The Kalibrate fuel round up: November 2022

Kalibrate works with a diverse range of fuel organizations, so we always have our ear to the ground to see how the environment is evolving. This helps us understand the challenges and opportunities facing the brands we support, but it also helps us keep across the news, innovations, transformations, trials, and tribulations, within the fuel space.

Discounts in Europe are extended

We discussed in the October fuel round-up that the French government and Total had created a discount scheme to help motorists with the cost of fuel, starting at 30c and 20c per litre discount, ending on November 1.

However, they have now continued this discount into November, lowering it to 10c per litre until the end of December, the continuation of this discount has already been reflected in pump prices — although the increase has been less significant than expected.

Italy have also followed suit, dropping their 25c discount per litre to 15c per litre in December. This extension in discount has come as a relief for many, but moving into winter, with the pinch of inflation and recession creeping across the world, the rise in the cost of fuel will be a sore point for many.

Governments will continue to shift their focus to other measures to defend consumer spending power, away from them spending additional revenue. Fuel retailers need to watch out for shifts in consumer behaviour as fuel purchases take up a bigger slice of household expenses.

Read more about how governments are updating their stances on rebates here

Is China’s ‘zero-covid’ policy damaging crude oil prices?

China’s recent batch of lockdowns has had a noticeable impact on demand. China are one of the world’s biggest crude oil distributors which is being affected by the continuous ‘zero covid’ lockdowns, which are having a drastic effect on the Chinese economic growth, thus effecting the demand for oil.

Many investors are apprehensive of this fall in demand, ahead of a key meeting with the Organization of the Petroleum Exporting Countries (OPEC) and allies including Russia, known as OPEC+, on Dec. 4.

US oil prices have seen positive signs in recent weeks, but we still expect volatility in the market due to uncertainty around EU sanctions and a price cap on Russian oil – in an attempt to limit the revenue Russia is able to use to fund ongoing military action in Ukraine.

Expect more clarity in December, once the OPEC+ meeting has taken place and the price cap has come into effect. In any case, fuel retailers with a strong data environment and the ability to quickly react to increased volatility are better equipped for what is to come.

Read more about the crude oil situation here.

UK Supermarkets accused of profiteering from the volatile market

While the UK has confirmed the 5p per litre fuel duty cut that has been in place since March will continue they have also confirmed the government will provide £13.6bn support in business rates over the next 5 years. This will give relief to forecourts across the UK who have continued to support those during volatile times.

However, supermarkets are being accused of “rocket and feather” pricing, a term used to describe rapidly increasing pump prices when cost goes up, and slowly decreasing when cost goes down by the RAC.

Typically, supermarkets are associated with lower prices – their cost basis is different, and they often see fuel as a “loss leader” that drives footfall.

The association’s data suggests British supermarkets are enjoying margins of around 15p per litre. The lone exception is Costco, who recently cut their petrol price by 8p per litre for their members.

It is evident that fuel prices in the UK are still a major topic for discussion. The current environment is kinder to fuel retailers who can leverage automation for operational excellence and have the data to quickly spot margin and volume opportunities.

Electric vehicle (EV) drivers – UK tax update

The UK announced, in it’s autumn update, that they are attempting to make the UK motoring system fairer by taxing all EV owners from 2025.

This could lead to a slowdown of EV adoption according to the AA, as the incentive is no longer there to make the change. It has been noted that this decision to introduce tax payments is at odds with the UK’s zero emission ambitions. The AA president Edmund King said:

What do you think about this?

Read more from the BBC here.

Read more articles about:

Fuel pricingSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related Resources

Location intelligence

Right-size your franchise territories: Maximize revenue per market

Franchise territory management tools are evolving changing with advances in location intelligence.

Location intelligence

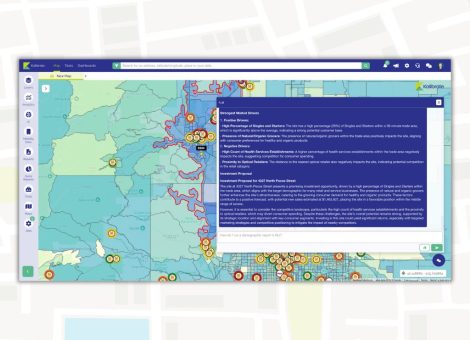

AI in location intelligence: See it in action

See videos and screen captures of how AI has been integrated into the KLI platform.