A closer look at electric vehicle penetration and impact

We’ve said it before and we’ll say it again: Alternative fuels are shaking up the global fuel industry. In particular, the popularity of electric vehicles is growing exponentially, and it’s not expected to slow any time soon. The latest Electric Vehicle Outlook Report predicts that sales of electric vehicles will shoot from a record 1.1 million worldwide in 2017, to a whopping 11 million in 2025, and then 30 million in 2030.

If those numbers don’t knock you out of your chair, then you may not understand the true impact that electric vehicle penetration can have on the fuel retail market. Understanding the current trend toward electric vehicles and then strategically responding to that trend will be key to surviving this wave and differentiating from competitors.

Let’s take a closer look at the reality of electric vehicle penetration and its impact.

4 Main Factors Driving Electric Vehicle Penetration

Dropping cost of electric vehicle batteries

There are a number of developing trends that are driving electric vehicle penetration. The first is that the cost of batteries is dropping rapidly. Currently, the cost of batteries has dropped 80 percent since 2010 — and those batteries are more powerful and more readily available than ever; Bloomberg New Energy Finance reported that the average energy density of electric vehicle batteries is improving about 5 to 7 percent per year.

Worldwide government support

Furthermore, new government policies are cropping up around the world in support of electric vehicles. At the government, state, and even regional level, subsidies and incentives are driving adoption. For example, people who invest in electric vehicles can park and recharge for free within the city of London. They also pay a lower road tax in comparison to more gas-guzzling vehicles, and the congestion charge — which can be as high as $15-20 per day for those who work in the city — is waived.

Many countries have committed to ending the sales of diesel and gas cars entirely. For example, India announced that it would only sell electric vehicles by 2025, and France committed to the same by 2040. China seems to be leading the charge for this switch; in 2017, one-fifth of all electric vehicle sales globally took place in just six Chinese cities, each of which have severe restrictions on buying new and used fossil fuel cars.

Positive industry response

Several major automakers have made bold statements about the push toward electric vehicles. Volvo, for example, stated that by 2019, it will only offer electric or hybrid vehicles. Volkswagen, after its infamous diesel scandal, promised to create electric versions of all 300 of its vehicles. And we can’t forget Tesla, of course, which builds only all-electric vehicles. Even car-sharing services like Uber have committed to make the switch to electric or hybrid vehicles.

Automakers aren’t the only ones embracing the trend toward electric vehicles. Several major oil companies, such as BP, have made major investments in charging infrastructure and battery technology. The oil industry clearly recognizes the real threat posed by electric vehicle penetration, and they understand that the only way to deal with that effectively is by becoming a part of that wave of innovation and adoption — at the very least, to give their customers options.

Decreased demand for oil and diesel

According to the 2017 Fuel Institute Report, only about 22 percent of respondents said they’d be interested in purchasing a diesel vehicle in the near future. Young people, between ages 18-34, were the most interested in electric vehicles, with the majority citing environmental impact and fuel economy as their main reasons for considering an electric vehicle. Those over 50, on the other hand, seemed to remain skeptical about the technology.

When asked why they wouldn’t consider an electric vehicle, an overwhelming majority cited the cost of batteries, the shorter driving ranges, and the lack of availability of charging stations as their main deterrents. But as the cost of batteries drops, technology enables further driving ranges, and more major oil companies invest in charging infrastructure — these concerns will become obsolete, making more room for electric vehicle penetration.

How will fuel retailers fare in this new reality?

Undoubtedly, electric vehicle takeover is already here. The adoption will continue to accelerate, and whether or not fuel retailers survive will depend on how they respond to this new reality. Anyone committed to staying in retail should recognize that the other, non-fuel elements of fuel retail success — such as location, facility, and brand — will be their highest profit drivers in the future. More and more, consumers are visiting gas stations for a different kind of refueling: food, drinks, and other in-store offerings.

Whether they’re there for fossil fuel or a quick charge, many consumers choose a gas station based on its non-fuel offerings. The beauty of electric vehicles is that to recharge, customers will have to spend some length of time at the outlet of their choice, and this dwell time is the perfect opportunity to provide customers with your other services. By investing in charging infrastructure and focusing on optimizing those other six volume magnets, you can provide more options for your customers and ultimately become a destination. Because if you don’t do it, other businesses will, and you run the risk of being late to the game and losing customers that would have purchased other non-fuel services as well.

If there’s a growing level of electric vehicle adoption in your region, such as a major metro in Europe with significant subsidies driving the switch, then at the very least, you need to consider putting charging stations in place. If there are no significant subsidies currently, such as in the U.S., then you have more time to plan a strategic response. Either way, it’s a fool’s errand to sit stagnant and ignore this wave.

It’s Time to Recharge Your Fuel Retail Strategy

Electric vehicles have been touted by some as a passing fad — but why would major automakers, oil companies, and governmental bodies make multi-million-dollar investments supporting this trend if it was just a fad? It’s true that certain hurdles still remain for consumers to fully adopt electric vehicles, but with future leaps in technology and tightening governmental restrictions, the fuel industry must inevitably reinvent itself.

Moving forward, fuel retailers will have to capture intelligence to better understand individual consumer behavior, demand cycles and other, non-fuel volume drivers: What do consumers want and need while they’re charging, refueling, or waiting to carpool? Using data science to understand that intersection between demand movement and the services that retailers can provide will be key to successfully evolving with upcoming waves of innovation.

Read more articles about:

Electric VehiclesSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related posts

Location intelligence

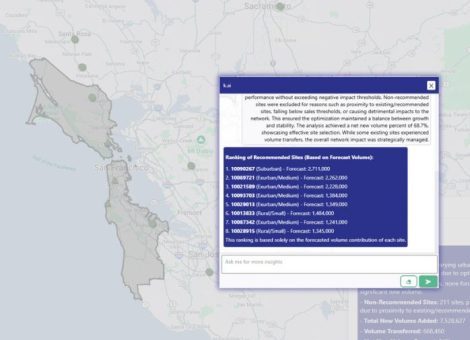

AI in location intelligence: The force multiplier for smarter site selection

AI is rapidly advancing in the world of real estate - this is the first blog in a two-part series on incorporating AI...

Fuel pricing

June 2025. Kalibrate's Canadian Petroleum Price Snapshot

Kalibrate conducts a daily survey of retail gasoline, diesel, propane, and furnace fuel prices in 77 Canadian cities....