Fast Casual Summit recap: Turning location data into competitive advantage

Earlier this week I had the privilege of joining Stephanie Bunnell, Global Marketing Lead at Azira, on stage at the Fast Casual Executive Summit in Austin. Our audience was packed with fast-casual operators – from established national brands to ambitious emerging concepts eager to scale.

Many of these leaders are navigating rapid growth, evaluating new markets, and making pivotal real estate and marketing decisions that will define their brand’s future. For them, location intelligence isn’t just a nice-to-have – it’s mission-critical. As restaurant concepts expand from a handful of units to dozens or hundreds, understanding where to grow (and where not to) can be the difference between scaling sustainably or overextending too soon.

That’s why our session, “Find Your Edge: Transform Location Data into Competitive Advantage,” focused on one big idea:

How can you use data to see beyond your own four walls – and gain the competitive clarity to grow with confidence?

It’s a topic I’m passionate about because the brands that master this mindset don’t just open better sites – they outthink their competition, optimize marketing spend, and make smarter, faster decisions across their organizations.

Seeing beyond your four walls

Most restaurant operators know their own numbers: sales, traffic, maybe some customer demographics. But few have a clear line of sight into what’s happening outside their own four walls – how competitor locations perform, where shared customers are visiting, and how trade areas evolve over time.

That’s where location intelligence comes in. By analyzing mobile movement data, demographic patterns, and cross-shop behavior, brands gain the ability to see the why behind performance – not just the what.

The power of data-driven site selection

During our session, I shared a story about a regional chicken chain in suburban Dallas that faced a common challenge: choosing between two seemingly identical shopping centers.

On paper, both options looked perfect – same anchors, rent, traffic counts, even comparable adjacencies. But when we analyzed the movement data, a completely different picture emerged.

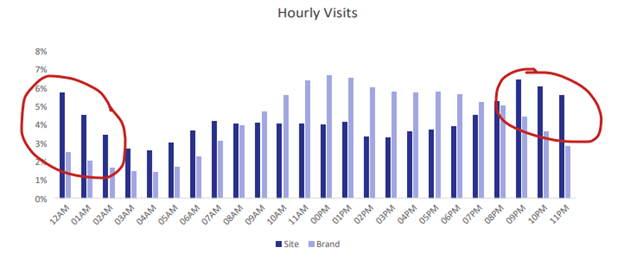

- Center A drew heavier evening and early morning traffic, thanks to nearby bars and a University.

- Center B over-indexed on weekday lunch visits, with strong crossover to fast-casual competitors like Chipotle and Panera.

That insight made all the difference. Center B better matched the brand’s core audience and day-part demand, allowing them to avoid a multi-million-dollar mistake and invest with confidence.

From data to marketing advantage

The same intelligence that drives smarter real estate decisions can also supercharge marketing.

When you know who your customers are and where they’re also dining, you can target your campaigns with surgical precision.

Layering in geo-targeting takes it even further. If a high-performing location closes, you can identify where most of its visitors came from and direct campaigns to those specific areas—helping retain customers and maintain sales.

Avoiding cannibalization – Finding hidden opportunities

Location data also helps restaurants see something many overlook: when they’re competing with themselves.

By overlaying trade areas, you can spot potential cannibalization between nearby stores and adjust your marketing or site strategy before it impacts performance.

Understanding cross-shop – Where else are my customers visiting?

One of the most powerful ideas from our discussion was reframing what “competition” really means. As Stephanie noted, sometimes it isn’t another brand – it’s inertia, the comfort of doing things the same way. Or as one thought leader put it, “your real competition is anything that stands between your customer and becoming healthier, wealthier, or wiser.”

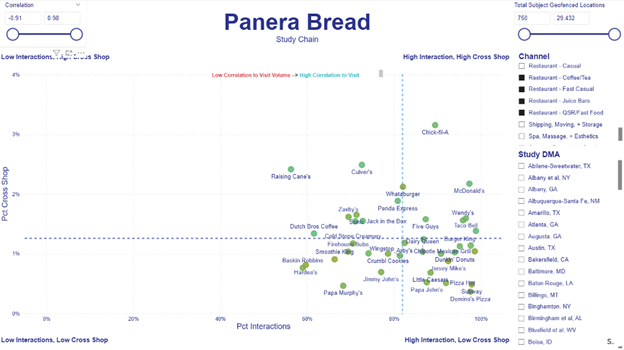

Location intelligence can help brands spot and overcome those barriers. Cross-shop data, for example, doesn’t just show that Panera fans also visit Raising Canes and Culvers, it can reveal unexpected patterns, like a strong overlap with a nearby gym. That insight might inspire post-workout messaging (“Strong workout. Treat yourself.”) or even a local partnership that fits seamlessly into your customer’s lifestyle.

Lessons for emerging restaurant brands

For emerging fast-casual and QSR concepts, every location decision is high-stakes. You don’t have the luxury of trial and error.

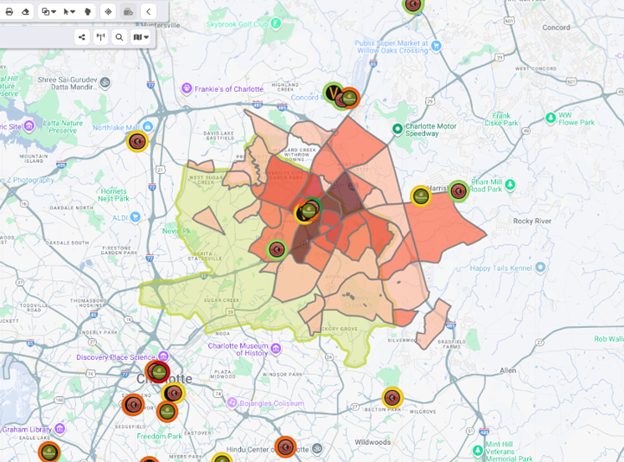

One of our clients – a three-unit salad concept – learned this firsthand. They were eager to expand into Charlotte and had their eyes on uptown. But, by mapping the trade areas of Sweetgreen and Chopt, they discovered the urban core was overserved, while the suburbs offered a better fit with no direct competition.

That single insight not only changed their strategy – it boosted their real estate committee approval rate from 30% to over 70%.

It’s a perfect example of how competitive data can act as a “free education,” helping you learn from established brands without paying the tuition yourself.

The future of AI: From reactive to predictive

At Kalibrate, the next chapter is where data becomes truly powerful. We’re moving beyond describing what’s happening to prescribing what to do about it – and ultimately predicting what comes next. By layering AI-driven interpretation onto macro-level movement patterns, we’re empowering brands to forecast performance before entering a market and make smarter, faster decisions with greater confidence than ever before.

Closing thoughts

Fast casual is one of the most dynamic and competitive segments in foodservice, and growth-minded brands – especially emerging ones – need every advantage they can get.

The future belongs to those who use data not just to react, but to anticipate, innovate, and outperform.

It was great to share the stage with Stephanie and the Azira team to explore how location intelligence helps brands at every stage of growth find their edge. If you’re interested in seeing how mobility data can be your competitive advantage, contact our team to learn more.

Read more articles about:

Location intelligenceSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related posts

Location intelligence

Forman Mills accelerates growth with the Kalibrate Location Intelligence platform

The value apparel and home goods retailer selects Kalibrate to to support its national expansion strategy.

Location intelligence

The Kalibrate news round-up: November 2025

In this monthly feature, we look across the industry and mainstream news to uncover stories of note that we think are...