Data centralization and buy-in

The growth of location intelligence to support decision making shows no sign of stopping. Recent research predicts the industry will see annual growth of 15.6% for the period of 2023 to 2030 (RSRResearch). But even though location intelligence isn’t a new concept to most leaders in the industry, many still fail to recognize how instrumental these tools have become to navigating the complexity of the market.

Location intelligence is a powerful capability for retailers, but successful adoption requires understanding the scope of your internal resources and where you need external support. However, there are some best practices that ensure retailers start off on the right foot and decrease the time taken to extract value.

Data centralization

Often, location intelligence capabilities are key to unlocking the information already held within retailers – held in disparate departments or fragmented platforms. Without it, the risk of poorly performing locations and high rents with long leases is heightened. Retailers who recognize and extract maximum value from location intelligence today – understanding customer behavior, the competition, and how their markets are evolving – are best equipped to thrive tomorrow.

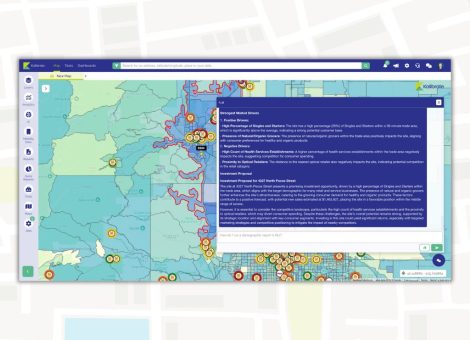

Data centralization is an obstacle many retailers encounter. Most brands will have significant amounts of customer data, store sales data, and loyalty schemes. Alongside this, third-party providers offer demographic, mobility, competitor, point of interest, and many other powerful datasets that enrich a retailer’s in-house insight. The challenge is making sure data is cleansed and accessible. Is it held is disparate platforms? If so, how can it be synced centrally so you can start working with it? Is it clean – structured in a uniform way and smoothed of anomalies that may distort outputs down the line? Conducting this type of data hygiene can be resource intensive. So, the extent to which you do this yourself will be determined by your internal resources and whether you adopt a location intelligence platform, seek support from a consultancy, or a mix of both.

Internal buy-in

Another critical factor in effective adoption is achieving cross-function buy-in as early as possible. Location intelligence has powerful applications across departments – from real estate and marketing to operations and field teams – but gaining early buy-in means stakeholders are more invested in future outputs. Taking these preparatory steps will ensure your location intelligence has a strong foundation from day one. This will enable it to deliver the types of valuable insights that’ll help you make the most informed site selection decisions.

The benefits of successful adoption

The benefits of the successful adoption of location intelligence are not limited to pure place-based applications. A robust customer profile and understanding of where your locations’ visitors come from empowers decision-making in marketing. By focusing campaign activity at the market segments most likely to become customers, retailers can increase return on marketing spend while reducing the ramp-up time of new locations.

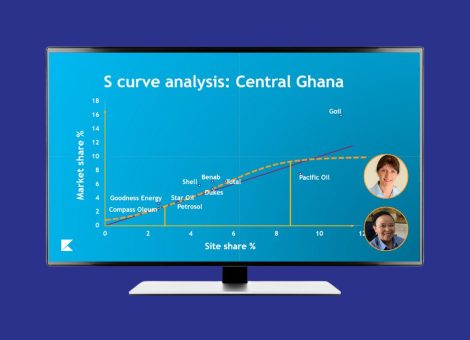

Many retailers use mobility insight to track customer penetration in specific block geographies. Where data tells them they’re under-penetrated based on the presence of their customer profile, targeted digital or direct mail campaigns can help them capture greater market share. Brands may also lean on location insight when creating an omnichannel strategy. With brick-and-mortar locations having experienced so much change, and the relentless growth of online as a sales channel, understanding the halo effect – how to store openings impact e-commerce business – is a vital capability.

Equipped with this insight, retailers may also make portfolio decisions through an omnichannel lens, strategically planning the optimum store count and location to maximize profitability across brick-and-mortar and online channels.

This article is a sample of Kalibrate’s recent report – “Unlocking the Full Power of Location Intelligence”

Read more articles about:

Location intelligenceSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related Posts

Location intelligence

Right-size your franchise territories: Maximize revenue per market

Franchise territory management tools are evolving changing with advances in location intelligence.

Location intelligence

AI in location intelligence: See it in action

See videos and screen captures of how AI has been integrated into the KLI platform.