The Kingdom of Saudi Arabia is very different to its neighbours in terms of fuel retail. Historically there have always been multiple players in the market from single site operators to huge national brands.

Demographically, Saudi Arabia is a very young country, with 70% of the population under 35 years old. The make up of drivers is changing, as women were first granted driving licences in the Kingdom in June 2018, and there has been an influx of female drivers on the road in the years since.

The government in Saudi Arabia are pushing the market towards consolidation with new stricter licencing rules and regulations. There are a lot of restrictions that fuel retailers need to stick to in order to attain the higher margins awarded to licenced retailers, and these require a lot of investment. Notably, to retain licences you’ll need to have 200 fuel retail locations, and they must have certain facilities available like a convenience store or coffee shop.

The eventual outcome will be that the small single site operators will be bought out, and in 10 years’ time there will be 10 or 12 main players.

So, the race is on for fuel retailers in Saudi Arabia. Many are looking at acquisition targets as well as optimizing existing sites – both of which require large cap ex investments. Now is the perfect time to utilize a data and analytics lead software platform to help expedite decision making. Making the right investment decisions quickly and confidently will put you ahead of the pack.

With forced consolidation like this there will be many opportunities to acquire sites – as well as increased competition. Fuel retailers need to make sure they are competing for the right locations. The ones that will add to their profit and not drain their operational resources.

How to assess if a location is right for your business?

- How to assess the potential of any fuel retail acquisition target

The quality of acquisition targets is variable. Whether you’re looking at one single site or a full portfolio acquisition it’s imperative that you understand the future potential of each location – regardless of the current performance of that site.

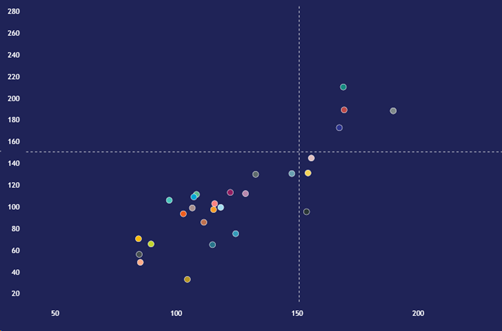

This quadrant chart maps each acquisition target in terms of both performance and potential. This gives you an understanding of the longevity of the site. If it’s performing well today, will it continue to perform well in the future?

Each dot on this chart represents a fuel retail location.

The sites in the top right quadrant have high potential and high performance. They are high achieving sites and would immediately add to the quality of your network.

The sites that fall into the bottom right quadrant have high potential but are underperforming. These could be great acquisition targets as the price can be negotiated based on their current performance – and the potential of their location is so strong that with investment performance will improve. For a longer term outlook they will add value to your portfolio.

Sites in the bottom left quadrant have poor potential and poor performance. It’s not unusual to see the majority of sites here – particularly in a market like Saudi Arabia where there are lots of smaller operators who have built where they can. But these are sites that you might want to think twice about before acquiring. The strength of their location isn’t great, so even with a new brand and investment they are unlikely to see big performance increases. Sites like these will allow you to scale your business in terms of locations – but might not add to your profits.

- Which acquisition targets are good now – which ones need investment to improve performance – and which might never perform well?

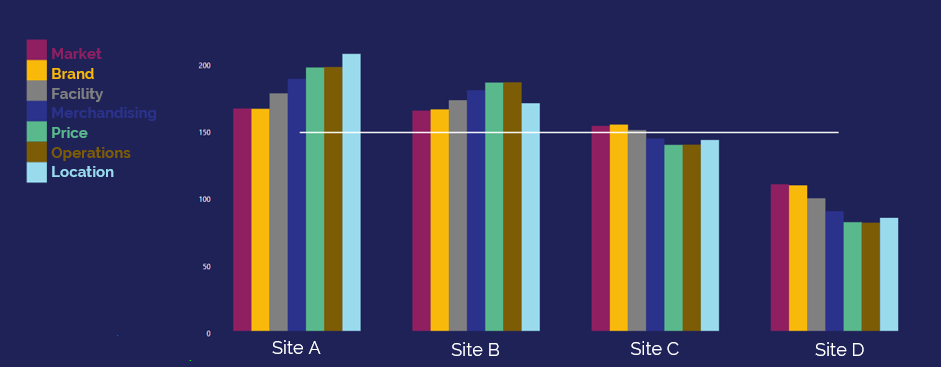

Kalibrate’s 7 Elements framework can help you to assess where investment is needed to turbo charge performance.

- Location

- Market

- Brand

- Facilities

- Merchandising

- Price

- Operations

These 7 elements are what draw consumers to a particular site and impact the performance of a fuel station. It allows us to visualize the strengths and weaknesses of any fuel retail site and find out why a site in underperforming and where a site needs focused investment.

This site comparison chart shows that sites A and B are performing really well in all areas and would be excellent additions to your portfolio. Site C has a low location score, but investment in operations and merchandising and a change in price position could improve performance. Site D is underperforming in all areas, it needs significant investment and probably won’t provide good enough returns to make it a good acquisition target.

Will these sites bring me new customers – or take volume away from my existing sites?

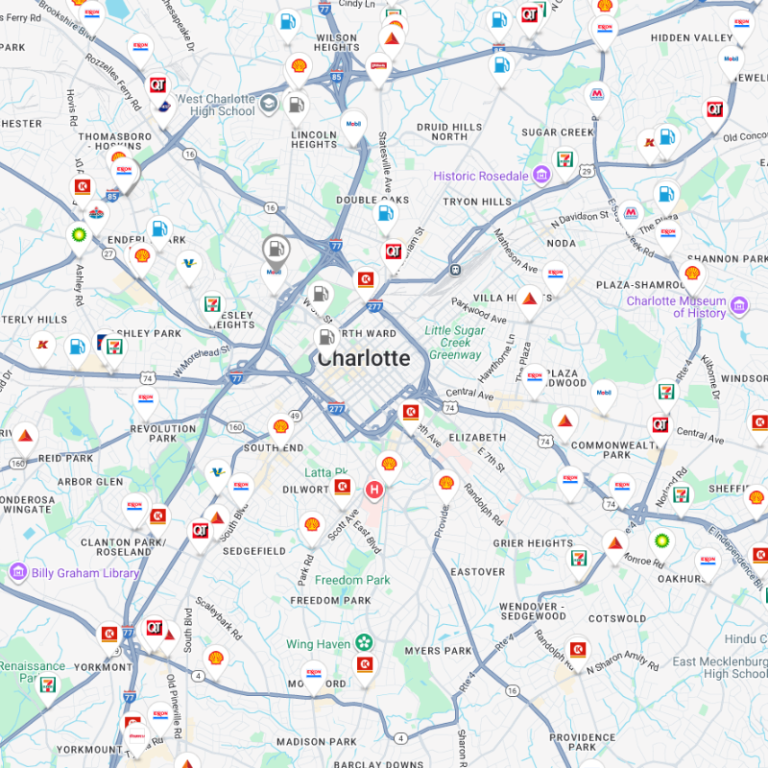

A geo spatial tool like Kalibrate Fuel Planning allows you to visualize all sites on a map. You can see you existing sites and any potential acquisition targets in one view.

You want to make sure you have good geographical coverage without cannibalizing your existing sites’ volumes. Kalibrate’s predictive model will show you how your network will look in the future if you decide to acquire these new sites. You’ll see how your overall volumes will change as well as your market share, helping you set the best strategy for the future of your fuel brand.

When the market is shifting quickly the risk of making bad decisions in the pursuit of growth increases. Smart tools can give you all the information required to make the right decisions at the right time. You can grow your network quickly and smartly.