Fuel and convenience: market entry through network acquisition

When we work with fuel retailers entering new markets, there are three main approaches to consider.

The first is greenfield development; building brand new sites. This approach can be slow, with the time to gain planning permission sometimes measured in years over months – and the build costs are substantial. If you are expanding into a highly competitive developed market, it’s also likely that many of the prime locations are already occupied by existing gas stations. With that said, new builds – if spread over a number of years – could mean more staggered costs than some alternative options whilst allowing you full control over what and where you build.

The second, and quickest route to scale, is acquisition. It’s fast because acquiring existing sites means you don’t require planning approval. Infrastructure is largely in place, reducing the time to value because the sites are already operational. The drawback of acquisition is the requirement for a significant amount of capital up front.

In addition, acquiring the portfolio of a competitor may not give the exact market impact you’re looking for as you will often acquire a mixture of sites, some of which may not meet your expected standards or be in suboptimal locations.

The third approach, the combination of new build plus acquisition may be the optimal route for a retailer

Balancing upfront costs with immediate returns, new build plus acquisition allows the acquiring brand to gain some immediate returns while managing costs of new builds and upgrades to acquired sites as capital allows.

Let’s take a deeper dive into this third category.

Assessing an acquisition alongside new build

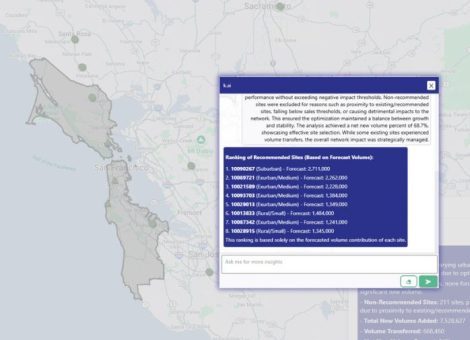

When Kalibrate works with fuel retailers taking a new build plus acquisition approach to market entry, we start by understanding the strategic requirements. How many units do they need to reach critical mass?

Based on this, we can begin to assess which acquisition portfolio targets, alongside new builds, have the optimum locations and site count to achieve the targeted market share. To conduct this analysis, Kalibrate would deploy ‘what if?’ scenario simulations using our proprietary predictive modeling. This means we can quickly evaluate multiple options and combinations to assist in identifying the option which would be best meet the retailer’s strategic objectives for that market.

Let’s start with assessing proposed acquisition candidates together with new build locations using a market share and outlet share s-curve.

Acquisition network A

Acquisition network A

This visualization represents a smaller portfolio acquisition alongside new build sites. On the s-curve, the entry is too conservative, in terms of unit counts, to reach critical mass. The brand impact would not be significant enough to reach a desirable market share and it’s highly likely the sites would underperform.

Acquisition network B

Acquisition network B

A more aggressive market entry would see a larger portfolio acquired. In this instance, the market would be oversaturated. The portfolio would capture a larger market share, but the profitability may not be optimal across the sites. It’s likely sites would be cannibalizing each other, limiting the overall profitability of the new portfolio.

Acquisition network C

Acquisition network C

In the third acquisition candidate, the combination of acquired sites plus the new build locations would enable critical mass while remaining in the sweet spot and avoiding oversaturation. Market share would surpass the levels expected based on the number of outlets. In this hypothetical situation, acquisition portfolio C plus the new builds would be the optimal target.

Rebrand and upgrade prioritization

After an acquisition, the challenge then becomes the timing of any rebrands and site refurbishments or upgrades. More critically, which sites should be prioritized – and what action should be taken – to start repaying the capital investment.

Rebrands, rebuilds, and upgrade simulations can be conducted with network planning solutions – like Kalibrate Planning. Kalibrate can apply various tools and analytical insights to help retailers identify opportunities and prioritize investments to maximize return and decrease time to value. The ability to run different simulations such as rebrands, upgrades or even scrape and rebuilds either individually or across the portfolio provides the insight required to identify the right actions to take and ensure the right prioritization is applied. For example, the acquiring network could focus on sites with the greatest untapped potential first to recoup investment quicker, whilst also balancing minor upgrades against major investments

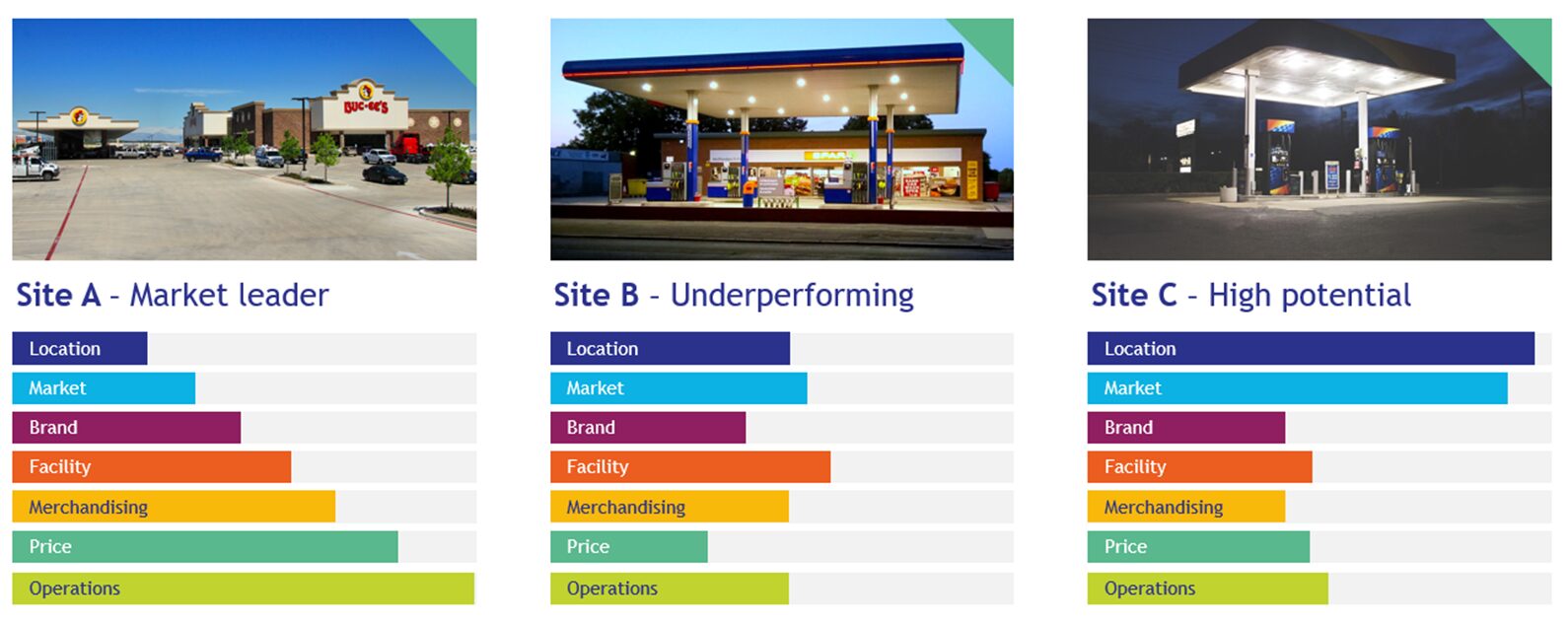

To identify sites that have strong market potential but may be underperforming for other reasons, we would apply Kalibrate’s 7 Elements for Fuel and Convenience Retail Success.

Kalibrate uses a combination of proprietary modeling, extensive global market and site data sets, and a profound understanding of fuel retailing to generate 7 Element (7E) scores for each site in a market. That market can be a single city, region or a whole country. The best-practice approach for fuel retailers seeks to maximize performance by considering the role of each element in tactical and strategic actions.

These 7E scores provide a standardized benchmark to support decision making by understanding the strengths and weaknesses of sites and pinpointing areas of underperformance.

A Performance Potential Quadrant (PPQ)

Application of a 7E framework allows an acquiring party to quantify ‘dirt strength’ i.e., a good location, but are lacking in other areas of the 7 elements. Essentially, we’d consider these sites to have higher potential but lower performance. These sites have the greatest opportunity to capture a greater share of their market. The 7E analysis can then instruct whether fuel price, facilities, operations, merchandising, or brand would help unlock the potential of the site.

In our hypothetical acquisition portfolio, those sites in the lower right quadrant would be considered the priority. The 7E framework outputs can guide the acquiring network on the steps to take to realize the volume potential.

In this instance, the sites in the lower right quadrant of the PPQ would be most closely aligned with Site C. The market and location should deliver strong performance, but the site is held back by a suboptimal brand, merchandising, and pricing strategy. Improvements to facilities and operations would also help the site reach its volume potential.

Takeaways

The approach outlined above is a strategic view of growth through acquisition. Understanding the current performance and potential performance of acquisition targets helps you recover return on investment quicker by targeting the right sites for improvement and prioritizing further capital spend. Conversely, understanding which sites are unlikely to ever deliver a return helps avoid costly missteps or help identify those sites which might be right for disposal or closure

Data-driven methodologies, which factor-in all the contributors to success, help decision-makers invest wisely – whether that’s through new build, acquisition, or a combination of both.

Read more articles about:

Location intelligenceSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related resources

Location intelligence

AI in location intelligence: The force multiplier for smarter site selection

AI is rapidly advancing in the world of real estate - this is the first blog in a two-part series on incorporating AI...

Location intelligence

Five burger companies, five problems

These burger brands had challenges from international growth to understanding franchise locations cannibalization,...