Petroleum pricing in Canada — the Q1 2022 report

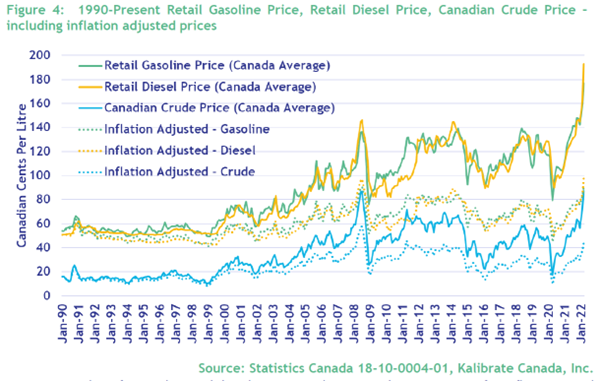

Canadian retail prices have reached extraordinary heights in the first quarter of 2022. This has been the result of several compounding factors, including higher crude prices, higher taxes, and higher refining margins.

Global crude oil markets began the year in what was already considered a tight market as world petroleum demand had outpaced supply through much of the later half of 2021, leading to contracting crude oil inventories. As geopolitical tensions escalated, curtailing crude production, Canadian crude prices reached unprecedented levels by March — having risen over thirty cents per liter from the end of 2021.

So what happens next?

Looking forward to Q2 we’re likely to see Canadian gasoline pricing rise further throughout Spring as demand picks up again. An increase in carbon taxes on April 1st in several provinces will add to retail petroleum prices, but other provinces have introduced lower taxes to bring relief from the rising pump prices over the coming months.

With global instability from conflict issues and COVID continuing to impact large economies, fuel price volatility is set to continue.

Read the full report from Kalibrate Canada to get detailed insight on Canadian petroleum pricing in the last quarter, including:

- A gasoline and diesel market overview

Find out how prices have changed across the nation — with a breakdown of the final pump price, and an explanation of supply, demand, and other influencing factors.

- The market outlook for Q2 2022

Read Kalibrate’s analysis on how volatility will affect the market — and Canadian pump prices in 2022

- Record retail petroleum prices — the Canadian perspective

We look back over the past 30 years to show historic trends in gasoline and diesel pump prices, taxes, refinery capacity, and stock — to analyze the changes that have led to the record highs we’re currently seeing.

Read more articles about:

Fuel pricingSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related posts

Fuel pricing

November 2025. Kalibrate's Canadian Petroleum Price Snapshot

Kalibrate conducts a daily survey of retail gasoline, diesel, propane, and furnace fuel prices in 77 Canadian cities....

Fuel pricing

October 2025. Kalibrate's Canadian Petroleum Price Snapshot

Kalibrate conducts a daily survey of retail gasoline, diesel, propane, and furnace fuel prices in 77 Canadian cities....