Together in electric dreams: part two

The second in our three-part series on the future of the electric vehicle (EV) market focuses on planning charging sites, choosing from different charging models, and how increasing EV adoption will impact fuel sales.

What charge points EVs drivers need and where to build them

To meet current demand and encourage further adoption, the EV market must provide:

- The right number of chargers

- In the right places

- At the right speeds

For many electric cars, 50kWh chargers can take over an hour to give up to a 200 mile charge, and so are best placed in parking lots of workplaces, shopping malls, supermarkets, leisure centers and other locations where drivers will typically stay between 30 minutes and two hours. This is fine for top-up charging. However, ultra fast chargers near cities and on highways will be essential to overcome range anxiety as well as service drivers without access to off-street parking or slow charging.

“Being able to recharge cars within the recommended driving break time (10/15 minutes every two hours) is expected to be a game changer for market uptake as it should help to address drivers’ remaining range anxiety.”

Roll-out of public EV charging infrastructure in the EU, Transport and Environment, 2018

Fast charging has been shown to drive more adoption than standard charging, while also increasing electric distances travelled. In one study, providing charging solutions above 50kWh close to urban areas was found to increase annual EV kilometers traveled by about 25% (even in cases where it was used for less than 5% of total charging events).

Will the world meet the increased demand for power?

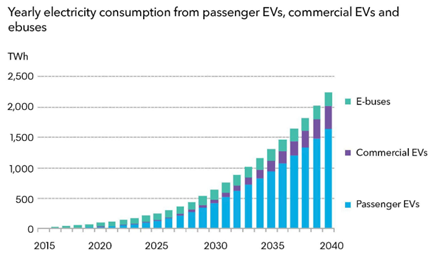

Demand from all types of EV’s is predicted to rise from 74TWh to 2,333TWh in 2040.

Source: Bloomberg NEF EV Outlook 2019

That sounds like a lot, but it’s only an extra 6.8% on top of total global energy consumption.

The market can integrate the additional demand. However, fast chargers do incur a greater impact on the grid and there will be an increase in evening peak loads; could retailers could charge higher tariffs for fast charging at peak times? EV customers are currently less price sensitive than petrol customers, although this may change as the market becomes more competitive. Further down the line, vehicle to grid (V2G) technology could help meet some of the increased demand by transferring energy produced during regenerative braking back to the grid.

How will EV adoption impact fuel sales?

In 2018, plug-in vehicles displaced about 0.25% of all gasoline sold in the United States. Not very much. But 42% more than in 2017. And about twice as much as it was in 2016.

If we zoom out from a regional snapshot to a long term, global perspective, the implications become clearer.

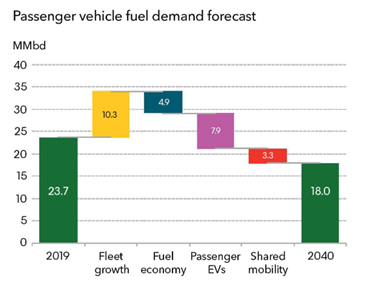

Combined impact from passenger EVs, shared EVs, commercial EVs, and e-buses is forecast to displace a combined 13.7MMbd of oil demand by 2040

Source: Bloomberg NEF – EV Outlook 2019

Currently, global passenger vehicles account for 23.7m barrels of fuel per day. By 2040—the tipping point year for EVs—that will be just 18m barrels a day.

Even though fleet growth of conventional vehicles will increase demand, the rise of passenger EVs, together with increased fuel economy and shared mobility (e.g. ride sharing in Uber) will actually reduce the total demand. Passenger EVs alone will account for nearly eight million fewer barrels per day.

EVs and the oil crash

All the evidence points to a steep decline in the global gasoline market. Most analysts agree that demand for oil will stay strong throughout the 2020s then start declining around 2030. Although some analysts even predict a crash could come as early as 2023 or 2025. Demand for oil won’t disappear but EVs will have a significant impact on fuel consumption.

This means fuel retailers, manufacturers, and energy providers need to start planning now. While some smaller retailers may still be struggling with the immediate business case, numerous major brands are acquiring or teaming up with charger providers.

The obvious next step is to ensure they get maximum return on their investment. Some of which will come through their pricing strategy.

How can fuel retailers and charge point operators devise optimal pricing strategies in such a fast-moving market?

Read more articles about:

Electric VehiclesSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related posts

Location intelligence

Market Optimizer: Demo video

Market Optimizer allows users to strategically grow their network in existing markets while balancing revenue...

Fuel pricing

The Kalibrate news round-up: June 2025

In this monthly feature, we look across the industry and mainstream news to uncover stories of note that we think are...