How do automated vehicles impact fuel demand?

Once a thing of science fiction, automated vehicles are now a reality — and very soon, they could be the norm. Automated vehicles, also referred to as autonomous or “driverless” cars, use sensors and GPS software to navigate the roadways without the need for human interference.

When Arizona’s self-driving vehicle research program resulted in a fatal crash, the safety and ethics of autonomous vehicles came into question. But development hasn’t slowed; over 46 organizations are currently developing self-driving vehicles, including Tesla, Audi and Ford. Even Amazon has invested billions of dollars in developing autonomous vehicles for more efficient package delivery through a partnership with Toyota.

With development and research of the new technology growing exponentially, the question fuel retailers are asking is: How will automated vehicles impact fuel usage?

Mobility Trends Leading Toward Automated Vehicles

About 20 years ago, car manufacturers introduced active safety features, which beep when you get too close to the car in front of you, or gently jerk your car back toward the road when you cross the yellow line. That safety technology is getting better and better and, combined with a wave of mobility trends among consumers, is careening us toward the inevitable future of automated vehicles.

More and more, consumers are turning to passenger transport, such as trains, buses and ride-sharing services like Uber, as their primary mode of transportation. According to the U.S. Department of Energy, the demand for passenger transport is expected to increase by 94 percent by 2050.

So what’s driving this increase in demand?

1. Time

The average American driver wastes about a week per year sitting in congested traffic. In dense urban areas like Los Angeles and New York City, that time can double. Increasingly, consumers are looking for faster alternatives.

Because automated vehicles have the ability to navigate the most effective routes via satellite navigation, park themselves after they drop off passengers and act as crowd-sourced shuttles and other new modes of transport, they could cut down time spent in traffic.

2. Money

While sitting in traffic, that same driver loses about $1,400 idling away gas. When you add up the costs of parking, fuel, car maintenance, bus fare and the other costs associated with owning and operating a vehicle, transportation costs are the second largest expense in the U.S., after only housing costs. In fact, studies have shown that if you drive less than 10,000 miles per year, it’s cheaper to get rid of your car and use a ride-sharing service instead.

Therefore, shared automated vehicles could be a financially prudent alternative. This shared model allows for multiple uses of automated vehicles; in the morning, the automated vehicle could be a school drop-off; during the day, it’s a hospital shuttle; and in the evening, it becomes a taxi. Additionally, automated vehicles would eliminate the need for parking fees; they’d drop passengers off in town and go park themselves elsewhere.

3. Age

As we age, our vision begins to decline and the risk of things like heart attack and stroke increases, making driving an increasingly risky business. In the U.K., doctors may ban people from driving due to poor vision or other health risks that could interfere with their control of the vehicle — but with otherwise normal lives, these people still need to get to work, appointments, grocery stores and more.

So the demand for transportation still exists among the aging population, and automated vehicles eliminate the safety need for good health and vision. Automated micro-transit vehicles could be a comfortable, convenient alternative for this aging population.

How Do These Trends Impact Fuel Demand?

We’ve only hit the tip of the iceberg with self-driving technology, and as adoption rates speed up, we’re going to see a massive shift in mobility and transportation. With that, we’ll also see shifts in the volume and frequency of fuel demand cycles.

As consumers increasingly favor public transit and ride sharing services, fuel demand could decrease due to the smaller number of personal vehicles on the road. On the other hand, if automated vehicles allow traditionally immobile populations, such as the elderly, to get around more easily, fuel usage could increase.

Advancements in mapping and the ability to choose the least-congested routes allow automated vehicles to use fuel more efficiently, which drives fuel demand down. However, less congestion could mean that people are more likely to take trips more often.

The use of “zombie cars,” which go home and park themselves after dropping off passengers, will also have mixed effects on fuel usage. Although this model will eliminate the need for parking fees and likely lead to a shared model, decreasing the number of cars on the road, it doubles the trip — and therefore, doubles fuel usage.

Retail Planning in the Age of Automation

Have you noticed a trend? All of these disruptors are double-edged swords when it comes to fuel demand. As automated vehicles increase driving efficiency and the use of ride-sharing models, fuel demand decreases — at the same time, as automated vehicles improve congestion, decrease the cost of transportation and enable new populations to travel more frequently, fuel demand increases.

There are so many moving pieces. In order to price and plan effectively, fuel retailers will need to adapt their strategies to measure the disparate demand cycles caused by new technology, changing transportation models and consumer trends. Understanding this data and making accurate predictions will require the use of a smart market intelligence solution.

Today, many fuel companies have already rebranded themselves as energy companies, rather than oil or petrol companies, so they have the flexibility to work within whatever transportation future the world is heading for. That future is nebulous, certainly, but it doesn’t have to be scary. With a dynamic predictive model on your side, you can find the hidden truth in your data and make smarter, more confident decisions for your retail network.

Read More on the Future of Vehicles

Read more articles about:

Fuel pricingSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related posts

Location intelligence

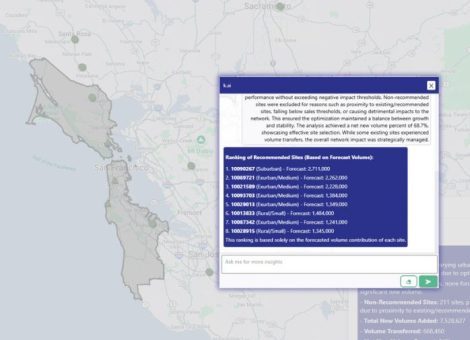

AI in location intelligence: The force multiplier for smarter site selection

AI is rapidly advancing in the world of real estate - this is the first blog in a two-part series on incorporating AI...

Fuel pricing

June 2025. Kalibrate's Canadian Petroleum Price Snapshot

Kalibrate conducts a daily survey of retail gasoline, diesel, propane, and furnace fuel prices in 77 Canadian cities....