Investing to defend your fuel retail network

The fuel retail market is dynamic. Fuel retailers frequently face the challenge of optimizing their existing networks rather than expanding aggressively. We most regularly encounter clients investing to defend their position in retail networks with limited capital or those operating in saturated markets.

If you haven’t already, read part one here

Let’s delve into strategies that decision makers can employ to defend their positions in competitive environments.

Base business optimization

For companies with a limited appetite for growth, one approach we use is ‘base business optimization’. To put it simply, base business optimization focuses on optimizing existing sites to draw out their maximum potential.

This involves utilizing a Performance Potential Quadrant, along with our 7 Elements for Fuel Retail Success- market, location, facilities, operations, merchandising, brand, and price. We utilize these methodologies to identify opportunities for improvement.

The goal is to enhance the current network through activities like knock down rebuilds, shop upgrades, or forecourt enhancements. By strategically leveraging available space, businesses can explore additional offerings such as Quick Service Restaurants (QSR), car wash facilities, or ATMs to attract more customers.

These approaches are data supported, cost-effective ways to defend market share and optimize operations against encroaching competitors.

Getting back on track

A less capital-intensive yet highly effective strategy is what we call a ‘back on track’ approach. This approach involves identifying underperforming sites due to operational reasons and addressing problems that don’t show easily on a spreadsheet.

Operational issues may include poor dealer performance, tired-looking sites, or inadequate attendance service. By physically visiting these sites and collaboratively creating checklists, businesses can pinpoint areas for improvement. Whether it’s dealer replacement, training, site cleanup, or enhancing attendants’ services, this hands-on approach helps fix operational deficiencies.

In one instance with a client, we found that the type of material used in employee uniforms was causing them to look worn and outdated very quickly, causing the look and feel of the site to suffer. Another common issue we find is frequent fuel pump outages and fuel stockouts. Nothing is going to dissuade a potential customer from coming back to a site more than if there is no fuel available, so identifying and addressing those issues is an immediate way to ensuring a better customer experience overall.

Discover your way

There is no single correct answer to the right way to invest to defend a fuel retail network’s market position. Careful analysis of the factors driving both success and underperformance reveal the appropriate strategy in each scenario. Those that are data focused and led by insight in their strategy are best placed to drive optimization and value in their portfolio, delivering for your retail network and the customers you serve.

We always like to hear about how fuel retailers come up with creative ways to defend and shore up their sites against the competition. If defense is on your agenda and you’d like some extra insight to validate your decisions, get in touch with the team here.

Read more articles about:

Fuel pricingSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related resources

Fuel pricing

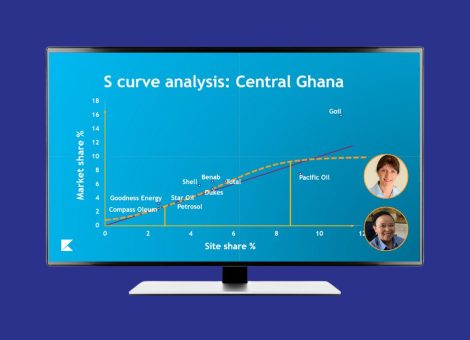

Middle East / Africa - Fuel network planning: Critical insights

Join our team as we look at the key points of insight that fuel network planners need to consider when making...

Location intelligence

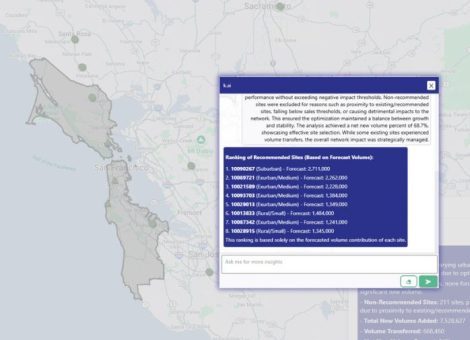

AI in location intelligence: The force multiplier for smarter site selection

AI is rapidly advancing in the world of real estate - this is the first blog in a two-part series on incorporating AI...