The Kalibrate fuel round up: January 2023

Kalibrate works with a diverse range of fuel organizations, so we always have our ear to the ground to see how the environment is evolving. This helps us understand the challenges and opportunities facing the brands we support, but it also helps us keep across the news, innovations, transformations, trials, and tribulations, within the fuel space.

Fuel prices on the rise on the back of expected demand surge

Fuel prices are moving up again, both in the US and in Europe. This demand is being driven by hopes that China seems to be finally dropping its zero-Covid strategy. Fuel retailers should expect such moves to stimulate economic growth and global demand for oil products.

The situation remains volatile, and further fuel price increases are likely to bring the industry back into the media spotlight. As always, fuel retailers with a strong data environment and the ability to leverage automation for operational excellence are best placed to identify and exploit volume and margin opportunities as they appear.

Changes in consumer behaviour signal price sensitivity is increasing

Consumer behaviour is shifting. According to recent research, 61% of motorists in Italy now choose their petrol station based on price (it was 27% in July 2022), and 58% now choose self-service stations over traditional ones (29% in July 2022). Globally, we are seeing more individuals compare prices when filling up – around 53% of consumers make a habit of comparing prices to find the best deal. In some markets it is as high as 75% of consumers.

Kalibrate’s Matteo Locane reflected on the changing habits we are seeing in the fuel market, “high fuel prices and rising inflation are eroding the purchase power of consumers, who are switching to ‘defensive’ consumption habits.

“Timely and reliable data is key for fuel retailers in this environment, and access to additional information such as mobility data – and to the tools to make sense of it! – can be a source of sustainable competitive advantage.”

Price caps on Russian crude exports

While European governments are discussing a further tightening of the price cap imposed on Russian crude exports, the US government does not seem keen to support such initiative – at least for now. The Biden administration has indicated that they would oppose moves and are looking to wait for G7 initiatives to take effect. The intention for the US is to wait until additional price caps on refined Russian products (such as diesel) have come into effect before making any decisions.

It can take months for the impact of price caps to truly show. Fuel retailers should remain alert and monitor their costs closely over the coming weeks to analyze the ongoing impact of the price cap.

Adoption of EV

The upcoming bans on the sale of petrol and diesel cars – and the difficulties around their implementation – may actually be good news for fuel retailers today. The current expectation is that it will take until the mid-2040s to see EVs really take over the market. With consumers still expected to buy, and run (with a lifespan of 10-15 years), ICE vehicles in 2030, fuel network planners have an interesting few years ahead, and will need to be mindful of these market changes.

EV is coming, and you should be prepared, but do not forget who your current customers are. Focus on operational excellence on the fuel side and start working on your plans for your non-fuel offering at the same time for a sustainable operational advantage over the coming years.

Read more articles about:

Fuel pricingSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related Resources

Location intelligence

Right-size your franchise territories: Maximize revenue per market

Franchise territory management tools are evolving changing with advances in location intelligence.

Location intelligence

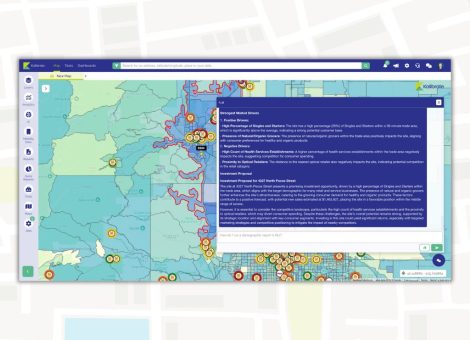

AI in location intelligence: See it in action

See videos and screen captures of how AI has been integrated into the KLI platform.