If you’re not doing this before moving into a new market, you might lose

Understand market landscape

It starts with getting a bird’s eye view of the market landscape in terms of demand. In other words, what is the average volume potential in the market you want to enter and what are your expected margins?

Volume potential and expected margins

Identifying the average volume potential and your expected margins are two important steps. The 7 Elements for Fuel Retail Success, and factors such as location, population, demographics and fuel pricing all have influence on the volume sold in a market.

Knowing the population of the area you are entering and the number of sites that serve that population will give you insight into the volume potential on a per site basis. Ask yourself whether the convenience fuel market is currently under built or already overly saturated. For example, one market might have a population of 300,000 and 100 sites serving that population, while another might have the same number of sites, but a population of 1,000,000 people. In the latter case, the market is under served in the number of sites. This potentially translates to a higher average volume for those 100 sites. Likewise, fewer sites in a larger populated market can indicate that customers have longer commute distances and may require more frequent fill-ups — again, impacting the average volume potential for each site.

When assessing your expected margins, closely review the fuel prices in the state or region you are thinking of entering. Different states might have different margins for retailers. For instance, in the U.S, fuel is typically less expensive in Arkansas than in Chicago, due to state fuel taxes. It will be important to understand the fuel margin in your market in order to forecast the financial gain for each gallon sold in that market and to accurately measure total site profitability.

Understand retail fuel landscape

Competitors and value propositions

Once a macro view of the volume potential has been completed, focus on a more granular understanding of who the competitors are in the market and what they offer. How large are their convenience store offerings? How does your value proposition align and compete with theirs? If a competitor has a value proposition that is similar to yours, how will you adjust what you bring to the market in order to be competitive? That competitive edge might come from price, or an extra convenience store offering.

There are both pacesetters and under performers in any given market; it is important to analyze both. Pacesetter locations propose a challenge to your potential site because well-known brands often have brand-loyal customers. Capturing those customers loyal to other brands will take a tailored and well-orchestrated strategy.

While it is important to make sure your new site will be competitive with the pacesetters, it is also important to forecast the potential negative impact under-performing competitor sites might have on your sites. A common occurrence when a site is not doing well in a market is that it starts to drop fuel prices in order to retain a minimum amount of volume to stay competitive. While this is not a sustainable method, it can still impact your site. Large pricing gaps could be detrimental, especially if an under-performing site enacts this strategy soon after you open.

Forecasting

Forecasting the opportunity for success and return on investment in potential new markets can be of huge value to you. If you have multiple opportunities to grow into a market and are deciding which will be the best choice, running “what if” volume projections will help form science-based metrics to back those decisions.

When comparing different locations or growth strategies, using a predictive modeling tool to project possible outcomes will offer the clarity you need. For example, if you have a potential location to build a new site or you have a potential acquisition candidate, using a forecasting tool will enable you to compare the potential volume for both sites before investing capital.

Research

You may be utilizing a real estate agency to search for available properties in a market. While they might be able to provide you with a list of potential locations, it is important to remember that their main goal is to sell you on the available properties and not necessarily on high potential areas for a fuel and convenience store. In your research, it is important to incorporate which locations will best meet your specific volume and inside sales objectives. Knowing how you fit and perform in a future market will give you the confidence and ability to make the right business decision that will stand the test of time in an otherwise unknown market.

Market intel

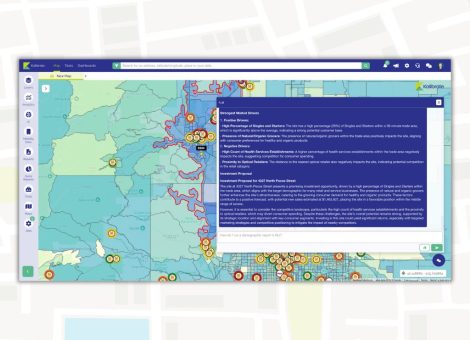

How would someone go about acquiring this range of information? Often, gathering and understanding this depth of intel without a predictive modeling tool can be challenging. It requires digging for data on mapping sites that will be able to show you how many gas and convenience stores are in the immediate area of your potential site. But that digging will not uncover the impact of “what if” projections.

Using a software tool that offers clear market intelligence can help you identify and understand traffic patterns, demographic characteristics and historical trends. Couple that intel with predictive capabilities and you can forecast potential high-demand opportunities and see the impact before implementing.

The stakes are high when deciding how and where to move into a new market. Without a clear understanding of the market and retail fuel landscape, you are taking great risks. Using location planning and market intel tools to help evaluate these key factors will help make the move into a new market a positive extension of your company and one that will offer a high return on investment for many years to come.

Learn how Kalibrate can help you obtain the right intel for your market expansion decisions.

Learn more about market data

Read more articles about:

Location intelligenceSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related posts

Location intelligence

Right-size your franchise territories: Maximize revenue per market

Franchise territory management tools are evolving changing with advances in location intelligence.

Location intelligence

AI in location intelligence: See it in action

See videos and screen captures of how AI has been integrated into the KLI platform.