Fuel retail M&A in Europe: How viable are acquisition sites?

Mergers and acquisitions in the European fuel retail market are hotting up.

Earlier this year Alimentation Couche Tard (Circle K) completed their acquisition of 2,175 of TotalEnergies’ European sites, including 1,191 in Germany, 562 in Belgium, 378 n the Netherlands, and 44 in Luxembourg.

More recently, Philipps 66 have announced plans to divest its non-core assets and sell its JET branded fuel station network in Germany and Austria.

With multiple fuel retail sites available for acquisition, how do you know which sites are worth the investment? How can a business assess the full potential of a site or a full network and still act quickly enough to beat the competition?

Kalibrate’s 7 Elements for Fuel and Convenience Retail Success allow you to measure the potential of a site – not just the current performance.

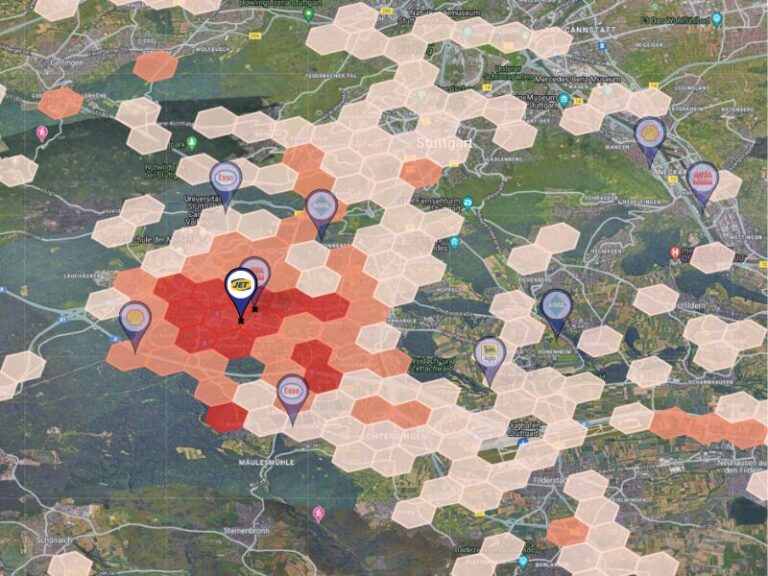

Let’s look at an example of fuel stations in Germany:

Both sites are located on the outskirts of Stuttgart, Germany.

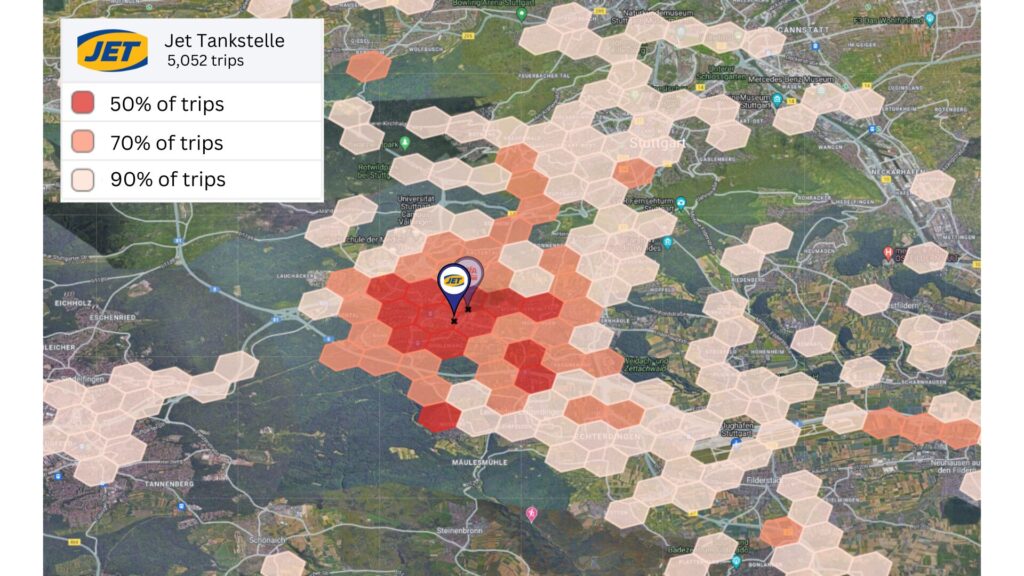

Site A is located on a busy road in a business district with a large residential area to the south. It offers four pumps with 21 nozzles, creating six simultaneous fueling positions. Both the fuel and shop are branded Jet. The shop offers a small bakery serving fresh goods and a car wash is also available.

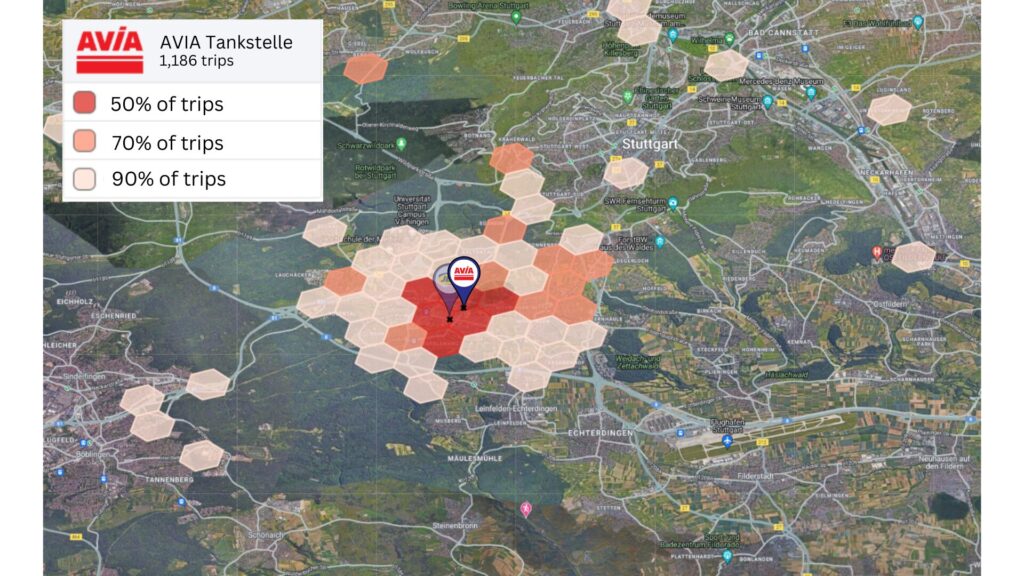

Site B is located 600m north of Site A, on the edge of a large residential area. It covers a significantly smaller area and offers two pumps and 14 nozzles. Despite being small in size, it offers a shop, bakery and car wash, as well as self-service delivery lockers. Both the fuel and shop are branded Avia.

Here’s how they score against Kalibrate’s 7Es:

While Site A is stronger in many areas, Site B has a higher location score – suggesting investment in this site would lead to an increased return. The 7 Elements framework flags facility as an area of improvement for both sites. While neither site occupies a large footprint, and extending is unlikely in these urban areas, understanding the customer base and providing the offerings that meet their specific needs and differentiate each fuel stations will significantly improve the facility score – and bring more customers to the site.

By analyzing mobility data we can see where customers of each site originate from. This side-by-side comparison shows that these two sites are in direct competition with each other, getting the bulk of their customers from the same locations. However, Site A is attracting considerable numbers of customers from further away and their trade area covers a far larger range which suggests that their offer is better suited to the local clientele. Combining mobility data with demographic and psychographic data will create a reliable customer profile for these sites that can be used to tweak the in-store and ancillary offers and boost the overall profitability of these fuel stations.

What’s the potential?

Using the 7 Elements framework and mobility data analysis, we can see which of these sites has the most potential.

Site A is performing well, drawing in customers from a large trade area. If this is site is being considered as an acquisition target, it will immediately add to your network quality. There is room for improvement on the facility score, so investing in the in-store offer here will yield an overall increase in sales performance.

Site B has a smaller trade area and less customers over the same time period, so is likely to be yielding lower sales than Site A. It may still be a suitable acquisition target. It’s high location score means that it has great potential. Investing in facility and operations will have a big impact on site performance. Sites like this one, that may be behind the market average on current performance could be acquired at a lower price, and knowing exactly what to alter to attract more customers and improve sales can give a savvy business a low-cost acquisition site with huge potential.

For more ways to unlock site potential, read about Kalibrate’s performance potential analysis

Or take a look at these client stories to learn about the different ways Kalibrate is helping fuel retailers across the world

Read more articles about:

Location intelligenceSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related posts

Location intelligence

Forman Mills accelerates growth with the Kalibrate Location Intelligence platform

The value apparel and home goods retailer selects Kalibrate to to support its national expansion strategy.

Location intelligence

The Kalibrate news round-up: November 2025

In this monthly feature, we look across the industry and mainstream news to uncover stories of note that we think are...