Dave Huntoon: retail trends to look out for in 2024

Well, it’s that time of year again. Here are our top five retail predictions for 2024:

Construction costs challenges persist

Retailers who want to continue growing are being impacted by higher construction costs. Associated Builders and Contractors estimates that inputs to commercial construction have increased by 40% from February 2020 to October 2023 despite recent declines over the past year. Retailers who have benefited from significant comp sales growth over the past 4 years (such as those in the home improvement sector) may be able to offset higher construction costs with higher sales, but most operators don’t have that luxury. Many retailers are turning to cost engineering and smaller prototypes to counteract higher costs, but those efforts can only go so far.

Ordinarily, new shopping center developments coming online would help to reduce rents, but…

New retail construction remains constrained

New retail construction is down significantly relative to historical averages over the past 20 years, with no near-term improvement in sight. There are a handful of reasons for this:

Higher interest rates

While not high by historic levels (says the guy who bought his first house in 1980 with a 13½% mortgage), interest rates are higher than they’ve been since the 2008 recession.

Retail bankruptcies

A number of large retailers have gone bankrupt and liquidated in the past year (ex. Bed, Bath & Beyond, Tuesday Morning, Christmas Tree Shops, and Shoe City) while many others have announced significant numbers of store closings (including Walgreens, Signet Jewelers, and Foot Locker).

“Zombie Malls” (I love that term)

There are still hundreds of regional shopping centers in the U.S. that are plagued by significant vacancy rates. While these centers may appear to represent potential deployment opportunities for retailers, a “zombie mall” with no clear turnaround plan in sight is not a desirable location opportunity for anyone.

Online sales continue to influence brick and mortar performance

Online shopping will continue to chip away at brick-and-mortar sales. While e-commerce enjoyed a spike in sales during the pandemic, the reality is that e-commerce sales as a percent of total retail sales are effectively where they would have been in 2023 even without the pandemic (see graph below) and show no signs of slowing down.

Operators who are immune to e-commerce (such as personal service providers) and retailers with established, robust omnichannel offerings (such as Williams-Sonoma and Home Depot) will continue to thrive, while others will continue to experience inexorable market share declines.

Electric vehicles: nominal 2024 impacts

There has been a lot of hype concerning electric vehicles over the past few years. The Biden administration has a goal of taking battery electric vehicles from a 6% share of the U.S. market in 2022 to 67% by 2032 and has announced plans to electrify much of the federal vehicle fleet. On the flip side, U.S. auto manufacturers have seen a slackening of demand for EVs despite plans to significantly increase the number of EV makes and models over the next two years.

Long term, growth in electric vehicle market share will have a significant impact on gas stations as well as other retailers and shopping centers. While direct current fast charging equipment can take 20 minutes to an hour to fully charge a vehicle today, there will be increasing incentive to deploy charging equipment near retail and service providers where consumers want to spend that much time. (I mean, an hour in a convenience store?). However, we anticipate that this impact will have little or no measurable impact on consumer traffic and retail comp sales growth in 2024.

Medtail maintains its pace

Health and wellness tenants ranging from dental providers and urgent care centers to medspa operators and aesthetics offerings will continue to experience growth in the coming year. These tenants continue to show interest in deploying in traditional retail locations, with landlords increasingly receptive to further diversification of the consumer offerings in their centers. This is in part due to the continued erosion of the traditional medical referral network, and the growth of direct to consumer marketing and outreach. The medspa and aesthetics sectors in particular are experiencing significant interest and investment from private equity firms.

And – a bonus sixth trend:

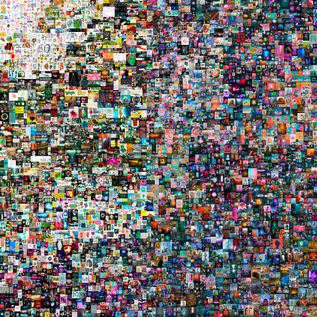

The Death of NFTs (Non Fungible Tokens) – while this has nothing to do with retail, I feel compelled to mention this category. What the hell happened to the market for NFTs over the past wo years? How does an entire market implode that quickly? Remember the sale of Beeple’s “Everydays” collage in 2021 for $69 million? I’ve always loved Warren Buffett’s observation: “Take Wrigley’s chewing gum. I don’t think the Internet is going to change how people chew gum.” Apparently, it’s not going to change how people look at paintings either.

Read more articles about:

Location intelligenceSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related resources

Location intelligence

Five burger companies, five problems

These burger brands had challenges from international growth to understanding franchise locations cannibalization,...

Location intelligence

Market Optimizer: Demo video

Market Optimizer allows users to strategically grow their network in existing markets while balancing revenue...