2025 EV predictions

At the beginning of 2024, we provided our EV predictions for the year. Key themes in those predictions included EV adoption continuing to grow but at varying rates by market, traditional fuel volumes being impacted, more EV-first offers and more affordable EVs on the road.

Looking back, these were broadly correct, however, several pivotal events have significantly influenced the global EV market, shaping its trajectory and adoption rates throughout 2024. These include:

- The US Election: Tax credits and NEVI funding have strengthened EV adoption and infrastructure development, but with the change in government there are rumors of funds being cut or redirected leading to market uncertainty.

- European market shifts: Overall market trends remained positive, with EV sales projected to have reached 24% by year-end, but significant headwinds have resulted in uneven growth. Reduced subsidies and higher tariffs resulted in a decline in EV sales in some markets, most notably Germany which saw a dramatic drop of 28% in EV sales. In other markets such as The Netherlands and France, growth has continued, buoyed by support for green energy policies.

- China reached a major milestone: China now produces around 80% of all EVs globally. This is driving in-country adoption but is more notably impacting global markets. The cost of production and economies of scale are leading to more affordable EVs hitting the road, but increasing tariffs may offset any benefit to the consumer.

Here are some key trends that should be taken into consideration when planning the roll-out of EV chargers in 2025.

Shifts in EV adoption at a country level

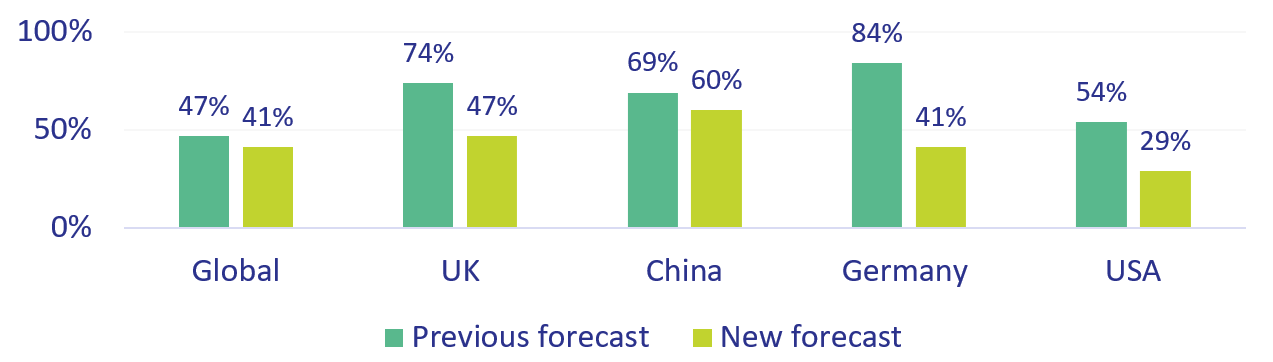

Global EV Adoption is projected to rise from around 25% today to 41% by 2030, down from last year’s projection of 47%. Today Norway is leading the charge with 95%, followed by Sweden (60%), China (55%) and The Netherlands (30%). The uneven nature of global EV adoption was expected to become even more pronounced, but some of the major global economies have started to pair back some of their ambitions that may give other countries a chance to catch up.

China shows no signs of slowing down, but the UK, Germany and the USA have all seen 2030 targets significantly reduced:

Charger deployment won’t slow down, but developers will need to be smarter

There has been a clear trend of EV charging infrastructure being developed in highly urban areas and along major arterial routes (primarily where public funding is available) but other areas are chronically underserved. This leaves significant potential available to those looking to develop EV charging infrastructure.

Increased competition does mean, however, that developers will need to make smarter decisions on where to place chargers. Reports state that chargers need a minimum of 17% utilization to break even and between 25% and 35% utilization to give a reasonable return on investment.

See why Kalibrate is developing Europe’s first regional charger utilization model here.

There are both opportunities and threats to retailers

Kalibrate is fortunate enough to work with some of the biggest retailers in the world, and we’re seeing first-hand the positive benefits of investing in EVs. From re-designed gas stations to EV hubs to retail locations with added EV facilities, our customers are seeing increasing footfall at their locations and new revenue streams that are driving further investment across their network.

At the same time, traditional fuel retailers are starting to see their core business impacted by more BEV, PHEV and fuel-efficient ICE vehicles on the road. As the profitability of existing networks is called into question, strategic investment decisions need to be made that rely on robust data and projections.

Our advice for 2025

Despite changes in market dynamics, the facts remain that EV demand continues to grow, and demand for EV chargers outstrips supply in underserved areas. There is still significant potential out there for the development of EV chargers, and the rate of new location openings will continue to accelerate.

However, to maximize the return on investment on development projects through 2025 and beyond, CPOs and retailers alike will need to make smarter decisions related to the markets and the locations that they develop. Robust data and analytical insights should be leveraged to select the highest potential markets and strategic locations that provide the utilization required to justify the investment.

For fuel retailers, it’s equally important to look at EV data and ask the question “What does this mean for my existing business?” Understanding the trajectory of EVs and the impact that may have on existing revenue streams is imperative to developing a network planning strategy and ensuring the success of the your business.

Read more articles about:

Electric VehiclesSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related resources

Location intelligence

Forman Mills accelerates growth with the Kalibrate Location Intelligence platform

The value apparel and home goods retailer selects Kalibrate to to support its national expansion strategy.

Location intelligence

The Kalibrate news round-up: November 2025

In this monthly feature, we look across the industry and mainstream news to uncover stories of note that we think are...