Volatile fuel pricing — Managing competitive pricing

Volatility in fuel pricing is impacting the whole world right now. A combination of supply and demand changes and geopolitical issues has resulted in record highs across the globe.

Since February, the price of Brent crude has fluctuated from lows of $90 to highs of $128 USD. With such large variations happening at speed — many fuel retailers struggle to stay competitive.

Depending on when fuel retailers buy their fuel supply, the buying contracts they’re on, and how much fuel they can purchase at once, they can have drastically different costs to their closest competitors.

If you’re stuck with a tank of expensive fuel, what are your options?

Maintain margins

You can maintain your margins and price higher than your competitors. You are likely to lose volume to the competition here, but may be able to offset volume loss with the margin you make. However, it’s important to be conscious of your brand promise here. If consumer perception is that your brand offers low price points or is always with or below competitor prices, maintaining margin and pricing above competitors could have negative impacts long term.

Lose margin — but gain customers

Fuel retailers who have other revenue streams, like convenience stores and QSRs, may consider losing margin in order to remain competitive. Sacrificing margin on the pumps can attract more fuel customers who convert in store to bring in additional revenue.

Considerations

With global tensions continue, fuel price volatility will remain. There is no “one size fits all” approach. The situation and your response to it should be regularly evaluated.

Whichever position you chose here, you need to continually assess the changing situation. If any part of your network becomes unmanageably unprofitable, you may need to temporarily close sites to minimize revenue loss. Consider ways to rationalize your network and focus footfall to stronger sites. But keep your strategy agile as circumstances are constantly changing and demand changes, fast.

Data analysis is an extremely important part of this process. You need to have a crystal-clear view of your data to ensure you execute decisions that comply with regional regulations. It’s incredibly hard to implement quick responses using “gut feel” alone. Regardless of the systems and software you use, you need to ensure you are monitoring the data available, making justifiable decisions, and implementing changes with confidence.

Read more articles about:

Fuel pricingSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related posts

Fuel pricing

Fuel pricing by exception: When do analysts actually analyze?

Managing fuel prices can be time-consuming, especially when analysts spend much of their day on routine tasks....

Fuel pricing

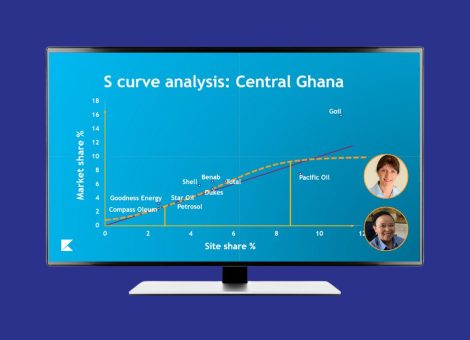

Middle East / Africa - Fuel network planning: Critical insights

Join our team as we look at the key points of insight that fuel network planners need to consider when making...