Dine Brands recently announced that they had opened their first dual-brand IHOP/Applebee’s restaurant in the US in Sequin, Texas, with plans to open 12 more this year. Dine Brands has opened almost 20 dual brand units internationally over the past 2 years and is now bringing the concept back to their home market.

There is a lot to like about the IHOP/Applebee’s concept:

Complementary meal offerings – not surprisingly, IHOP has always been a strong breakfast operator, while Applebee’s is stronger for lunch and dinner. Combining the two concepts enables Dine Brands to maximize traffic for all three meal segments.

Many restaurant chains have added breakfast to their menu offering in an effort to increase same-store sales (including Taco Bell in 2014 and Wendy’s in 2020). However, the combined IHOP/Applebee’s offering accomplishes this without the added time and expense involved in marketing a new offering and building top-of-mind awareness.

Combined menu and dining – rather than operating two distinct restaurants under one roof, the new dual concept operates as a single restaurant, with both IHOP and Applebee’s offerings available on the same menu. As such, the new concept can be run in the same size unit as an individual IHOP or Applebee’s restaurant.

This was not the case when Darden open their first co-branded Olive Garden and Red Lobster restaurant in 2011. The Darden concept included dual kitchens, restrooms, and bar, but maintained separate entrances and dining areas for Olive Garden and Red Lobster. The primary goal of the dual concept was to enable Darden to open restaurants in markets that were too small for Olive Garden or Red Lobster alone, but which could support a dual unit.

So, what’s not to like about a dual concept? There are three primary considerations, both near-term and existential, that need to be accounted for.

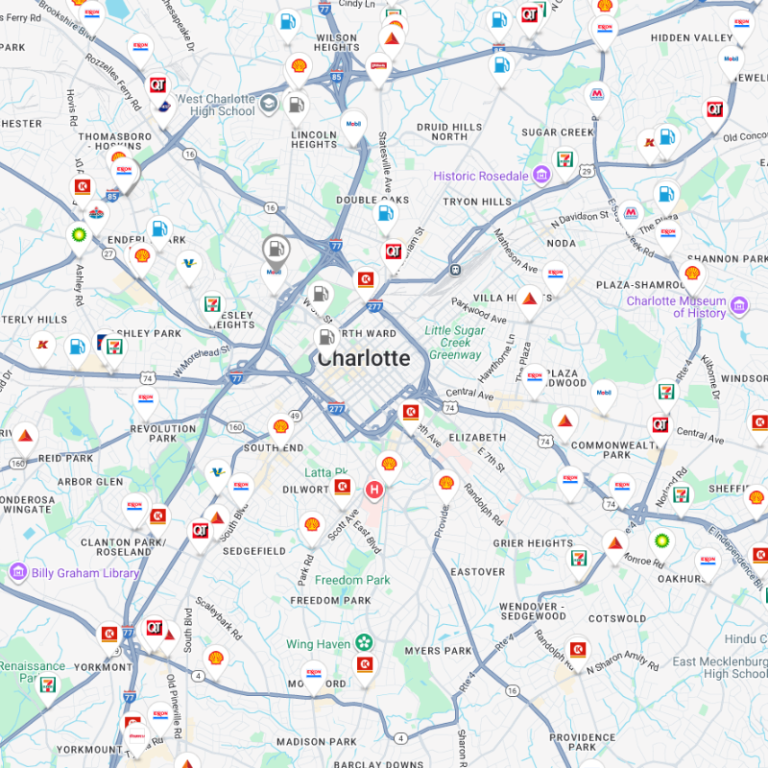

- Proximate sister units – the choice of locations within which to open a dual concept will be constrained to the proximity to sister units for either concept. A given location may be ideal for Applebee’s, but located too close to an existing IHOP unit (either because of projected sales cannibalization or existing franchisee territory constraints). This is not a reason to abandon the concept, but simply means that the operator needs to ensure that the location does not unduly impact nearby units of either concept.

- Customer profile – to be successful, the customer profile for both restaurant concepts needs to be complementary enough to facilitate cross-patronage between the two menu offerings. The underlying customer bases don’t need to be identical, but should be similar enough for the dual concept to thrive.

- Chain disposition – the potential breakup of the parent company, or sale of one of the concepts, will have a significant impact on the future viability of the dual concept. This is exactly what happened to Darden, when institutional shareholder pressure resulted in Red Lobster being spun off as a separate company. Darden ended up closing the six co-branded restaurants in operation in 2014, with plans to permanently shutter two and convert the balance (presumably the higher volume units) to Olive Garden alone.

Part of the concern for Darden was the fact that the restaurant layout (with two entrances and two dining areas) made it more difficult to simply convert to one brand or the other. This would not be an issue for Dine Brands, given the fact that they are operating the restaurant as a single entity. However, in the event of a sale of either Applebee’s or IHOP, Dine Brands would either need to enter into an operating agreement to continue having dual brand units, or convert to the remaining brand.

Dual-branding opportunities are not limited to sister restaurants alone. There has been enormous co-branded development for some time between restaurants (particularly QSRs and convenience stores. While many convenience stores sell food-to-go within the store itself (who can forget the sight of hot dogs rotating on a grill), there are clear benefits to co-locating with an existing restaurant chain – the convenience can benefit immediately from the brand identify associated with a restaurant chain. If your concept is considering a dual-branded store or store-within-a-store strategy, contact our team to talk about how analytics can shape your approach.