What are the typical needs of owners of fuel retail networks when they approach Kalibrate? Typically, they recognize the critical role data can play in helping them spend capital effectively on their fuel retail networks to grow or preserve their revenue.

Depending on market conditions, maturity, the competitive environment, and other situational variables, broadly speaking, we can organize fuel retailers approaching Kalibrate into four groups:

- Invest to Grow

- Invest to Defend

- Invest to Protect

- Monitor and Review

In Invest to Grow, clients have capital to spend but need assistance in identifying the best ways to invest this to maximize their performance.

In Invest to Defend, typically clients may be in a saturated market where there is little opportunity for expansion or there is high internal competition for capital. The emphasis here would be on defending what is already in the network through targeted capital expenditure on key assets.

In the Invest to Protect group, there may be minimal capital available. Clients need assistance to do the bare minimum to ensure they maintain their license to operate. For example, maintaining their health, safety, and environmental standards in line with regulatory requirements. This group may also seek to identify opportunities for divestments and closures to improve overall profitability.

In the fourth group, Monitor and Review, the aim is to assess whether investments have achieved their objectives and the learning outcomes we can generate to inform strategic decisions in the future.

In this blog, we focus on the Invest to Grow segment.

Ask the right questions

What does Invest to Grow look like? The typical question we’re asked is: how can we best allocate capital and resources for optimal retail, fuel, and convenience network performance? We have clients asking for help with understanding in which of their multiple markets they should invest – either in one country or in multiple countries. In which markets are the best opportunities? How can they be insight-driven in their strategy to maximize revenue growth?

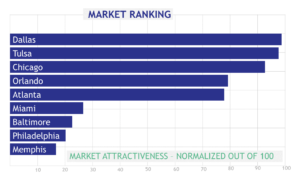

We help these clients to prioritize the investment strategy by ranking the markets using key performance drivers. We look at factors such as materiality, competitive position, profitability, risk, and cost to serve.

When we’re considering cost to serve, it’s important that a client not only looks at the retail network, but also at how they are going to be able to supply product to that network. Understanding supply envelopes and distribution costs will allow a more complete picture of opportunities in a market balanced against running costs.

Furthermore, clients should consider risk. Are there political risks to be considered? What are the economic risks? Are there barriers to entry, for example, regulatory requirements such as environmental impact assessment approval, licencing and zoning? Each of these variables contributes to the overall viability of a particular market.

Market entry

A subsection of Invest to Grow includes clients wishing to implement a new market entry strategy. They might have already decided on a market and seek to understand their brand impact in the market. Kalibrate addresses this by helping a client to determine what is the minimal and optimal number of sites they need to build or acquire.

We help clients to model their future performance for fuel volume and convenience store revenue.

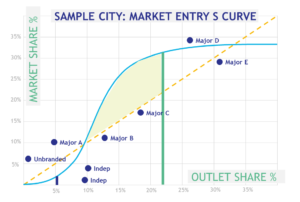

Through application of models for different market entry strategies, we can provide an S-curve to help clients understand the number of locations they need to achieve the target market position. The thick blue line at the far left of the S-curve is what we call critical mass – the volume of sites required to be effective in that market. Open fewer and you will lack the required brand exposure to make a big impact in the market.

At the green line, you reach saturation and adding more sites would risk cannibalizing your own network. The ideal position is in between critical mass and your saturation point and above the diagonal dotted orange line in terms of market effectiveness. Highlighted in pale green, this sweet spot is where a fuel retailer will maximize volume per site in the market.

As a component of Investing for Growth, we’re often engaged by clients to review mid-term strategic planning.

We use a variety of analytics tools to help us deliver the output such as the Potential Performance Quadrant Analysis. This helps retailers to identify high potential sites, which are potentially underperforming, as well as low potential sites which may be considered candidates for divestment and reallocation of capital.

Alongside the Potential Performance Analysis, we create client action plans for opportunities for knock down rebuilds in their market, for expansion of their c-store offer, or make other site upgrades to drive additional volume. This approach delivers a comprehensive strategic market plan that clients use to go forward over the next five years.

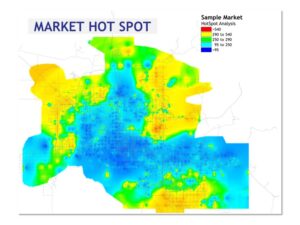

We’re often approached by retailers keen to grow market share by finding the best locations ahead of their competition. In these scenarios, they’re less interested in optimizing what they have – the play is pure growth through expansion. Usually, they’re interested in understanding where the best intersections are – where is the best ‘dirt strength’ in a market i.e. the locations with the highest potential in the market? In these engagements, Kalibrate is able to simulate a newly built site on every intersection within a market consecutively and rank is these based on volume potential and competitive intensity.

The output gives retailers the confidence to say – ‘these are the best sites to invest in the future’, delivering significant competitive advantage to their network planning team based on robust market intelligence.

Growth through acquisition

In this scenario, the retailer wants to grow very rapidly in a market and utilizes acquisition to scale. In a new market, if relying purely on new-build sites, a planning team would have to secure land banks and seek EIA (Environmental Impact Assessment), zoning, and other town planning approvals. Each of these tasks would be resource intensive, lengthening the time to reaching critical mass. In some cases, we’ve had clients wait two to three years to obtain the necessary approvals.

To scale faster, they look at acquiring either a single site or a small network of sites. The objective is being insight driven in identifying high potential single sites or to look at complete networks to acquire. That might mean not the fuel volume a site or network is achieving today, but what their ‘dirt strength’ is – the volume they could potentially achieve with the right brand or site upgrades.

If the network already has some sites in the acquisition target’s market, they also need to consider any impact on existing site volume post-acquisition and rebrand, and how to assess the potential for cannibalization.

Singe site growth

A final mode of expansion is site-by-site. Though slower than acquisition, it allows network planners to focus their attention on understanding the impact a single new site would have on the current portfolio and the competition.

Often the network may be considering a number of sites and need help running different scenarios to test whether the fuel volume and c-store potential could deliver on their investment.

Invest to… know!

Just as there are a variety of approaches to investment and growth, there are numerous insight-led approaches to ensuring capital spend is focused where it’s best placed to deliver return and meet objectives.

We always like to hear about how fuel retailers are expanding while delivering a great service to their customers. If growth is on your agenda and you’d like some extra insight to validate your decisions, get in touch with the team.