The Kalibrate fuel round up: May 2023

Kalibrate works with a diverse range of fuel organizations, so we always have our ear to the ground to see how the environment is evolving. This helps us understand the challenges and opportunities facing the brands we support, but it also helps us keep across the news, innovations, transformations, trials, and tribulations, within the fuel space.

Oil prices fall in May

Oil prices fell sharply early in the month despite falling inventories. There is typically a strong inverse relationship between US inventories and oil prices. However, it appears concerns about weak demand, worries around the US debt ceiling negotiations and uncertainty around the Federal Reserve’s next decisions were playing a bigger role. Prices recovered somewhat later in the month as debt ceiling negotiations appeared to be progressing and demand was expected to pick up for driving season.

Oil price predictions are becoming increasingly polarised: energy economists see signs of strong demand coming up, while traders remain bearish due to difficulties in the banking sector and complex debt ceiling negotiations. Fuel retailers should remain alert and make sure they have the tools in place to quickly react to sudden product price moves.

Competition watchdog aims at supermarkets

The UK Competition and Markets Authority (CMA) says it has found evidence that UK supermarkets have increased fuel prices to an unnecessarily high level. The competition watchdog claims that global factors (such as Russia’s invasion of Ukraine) do not fully explain the observed price levels, suggesting that retailers may be enjoying larger margins than they did before the pandemic.

Last month, the RCA accused forecourt owners of charging more for diesel than necessary. This time, the spotlight falls on supermarkets. Kalibrates’ Matteo Locane reflected on the current situation, “Clearly, fuel prices remain a sensitive subject due to the cost-of-living crisis. Fuel retailers should carefully watch media coverage of fuel prices and be ready to take action where needed”.

More acquisitions a clear trend in 2023

Majors Management and Alimentation Couche-Tard have announced that they will split the retail assets of Mapco Express. Alimentation Couche-Tard will acquire 112 fuel and convenience retail sites that will be carved out from the rest of the Mapco Express network, which will be acquired by Majors.

M&A activity in the fuel retail industry continues to pick up – this is at least the third major deal of the year, after bp’s acquisition of Travel Centers of America back in February and Alimentation Couche-Tard’s takeover of Total Energies assets in Germany and the Netherlands in March. Expect more consolidation activity in the space.

Read more articles about:

Fuel pricingSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related Resources

Location intelligence

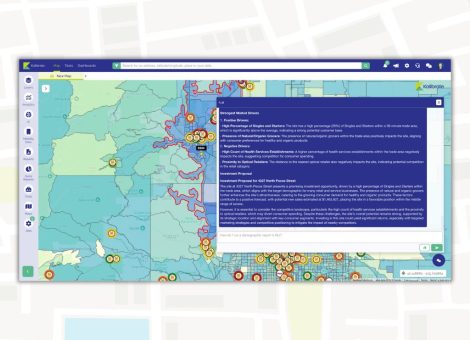

AI in location intelligence: See it in action

See videos and screen captures of how AI has been integrated into the KLI platform.

Fuel pricing

Fuel pricing by exception: When do analysts actually analyze?

Managing fuel prices can be time-consuming, especially when analysts spend much of their day on routine tasks....