In today’s rapidly evolving fuel retail landscape, it can feel like there’s a constant wave of new data and new features promising to revolutionize pricing strategy. Dashboards get bigger, datasets get richer, and AI models get more complex.

But more information doesn’t automatically lead to better pricing. In fact, when that information isn’t focused, it can create distraction, not direction.

For fuel pricing teams, success isn’t about who can gather the most data. It’s about using the right data in the right way to drive confident, profitable decisions.

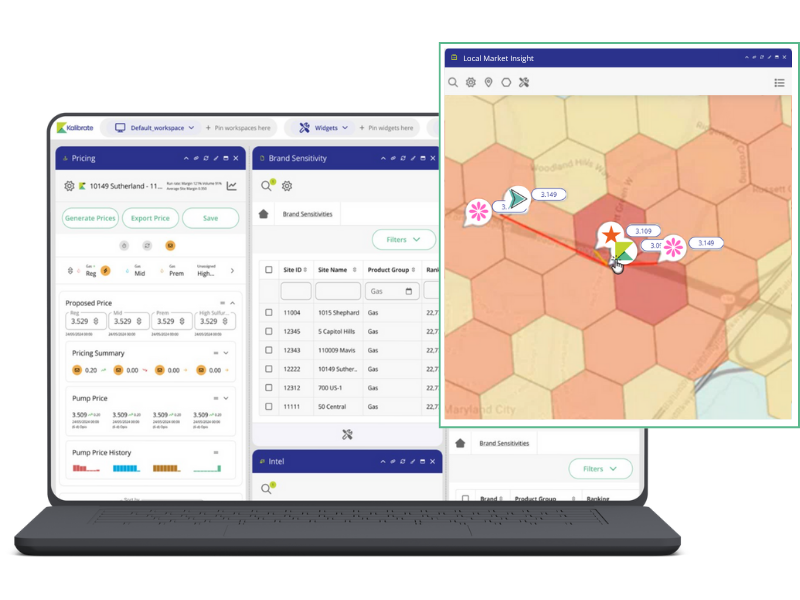

Actionable intelligence built for pricing performance

Fuel pricing is a precision game. Unlike other retail categories, a fraction of a single cent has the potential to shift volume and margin, influence customer behavior and ultimately transform profitability. Pricing teams need insight that they can act on with confidence, not another dashboard with data for data’s sake.

That’s the continued philosophy behind the upcoming features in Kalibrate Fuel Pricing – which integrates powerful location intelligence directly into the pricing workflow. The first of these new additions — Local Market Insights — goes beyond surface-level trends to show real competitive dynamics.

With this insight, pricing teams can:

- Understand customer movement patterns in their trade area.

- Identify which competitors they share footfall with and which ones don’t affect their volume at all.

- Refine pricing strategy to focus on the competitor stations that truly matter to their bottom line.

The result? A pricing strategy grounded in real competitive behavior, not noise.

Real-world results

One retailer in Germany recently used this exact analysis to sharpen their competitive set and align pricing more strategically. The impact was immediate: A 20% uplift in fuel volume. You can read the full story here: Location intelligence boosts German retailer’s fuel volume by 20%.

This example highlights the power of actionable insight: Fewer distractions, better decisions, stronger results.

A legacy of location intelligence

For years, Kalibrate Location Intelligence has helped real estate teams across the US make smarter network planning decisions. That same proven methodology now underpins the evolution of our pricing intelligence, but with a key principle:

Every new insight must be tested, validated, and proven useful before it becomes part of the product.

We don’t add data for the sake of innovation theatre. We add it when it drives better outcomes for our clients.

Insight that matters, not noise that distracts

When it comes to fuel pricing, every cent matters. It’s essential to build pricing strategies on clear, causal signals rather than data that might be interesting. Not all data adds value.

Before any dataset or factor is incorporated into pricing decisions, it should be proven to have a measurable and direct relationship to performance outcomes. This disciplined approach ensures that insights sharpen strategy rather than cloud it. Helping fuel pricing teams move with confidence rather than guesswork.

Looking ahead

This is just the start. More location-based intelligence is on the way, but only after rigorous testing with our client base to ensure every addition delivers measurable value.

Fuel pricing leaders don’t need more noise. They need clarity. They need confidence. And they need insight that sharpens their strategy.