Dave Huntoon: Assessing ChatGPT's answers to predictive analytics questions

Artificial Intelligence (“AI”) has emerged as the next major technological innovation that will impact virtually all parts of our lives. In my capacity as “The Old Man” at Kalibrate (presumably under the mistaken impression that age imparts wisdom in addition to a graying and disappearing hairline), I have been asked to provide some perspective on the role that AI will play in the predictive analytics field, particularly as it relates to sales forecasting for new locations. I firmly believe that AI is here to stay and will have an impact, but these are early days for the field. Recall the famous match between Gary Kasparov and Deep Blue, an IBM supercomputer, back in the 1990s. Kasparov, the reigning world chess champion, won the first six-game match 4 – 2 in 1996, but lost 3½ – 2½ a year later, as the algorithms leveraged by Deep Blue continued to improve.

To test AI’s capabilities in the field of predictive analytics, we asked ChatGPT a series of questions related to restaurant openings. While not the only AI platform available for widespread use, ChatGPT is the fastest-growing and best-known platform, establishing a record 100 million users 2 months after launch and a mind-boggling 1.6 billion users after a mere 6 months. We have provided ChatGPT’s responses to each of our questions below, followed by my comments and grading of its answers.

“I’m a quick service restaurant operator looking to grow my burger concept. What are the first five steps I should take to ensure my new locations perform as well as possible?”

ChatGPT:

Congratulations on wanting to grow your burger concept! Here are the five steps you should take to ensure your new locations perform well:

- Develop a solid business plan: Before you begin any new location, you need to have a solid business plan in place. This should include your target market, your pricing strategy, your marketing plan, your staffing needs, and your financial projections. A business plan will help you stay on track and give you a roadmap for

- Choose the right location: The location of your new restaurant is critical to its success. You should consider factors such as foot traffic, parking availability, nearby competition, and the demographics of the area. Conduct market research to ensure that the location you choose has the potential to be successful.

- Build a strong team: The success of your new location depends on the quality of your team. Hire experienced and motivated staff who can provide excellent customer service and who are passionate about your brand. Make sure to invest in training and development to ensure that your team is well-equipped to meet the needs of your customers.

- Implement effective marketing strategies: Marketing is essential to the success of your new location. Develop a marketing plan that includes social media, email marketing, and local advertising. Consider offering promotions or discounts to attract new customers and incentivize repeat business.

- Monitor your performance: Keep a close eye on your new location’s performance to ensure that it is meeting your expectations. Monitor sales, customer feedback, and employee performance to identify areas for improvement. Use this information to make data-driven decisions and adjust your strategies as needed.

By following these five steps, you will be well on your way to growing your burger concept successfully. Good luck!

Assessment: Overall, a reasonable response to someone interested in starting a new restaurant concept. Creating a viable business plan, building a strong team, implementing effective marketing strategies, and monitoring performance are all important considerations. From a site selection perspective, ChatGPT has referenced many of the factors that should be considered, including nearby competition, demographics, and parking. However, the focus on foot traffic (rather than automotive traffic) is primarily applicable to urban locations. Furthermore, asking someone to “conduct market research” without specifying the type of market research recommended is of limited value.

Grade: B+

“I have 12 quick service restaurants. How can I make sure that new locations will not excessively cannibalize existing sites?”

ChatGPT:

Cannibalization is a common concern when expanding a restaurant chain. Here are some strategies you can use to ensure that new locations do not excessively cannibalize existing sites:

- Conduct market research: Before opening a new location, conduct market research to ensure that there is enough demand in the area to support a new restaurant. Look at demographic data, local competition, and foot traffic to determine whether a new location would be successful without cannibalizing your existing sites.

- Analyze sales data: Analyze sales data from your existing locations to determine the impact that opening a new location in the same market would have on your existing sites. Look at sales trends before and after new locations opened to see if there was a significant decline in sales at existing locations.

- Optimize site selection: Choose new locations carefully to ensure that they are not too close to your existing sites. Ideally, new locations should be far enough away that they will not compete directly with your existing sites. Use demographic data and traffic patterns to identify areas where there is demand for your brand without overlapping with your existing sites.

- Adjust your marketing strategies: Consider adjusting your marketing strategies to target specific customer segments or geographic areas. For example, you could offer promotions or discounts in areas where you have a new location to drive traffic to that location without cannibalizing your existing sites.

- Focus on innovation: Keep your menu and offerings fresh and innovative to attract new customers and keep your existing customers interested. This can help reduce the likelihood of cannibalization by creating a unique experience at each location.

By using these strategies, you can minimize the risk of cannibalization and ensure that new locations will not excessively compete with your existing sites.

Assessment: This was not a particularly helpful response. The “demand in the area to support a new restaurant” has little relationship to the projected cannibalization impact that it will impose on pre-existing units. ChatGPT does not reference the most obvious means of quantifying cannibalization – map the distribution of existing restaurant customers, and quantify the projected cannibalization impact based on relative proximity, retail/restaurant synergy, and other relevant considerations. The reference to marketing strategies is appropriate, while the focus on innovation is not; innovation has everything to do with operating a strong restaurant chain, but nothing to do with cannibalization per se. Furthermore, analyzing sales data will help determine after the fact if cannibalization has occurred, but will not predict future cannibalization.

Grade: C-

“My quick service restaurant chain is entering a new market. How can I leverage my existing customer data to inform my site selection process?”

ChatGPT:

Entering a new market can be an exciting opportunity for your quick service restaurant chain, and leveraging your existing customer data can help you make informed decisions about site selection. Here are some ways you can use your customer data to inform your site selection process:

- Analyze customer demographics: Look at the demographic data of your existing customers to identify characteristics that are common among them. Use this data to identify areas in the new market where there is a high concentration of these demographics.

- Identify customer behavior: Analyze your customer data to understand customer behavior, such as how often they visit your restaurants, what they typically order, and which locations they frequent. Use this data to identify areas in the new market where there is a high potential for customer demand.

- Use customer feedback: Look at customer feedback and reviews to identify common themes or complaints. Use this information to identify areas in the new market where there may be unmet customer needs that your brand can fill.

- Consider loyalty program data: Analyze your loyalty program data to identify areas in the new market where you have a high concentration of loyal customers. This can help you prioritize these areas for site selection.

- Look at transaction data: Analyze your transaction data to identify areas where your existing customers are traveling from to visit your restaurants. This can help you identify areas in the new market where there is a potential for customer demand.

By using your existing customer data to inform your site selection process, you can make more informed decisions about where to open new locations in the new market. This can help you maximize your potential for success and drive customer loyalty in the new market.

Assessment: Overall, this response was on target. ChatGPT references assessing loyalty data (to see which markets have a strong pre-existing awareness of the concept) and analyzing customer demographics to determine whether a new market is in-profile for the concept. Analyzing customer transaction data is critical when evaluating in-fill opportunities in an existing market, and can be used to quantify projected cannibalization. One area that ChatGPT missed was an assessment of competition – while existing customer data may not have any data on competition per se, it can be used to inferentially assess the impact of specific competitors on performance.

Grade: B+

“I work for a private equity company that has acquired a chain of quick service restaurants with 20 locations. They operate in New York exclusively now. What data can I use to figure out if we should expand into Massachusetts or Pennsylvania first?”

ChatGPT:

Expanding into new markets can be a significant opportunity for a quick service restaurant chain, but it’s important to carefully consider which markets to enter first. Here are some data points you can use to determine whether to expand into Massachusetts or Pennsylvania first:

- Market size and growth potential: Look at the size of the quick service restaurant market in both states and their growth potential. Consider factors such as population density, consumer spending, and demographic trends to determine which market has the highest growth potential for your chain.

- Competition analysis: Analyze the existing quick service restaurant chains in both states and their market share. Look at factors such as pricing, menu offerings, and customer demographics to determine which state has the most favorable competitive landscape for your chain.

- Customer analysis: Analyze customer data from your existing locations to determine where your customers are traveling from to visit your restaurants. Use this information to identify which state has the most potential for customer demand.

- Regulatory and economic factors: Consider regulatory and economic factors in each state, such as taxes, labor laws, and minimum wage laws. These factors can significantly impact the cost of doing business and should be carefully considered before expanding into a new market.

- Real estate and site selection: Evaluate the availability of real estate in each state and identify potential site locations. Consider factors such as foot traffic, accessibility, and parking availability to determine which state has the most favorable site selection opportunities.

By analyzing these data points, you can determine which state has the most potential for success and should be the first to enter. This can help you maximize your chances of success and grow your chain strategically.

Assessment: ChatGPT addressed some of the major considerations in expanding to new markets, with specific emphasis on customer demographics and competition. References to customer journeys, economic and regulatory impacts are also highly relevant, as is the availability of real estate. The geographic distribution of existing customers would likely provide little insight – with the exception of tourists, most restaurant patrons reside within the same market that the restaurant is located in. One element potentially overlooked was restaurant concepts unique to a specific market (think Cincinnati chili providers such as Skyline and Gold Star, neither of which have expanded beyond their Ohio/Kentucky/Indiana heartland) may prove difficult to expand to new markets.

Grade: B+

Overall assessment:

Given that it has only been on the market for 6 months, ChatGPT did an impressive job of identifying many of the key variables associated with assessing new restaurant locations. While there are some clear misses, I am confident that ChatGPT will continue to improve and provide more comprehensive responses in the future. However, there is a big difference between identifying the factors that need to be considered in the development of sales forecasting or cannibalization model and actually developing such a model.

Kalibrate leverages Machine Learning as a component of model development today, and will continue to monitor the role that AI could play in the future. However, given the millions of dollars in capital investment typically required to open new locations, Kalibrate will only deploy AI to support sales forecasting use cases once subjected to extensive human checks and verification.

Read more articles about:

Location intelligenceSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related posts

Location intelligence

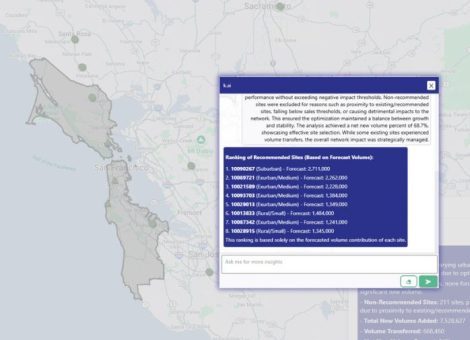

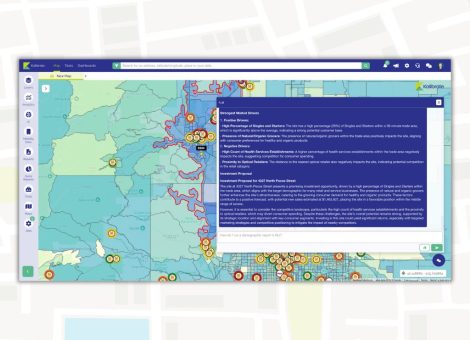

AI in location intelligence: See it in action

See videos and screen captures of how AI has been integrated into the KLI platform.

Fuel pricing

Middle East / Africa - Fuel network planning: Critical insights

Join our team as we look at the key points of insight that fuel network planners need to consider when making...