Part 5: what value does my brand bring to my fuel retail network?

So far in our series on the Top 5 Questions Convenience Retailers have about Retail Network Planning, we’ve covered the best practices for implementing a network planning tool and how you can pinpoint the best locations for new builds, as well as how you can identify target sites or networks for acquisition. Last time, we discussed your current network’s volume potential. Today, in our final installment of this series, our focus is on brand: What value does your brand bring to your fuel retail network?

Understanding the Impact of your Brand

Capturing the value of your fuel retail brand is not a matter of a one-time review. Indeed, reviewing your brand is a task you must take on consistently, as you may regularly take actions that you think will improve your brand overall, but that in reality, may move you backward or keep you stagnant in reference to your competitor’s pace.

Where do you begin? Start with a defined geography to create the bounds of your market. You can’t simply observe what actions you take to grow and strengthen brand on a nationwide level and assume all is well. While in some markets you may be the brand leader, in others you could be lagging behind. Choose your market boundary before examining how your decisions impact your brand and how your brand impacts your network.

Once that’s defined, you can begin to drill down into which other aspects of your site and network health might affect brand health. For example, consistency appears to have a large effect on brand. Your offering, your price philosophy, your facility, your operations — all have an impact on brand “score.” But brand also has an impact on all of these elements, as well. There is interplay, which makes it that much more important to regularly assess your brand’s overall health.

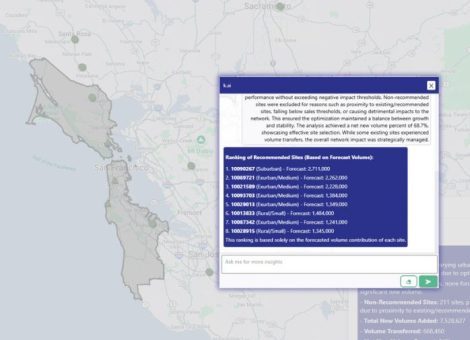

Of course, assessment without a tool that combs through and sorts your data may pose a challenge. When you select a model or tool, all of these seemingly subjective measures can be viewed objectively — but that isn’t the only benefit. The right model can also help you feed all of these factors into tactical projections, so you can make stronger investments based on potential volume.

Presence and Performance

Kalibrate measures brand health on presence and performance. Presence is at its peak when you have more and higher efficiency sites in a given market than your competitors. When presence is strong, you must also increase effectiveness to improve performance.

Look at your existing fuel retail network and determine in which areas you might seek to improve volume performance by either building new sites with higher throughputs (i.e., creating an even stronger presence), acquiring sites with a high-volume potential, or improving existing sites.

There are also less capital-intensive activities to consider for implementation across your market, such as promotions and small offering upgrades.

However you choose to approach increasing brand presence and site performance, consider the value your brand really adds to your fuel retail network’s success. A brand analysis at the deepest level can tell you exactly how many cents per gallon your brand contributes. Knowing that, it becomes clear that brand has value. Now, how do you increase it?

To learn more about how brand impacts your fuel retail network health, read about the 7 Elements for Fuel Convenience Retail Success here.

Read more articles about:

Location intelligenceSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related posts

Fuel pricing

Fuel pricing by exception: When do analysts actually analyze?

Managing fuel prices can be time-consuming, especially when analysts spend much of their day on routine tasks....

Fuel pricing

Middle East / Africa - Fuel network planning: Critical insights

Join our team as we look at the key points of insight that fuel network planners need to consider when making...