With decades of experience supporting fuel retailers, we’ve seen a few changes in our time. The forecourt of the 1990s is a world away from today, but what if we were to look 30 years from now? How would the growth of EV and changes in consumer behavior have been reflected on gas stations and the forecourt? We asked our team to give us their thoughts.

What types of locations would we find gas stations?

Elizabeth Kershaw:

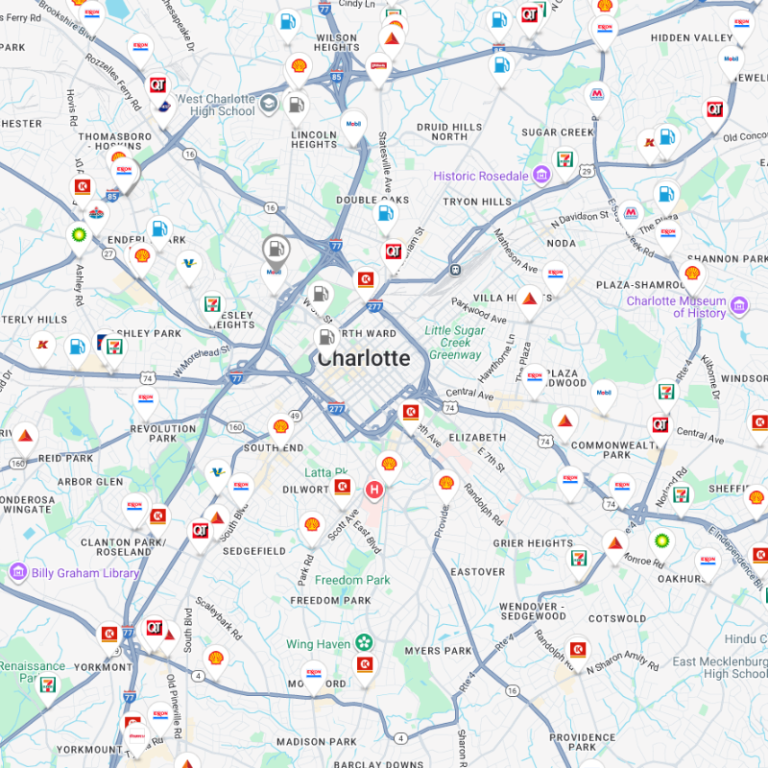

Broadly speaking, we expect to see ‘fueling’ sites in the same types of location as we do now. The shift will come in the types of fueling, services, and amenities – and there will be a large amount of variation by country and within urban, rural, and transient settings.

Part of this will be driven by electric vehicle adoption. Countries and regions with the highest levels may see urban gas station sites converted towards quick stop/top up charging destinations. As we move towards the rural settings, vehicles required for agriculture, different terrain, and longer journeys with less population density, gas stations will remain critical to local infrastructure.

Gas stations on highways and key arterial routes will be required long into the future, serving retail customers, commercial, and heavy haulage with a wide range of fuels.

Another factor to consider is the legislative. The expansion of ‘low emission zones’ around cities – such as the ones seen in London and Paris – will drive consumers towards different choices. That may be towards an electric or hybrid vehicle earlier than anticipated. Gas station operators active within these zones will need to consider how to preserve the ongoing viability of these sites.

How might the forecourt have changed – does it still exist?

Nancy Wheeler:

Demand for fuel will remain well into the second half of the century – but demand will vary significantly depending on the type of location. The forecourt, as we know it, will still exist in the right locations according to demand.

It’s likely that we’ll see bigger forecourts. Consider gasoline and diesel, alongside EV charging – it’s just going to take up more space – but the types of location where demand will exist should have a good availability. We may see more of the Buc-ee’s type model – which large stores attached to huge forecourts and dozens of fueling or charging points. Those sites will likely go beyond purely a convenience store; it’ll become the norm to see clothes, travel items, a wider selection of grocery – all alongside more compelling fresh food or QSR offers.

The smaller footprint gas stations we see today will have to think strategically about how to utilize their space. If EV charging is required, operators will need to assess the optimum configuration of pumps and chargers as EV adoption gathers pace.

How will we be paying for gasoline / alt fuels?

Beth Thompson:

Cash payments are generally going down across the globe, and they pose particular security concerns for retailers that operate unmanned stations.

Historically, mobile phone use on forecourts has been frowned upon due to concerns around fire hazards and loss of concentration – but more and more people use their mobile to tap and pay, and we can expect contactless/mobile wallet payments to become more common, particularly in countries where the average transaction value is relatively low. Loyalty integration with ANPR and automated debit payment would be a logical, if not potentially problematic, step towards frictionless transactions.

As for EV charging – a lot could be driven by the state of integration or fragmentation of the charging network in a country. Well-integrated networks may lean towards subscription models with customers paying a monthly subscription to access chargers at any location.

What types of operating models will we see?

Beth Thompson:

The current cost of entry for EV chargers could lead to greater consolidation as larger operators acquire small networks that are unable to fund mass charger roll out. However, this will be determined by the rate of EV adoption in the site’s trade area.

As alternative fuels begin to erode fuel volumes across the board, we may see site owners reassess locations through the lens of pure commercial real estate leasing. In effect, asking ‘what’s the best combination of ‘refueling’ and ancillary services – whether that’s café or QSR or retail – to maximize the potential of the square footage available?’

This operating model will require in-depth analysis of changing consumer behavior in the market, adapting to EV adoption, and planning the appropriate complementary retail offer. Data-led approaches will be the most successful.

Who will gas stations compete with?

Elizabeth Kershaw:

The competitor set will largely depend on the location of the gas station.

Consider urban locations – we’ve seen some major cities in developed countries impose low emissions zones. Here, it’s likely gasoline demand decline will be pronounced. EV charging services offer a viable alternative for gas station owners, but retailers and malls – and anywhere seeking to draw customers for an extended period – will also offer EV charging and may be the key competition. That said, urban residential areas often have little space for EV charging at home, so there will be no shortage of consumers requiring private charging.

The suburban will be more mixed. Suburbs with wealthier populations experience higher EV adoption. Some sites may become unviable for gasoline – but with more space in the suburbs, home charging will be more prevalent. In these areas, gas station operators will need to strategically diversify their sites, catering to their market to remain sustainable. They’ll compete indirectly with at-home charging but also retail centers that offer charging within parking bays.

In rural settings, the distances travelled, and types of vehicles used, will mean gasoline demand sustains for the longest. Until we reach the late majority of EV ownership, gas stations in rural locations will likely only see the impact of EV in reduced demand from transient visitors – i.e., those travelling through their market rather than living and working within it. Gas stations will continue to compete against each other.

Gas stations and locations specifically serving transient journeys will have to cater for EV charging alongside gasoline for a considerable period. These locations attract the most diverse customers – from haulage and other commercial fleet, to families travelling long distances for the holiday season. Again, careful analysis of demand and profitably across fuel, EV, and ancillary services is the best way to plan for long term sustainability.