A ban on Russian oil and the impact on fuel prices

Before the invasion of Ukraine, fuel prices across the globe were already on the rise. As explained in our Fuel Price Predictions 2022 blog back in November, the impact of increasing consumer demand — as the world moved slowly past the worst of the COVID pandemic — and a limited global fuel supply, pushed wholesale prices from $50 to $70 a barrel throughout the course of 2021. This steadily drove fuel prices up across the world.

Now, an even bigger factor has come into play. With the invasion of Ukraine, Russia has been issued with multiple economic sanctions. Major oil companies, BP and Shell have announced they’re pulling out of Russia and ending joint ventures with Russian businesses, and on March 8, 2022, both the US and UK placed a ban on all Russian oil imports.

What does a ban on Russian oil mean for our fuel prices?

Fuel prices will continue to rise.

The cost of crude oil makes up over 65% of the prices we pay at pumps. As Russia are the third largest oil producer, a ban on Russian oil means worldwide crude oil production will drop by 10-12% and crude oil prices will inevitably rise.

In an interview with CBC, Kalibrate’s Director of Consulting, Vijay Muralidharan, explained:

“The worry that Russian crude may suddenly become unavailable is causing crude buyers to look elsewhere to ensure a dependable supply — even if it costs them more. If Russian oil goes offline, Canada, the US, and even OPEC nations simply don’t have the capacity to increase production quickly. It’s going to take some time [and] it won’t happen overnight.”

What happens next?

We will see higher prices for some time to come.

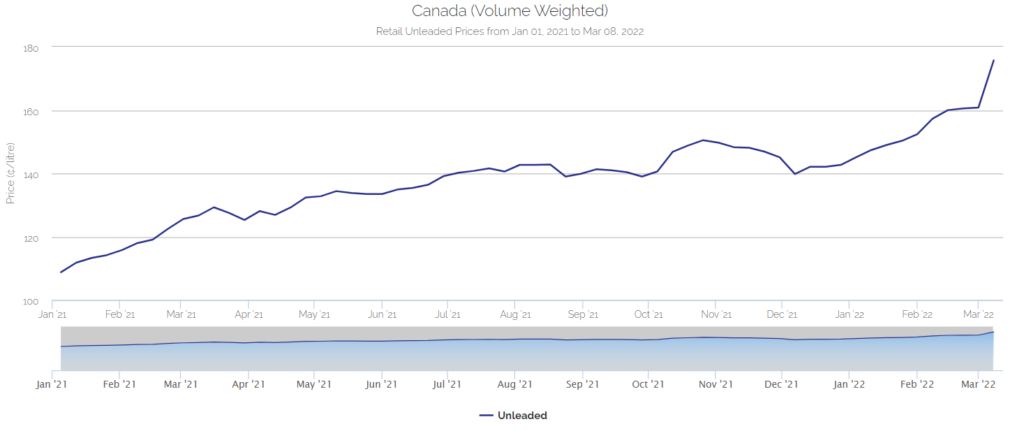

Usually, prices are lower throughout the winter months and increase in spring as demand strengthens for the summer driving season. However, 2021 debunked this trend as multiple factors compounded to steadily increase fuel prices as the year progressed — as shown in the Canadian fuel price chart below sources from https://charting.kalibrate.com/Charting/Timeline

The impact of a drop in demand

With fuel prices rising so dramatically, we are more likely to see a decrease in demand this spring.

Tom Hatton, Head of Product Management at Kalibrate, explains:

“For many households, the impacts of higher fuel prices and the cost-of-living squeeze will likely give rise to families needing to economize and so we’d expect to see a drop in retail demand.”

While lower demand normally equates to lower prices, the impact of a ban on Russian oil means prices are unlikely to drop anytime soon.

Can other countries increase supply to make up for the Russian deficit?

Yes, but it often requires large amounts of upfront investment to increase capacity. This takes time, and companies need to be sure they can recoup those costs. In a world where fuel demand has recently been lower than pre-pandemic levels, and governments worldwide pledging for greener alternatives — it’s not a straightforward solution.

We may see higher prices for some time to come.

What can fuel retailers do to weather the storm?

In an interview with Fleetpoint, Tom shared retailers’ concerns:

“Now, it’s down to fuel retailers to understand how they can meet the changing market mix and evolving profile of consumers. These latest price increases are equally as unwelcome to fuel retailers as they are to consumers. Retailers now face the challenge of maintaining margins without losing volume, and of course, they need to be mindful of the impact increasing pump prices has on other revenue streams.”

With higher fuel prices, retailers often face lower margins and will need to make up the shortfall with other services or in-store sales. But with the very real possibility of consumers reducing their fuel spend altogether, attracting customers into stores will be harder than ever.

___________________

Kalibrate collates and shares free fuel price data for Canada, which is available here. Although this data is not available for other countries, the Canadian data is a great indicator of price changes for the rest of the world — as the factors that are driving the increases in fuel prices are having a global impact. We will continue to monitor the situation and share updated data and analysis when available.

Read more articles about:

Fuel pricingSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related posts

Fuel pricing

Fuel pricing by exception: When do analysts actually analyze?

Managing fuel prices can be time-consuming, especially when analysts spend much of their day on routine tasks....

Fuel pricing

Middle East / Africa - Fuel network planning: Critical insights

Join our team as we look at the key points of insight that fuel network planners need to consider when making...