships with multiple brands. They’ll pick the most convenient based on their daily routine and stick to it. But there are signs of disruption. We’ve seen the emergence of flexible usage platforms such as Trainaway and many gym brands now offer day passes, which may mean increased cross-shopping in the years ahead.

What does this mean for site selection?

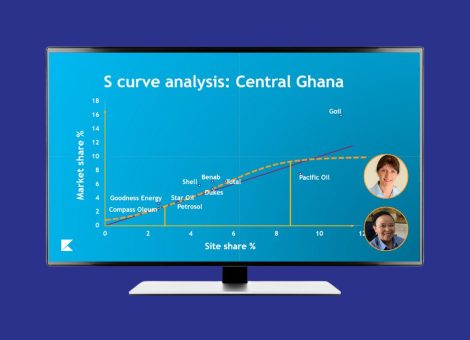

Understanding the competitive pressures your brand faces is a crucial factor in making smart site selection decisions. The benefits range from identifying white space opportunities, knowing which markets to enter, real estate portfolio optimization, and understanding which co-tenants you should locate near to or avoid. Our analysis considered competition within chains, but the application of mobility data to specific locations within a portfolio can uncover granular insight to help you maximize the performance of your sites.

For real estate and marketing professionals, cross shop analysis with by retail foot traffic uncovers valuable, actionable insight to help you prioritize your activity for the best return.

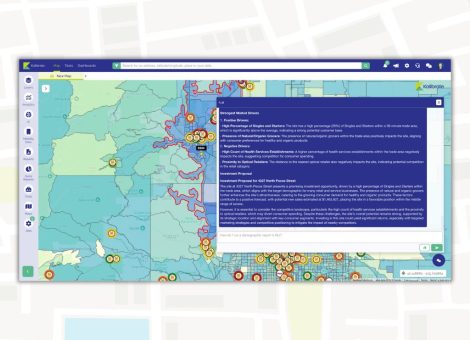

Competitive Insights demo – cross shopping

Read more articles about:

Location intelligenceSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related Posts

Location intelligence

Right-size your franchise territories: Maximize revenue per market

Franchise territory management tools are evolving changing with advances in location intelligence.

Location intelligence

AI in location intelligence: See it in action

See videos and screen captures of how AI has been integrated into the KLI platform.