Together in electric dreams: part three

The closing chapter in our electric vehicle (EV) series discusses the impact EVs will have on the market and how to start thinking about establishing an EV offering and pricing strategy.

What’s next for EVs and fuel?

So what do we know? EVs are here to stay. And they are projected to have a material impact on fuel within the next 10–15 years. However, the specifics are very much yet to be determined.

There is a lot of focus on network planning and placement, but the decision-making process and strategy is disparate; the market is highly complex and continually evolving, with new players emerging all the time. What’s more, the pace and direction of the industry could change at any time with advances in technology.

In the midst of all this uncertainty, one thing is clear; the pricing of charge points will be crucial.

A complex, interdependent market

There are multiple stakeholders in the EV market; from OEMs and energy suppliers to fleet operators and individual owners. Governments and local councils are taking an active role and many markets are mandating placement of charge points at new retail developments.

Commercial zones, supermarkets, leisure centres, and other retailers are showing an increased interest in the potential of charge points to attract extra footfall. Conventional fuel retailers must figure out how to balance the immediate upfront expense while ensuring they’re not left behind as the market transitions from fossil fuels to electricity. And, of course, charge point operators (CPOs) must decide what and where to build across their growing networks.

Each of these stakeholders has a unique set of considerations that will vary by geography. All will influence each other as the market plays itself out.

How will pricing evolve?

Let’s focus on CPOs. Currently, the CPO market is driven less by price and more by availability. Most CPOs operate a subscription model, charging a flat rate across an entire country or region (although some also have higher rates for non-subscribers).

However, this leaves scope for more competitive pricing that varies across networks. As the market matures and EV drivers have more choice than ever, pricing will have to adapt inline with local competition. This means we are likely to see EV pricing evolve from flat rate to variable pricing.

The data challenge

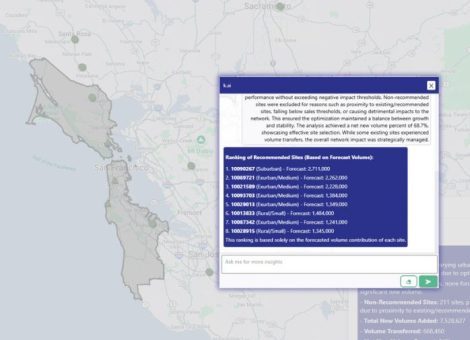

How can charge point operators—or fuel retailers—determine the optimal locations and optimal pricing strategies?

Data. A lot of data.

Our research has shown that the following data will help develop accurate planning and pricing models:

- Charge point site data—where existing charging locations are located, including the types of charge points and supported vehicle types

- EV network and utilization data—the number of EVs per region and the typical journeys and distances travelled, including up-time and pricing

- Existing and prospective customer data—including customer loyalty data, and segmentation and profiling data (i.e. anonymized user locations)

- Energy supply data—availability and cost of energy, including peak demand

- Competitor data—where they are located and what their pricing strategy is

The goal is to identify the optimal locations to serve current demand, reduce “range anxiety”, and encourage further adoption. The locations will then determine the right mix of slow, fast, or ultra fast chargers.

When you can accurately forecast demand against energy costs, you can begin to optimize pricing—balancing multiple variables, such as tariffs for peak energy use—to maximize ROI in what will become an increasingly competitive market.

All the data exists, but in different sources and with different levels of availability. The challenge for charge point operators is to secure access to as much of it as possible, then apply sophisticated modeling techniques to achieve actionable intelligence and gain an edge on the competition.

At Kalibrate, we’re experts in applying data science and predictive modeling to location planning and pricing problems, predicting the behavior of consumers at fuel and convenience retail networks.

You can read all of our latest news and insights in our blog.

Read more articles about:

Electric VehiclesSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related posts

Fuel pricing

Fuel pricing by exception: When do analysts actually analyze?

Managing fuel prices can be time-consuming, especially when analysts spend much of their day on routine tasks....

Fuel pricing

Middle East / Africa - Fuel network planning: Critical insights

Join our team as we look at the key points of insight that fuel network planners need to consider when making...