EV market outlook: Forecasting changing fuel demand

For fuel retailers, changing levels of fuel demand in their trade areas has always been a major factor influencing network planning decisions.

In most countries, electric vehicle (EV) adoption is a relatively new market force that will start to impact potential fuel volumes and should be considered when making both site and portfolio level plans.

Understanding the speed of growth of EV sales and how adoption is distributed within markets is critical when it comes to making strategic network decisions for the long term. So, as we reach the tail end of 2021, what’s the EV market situation?

According to BNEF, there are 12 million passenger EVs on the road globally today, but this is set to rise to over 600 million by 2040, based on technology, market, and economic trends.

Factors that support this growth

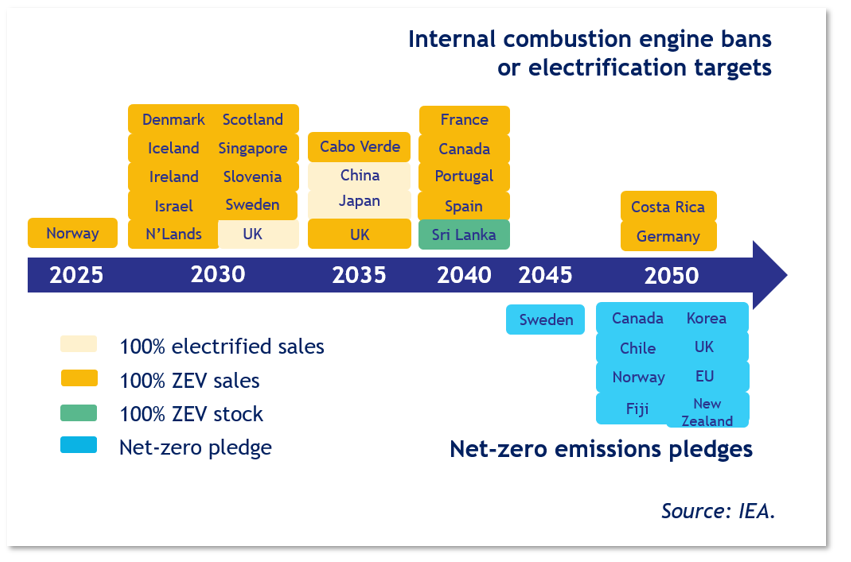

- Legislation – more than 20 countries have electrification targets or ICE bans for cars either signed into law or proposed, with many more in progress, and 8 countries plus the EU have announced net-zero pledges

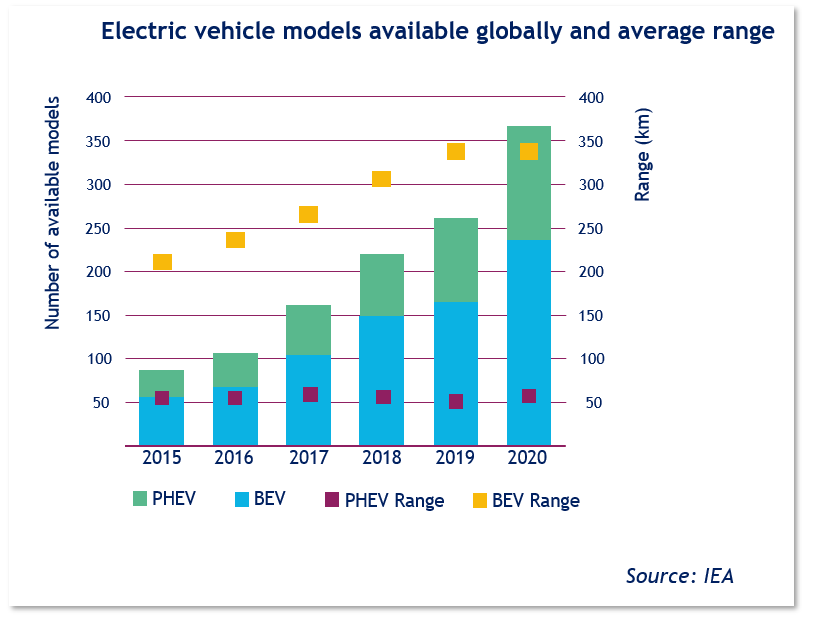

- Availability of a wider range of electric vehicles – over 200 battery EVs are in the market now, with ranges reaching parity with ICE vehicles, and almost 100 new pure electric models are set to launch within the next two years

- Infrastructure development – Over the last five years, there has been exponential growth in the availability of public chargers, reaching 1.3 million globally by the end of 2020, of which 30% are fast chargers; but there is some way to go to support the speed of growth in EV ownership.

Impact on oil demand

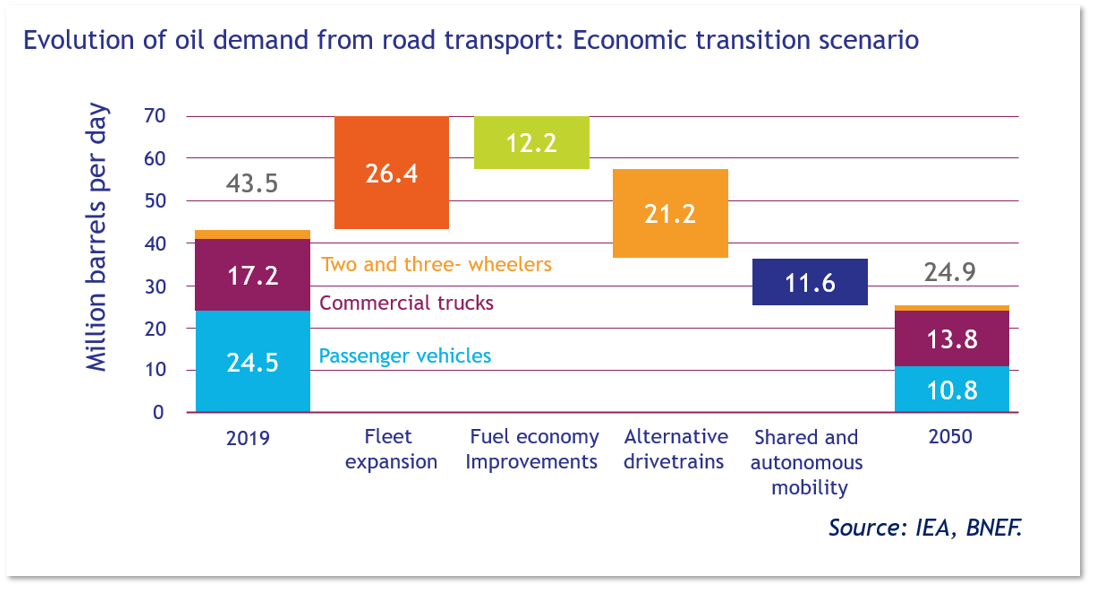

As a result of the increased adoption, Bloomberg estimates that EVs and fuel cells will displace over 21 million b/d of oil demand by 2050, with a net impact of 18.6 million b/d. This could be even higher if additional changes to policies and regulations are enacted.

What does that mean for fuel retailers?

The impact of the changes in oil demand will vary from country to country, market to market, and even site to site within a specific trade area. There will be no ‘one size fits all’ approach to site redevelopment or network planning. To establish the true effect, macro and micro-level impact analysis of legislation and changing fuel and EV demand is needed.

Map the key drivers behind gasoline demand or sales, and account for the unpredictable

It’s crucial to understand how vehicle sales shifting towards EVs will impact gasoline sales at a macro level and on individual gas stations over time, including possible impacts in the micro-operating environment e.g., changes in the competitive environment as a result of the changes in demand.

For robust, accurate demand forecasting we need to consider the following:

- EV adoption curves: How are different EV adoption curves going to influence future gas demand?

- Variable selection and impact: Which variable(s) are central to forecasting gasoline demand? Consider variations in demographic characteristics, vehicle ownership rates, customer

- Mobility, and other behavioral impacts

- Future uncertainties: How do uncertainties surrounding income, employment, behavioral patterns, and resource constraints simultaneously influence gasoline demand?

- Dynamic outcomes: What is the potential range of future outcomes (base, high, and low ranges) and the confidence in each scenario?

- Macro and micro forecasting: How do you translate market-level forecasts to site-level forecasts?

- Competitive environment: What is the impact of the competitive environment and its response to EV adoption, on micro level gasoline demand?

Using data to master your competitive environment

Here at Kalibate, we’ve been using data to predict gasoline demand impacts for decades — with a high degree of accuracy. Our proprietary modeling methodology can provide an understanding of the macro shift away from ICE towards EVs and its subsequent impact on gasoline demand by region. We do this by establishing the empirical relationship between the variables impacting demand and EV adoption rates, for a range of future outcomes resulting from differing policy and behavior changes.

Using the empirical understanding of demand shift at a macro level, we can predict how a shift towards EVs is expected to impact gasoline demand at an individual site level by accounting for certain demographic variables such as population, income levels, urbanity, and the competitive environment.

Simulating the competitive environment and how it may shift over time requires an understanding of micro level market share, and the threshold at which operating a fueling station is no longer viable, enabling a redistribution of demand to be calculated.

Once you know all of this, you can take decisive action on each individual site to maximize total site profitability.

Take action now

If you have gas stations in cities with ICE bans that are about to come into effect, or where increased adoption is likely, how do you compensate for the loss in fuel sales as a result?

One strategy would be to use targeted analysis to determine the right action to take on each site to maximize return. This would allow decisions on a site-by-site basis to determine whether you should:

- Add EV chargers

- Add hydrogen units

- Expand food offer

- Expand convenience offer

- Combination of the above

- Close the site

Whether your actions are focused around creating an alternative fuels proposition, enhancing or creating new revenue streams through food or convenience, or consolidating sites, making decisions backed by insight is key to strategic success.

If you’re looking at how to forecast how changing levels of fuel demand could impact your portfolio, reach out to Kalibrate to see how we can help.

Read more articles about:

Electric VehiclesSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related posts

Electric Vehicles

Kalibrate launches EV Pricing solution to transform electric vehicle charging operations

Launching Kalibrate EV Pricing - the intelligent EV pricing software for strategic CPOs

Electric Vehicles

The EV charger pricing challenge

As electric vehicles (EVs) become more prevalent, the task of managing EV charger pricing presents unique challenges...