Spirit Halloween: Shopping center footfall trends

Every fall, as pumpkins line porches and costumes fly off shelves, one brand dominates the US seasonal retail scene.

As North America’s largest Halloween retailer, Spirit Halloween operates over 1,500 pop-up stores, many transforming empty retail units into spooky shopping destinations. Trips to these stores to purchase masks, props, decorations, accessories and candy for trick-or-treaters have become a cultural phenomenon and part of holiday tradition. But beyond the costumes and ghoulish décor, Spirit Halloween’s arrival brings a significant surge in footfall for U.S. shopping centers.

As shoppers prepare for another Halloween fix, we utilized our Competitive Insights data to explore which type of shopping destinations benefit most from Spirit Halloween’s annual takeover, and how the brand has grown to represent the very essence of this annual fiendish festival.

Which shopping centers get the biggest lift from Halloween customers?

As Halloween approaches, Spirit Halloween becomes more than just a retailer, it turns into a powerful traffic magnet for US shopping centers. Known for short-term leases, themed displays and impressive store launches, the brand’s consistency draws in consumers from all corners of the country.

The biggest spikes in footfall during the Halloween season are found in power centers and community centers where Spirit Halloween attracts shoppers who also spend at neighboring stores.

- Power centers: Measuring 250,000 to 600,000 sq. ft. Mostly occupied by a few large retailers, plus a limited number of smaller stores/restaurants

- Community centers: Measuring 100,000 to 350,000 sq. ft. Features a broader range of stores, including general merchandise, apparel and smaller inline units

Now let’s deep dive into the data and look closely how Spirit Halloween drives seasonal traffic, and which retail formats see the biggest lift when the brand’s iconic orange and black storefronts open their doors.

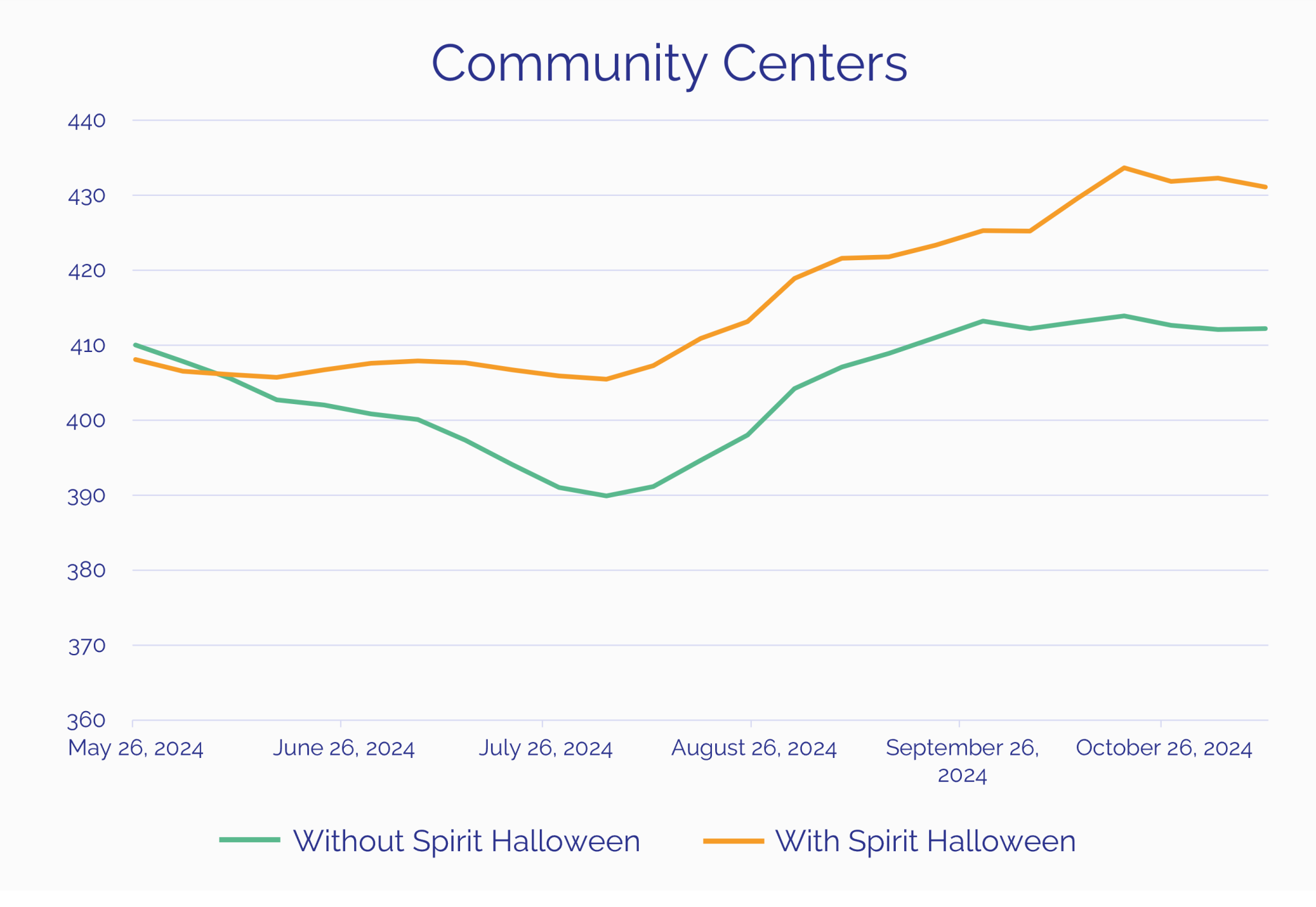

Community centers

Community shopping centers are mid-size retail hubs that typically serve the everyday needs of local residents. They are larger than neighborhood centers but smaller than regional malls, typically anchored by chain stores, supermarkets, discount outlets, and surrounded by smaller shops, services, restaurants and takeaways.

Thanks to their convenient location and diverse mix of retail options, community centers are popular destinations for local people. And in the run-up to Halloween, they benefit from a sizeable boost in foot traffic fueled by the launch of seasonal Spirit Halloween pop-up stores, with the strongest uplift occurring between October 13 and November 10 and peaking just before Halloween itself.

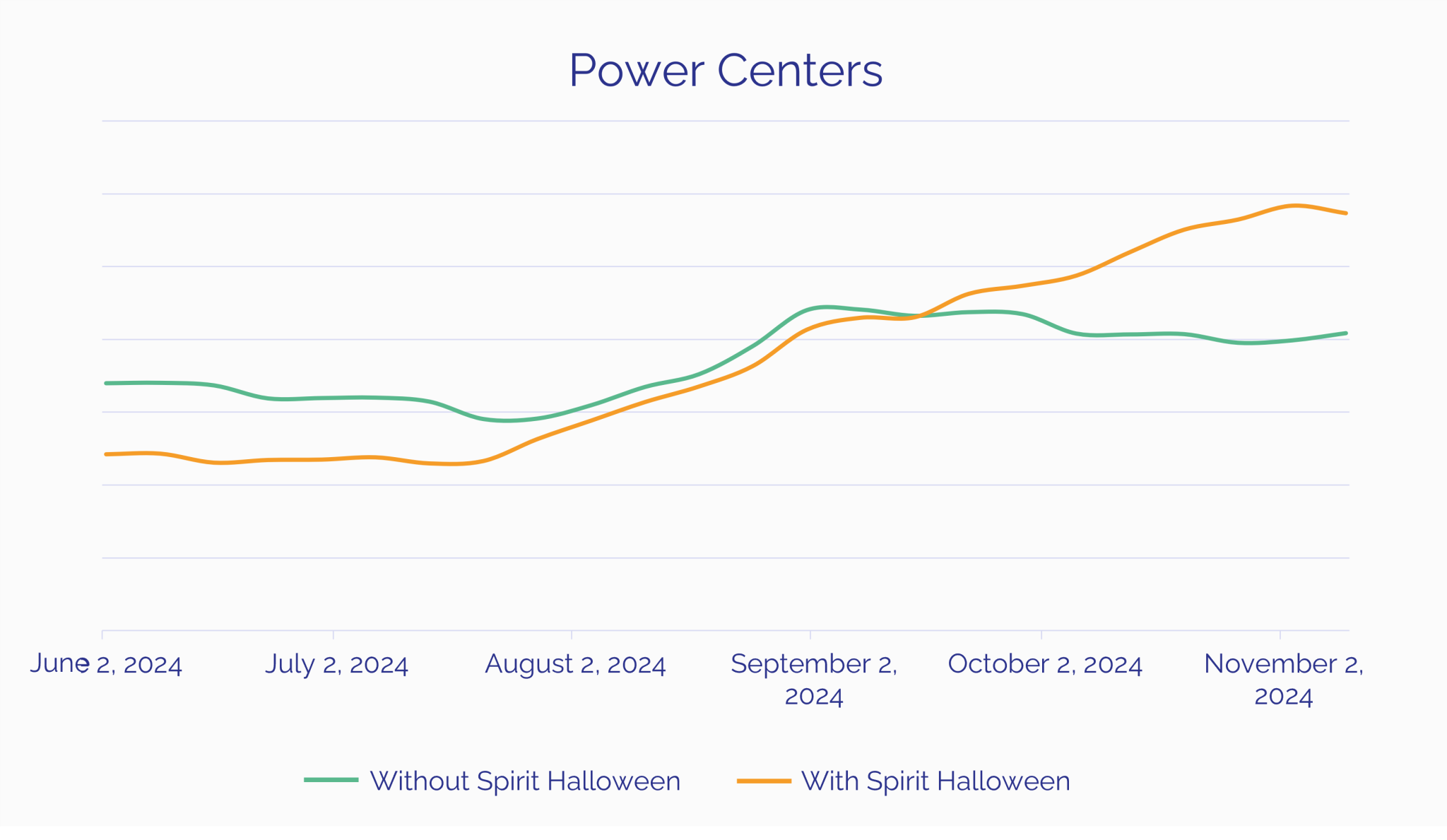

Power centers

Power centers refer to large retail developments featuring several big-box stores such as home improvement chains, electronic retailers and warehouse clubs. They often span vast spaces and are designed to provide a premium shopping experience, attracting customers from a wide geographical area. Unlike traditional malls and community centers, power centers focus on major national retailers rather than smaller independent or specialty shops, making them a popular destination for high-volume shoppers.

Major retailers like Costco, Best Buy and Lowe’s already attract swathes of visitors to power centers. But our data shows that footfall is amplified in late-October when Spirit Halloween stored are open, with the strongest spike between October 20 and mid-November.

Top US cities thriving thanks to Spirit Halloween stores

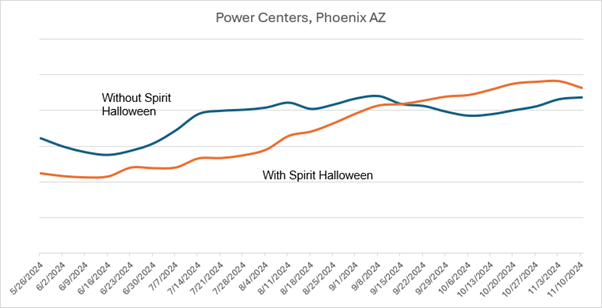

Phoenix, AZ

Major lifts appeared earlier in the season and were already visible in September.

- Sept 1, 2024 – With Spirit: 1,290 vs Without: 396 (+895 footfall)

- Sept 8, 2024 – With Spirit: 1,292 vs Without: 400 (+892 footfall)

- Sept 22, 2024 – With Spirit: 1,253 vs Without: 382 (+871 footfall)

No other U.S. city goes crazy for Halloween quite like Phoenix – and power shopping centers here specifically are reaping the benefits of Spirit Halloween stores.

Our data reveals that huge increases in power center footfall from early September coincides with the opening of Spirit Halloween stores. In fact, Phoenix power centers reported an after the launch of one of its spooky pop-ups. Interest in Halloween merchandise continued to grow the following week with an 892 footfall rise and from September 22 last year when there was an 871 boost.

Orlando, FL

Strongest spikes occurred late October, aligning with national shopping patterns.

- Oct 27, 2024 – With Spirit: 5,399 vs Without: 2,226 (+3,174 footfall)

- Nov 3, 2024 – With Spirit: 5,435 vs Without: 2,243 (+3,192 footfall)

- Nov 10, 2024 – With Spirit: 5,398 vs Without: 2,227 (+3,171 footfall)

When it comes to the most Halloween-friendly major cities, Orlando, FL, came out on top in our research. A massive surge in footfall peaked around Halloween time into early November as shoppers flocked to power centers to stock up on their creepy goods from Spirit Halloween.

In the week starting October 27, 2024, Orlando power centers featuring a Spirit Halloween store attracted 3,174 more visitors compared to centers that didn’t have one. The difference was even greater in the following week with 3,192 greater footfall. Even the period beginning November 10 – almost two weeks after October 31 – there was 3,171 more footfall in those power centers with Spirit Halloween stores than without.

Cincinnati, OH

Footfall surge peaked around Halloween into early November.

- Oct 27, 2024 – With Spirit: 1,796 vs Without: 862 (+934 footfall)

- Nov 3, 2024 – With Spirit: 1,787 vs Without: 850 (+937 footfall)

- Nov 10, 2024 – With Spirit: 1,754 vs Without: 838 (+916 footfall)

According to research, Cincinnati, OH, experienced the second highest footfall increase in its city power centers around the Halloween season. Figures from 2024 show power centers where Spirit Halloween had a presence drew 934 more visitors than those without a store in the week starting October 27. The following week attracted 916 more visitors, and the week after that, 916 more, with strong consumer intent also spreading to neighboring stores.

Benefits of Spirit Halloween stores in your shopping center

Spirit Halloween stores provide a seasonal boost to the local economy, with shopping centers feeling the biggest benefits. Not only do they drive higher foot traffic, but they also encourage shoppers to visit nearby retailers and buy their goods and services.

These pop-up Spirit Halloween stores attract a diverse range of customers, from families and teens to high-spending adults seeking out eerie costumes, home decorations, and ghastly products. This often translates into additional spending at other stores and restaurants in the vicinity.

The increased activity not only benefits other tenants in the center but also helps property owners fill vacant space temporarily while creating short-term seasonal value plus extra jobs for the community.

Do you want to unlock Halloween season insights?

Want to understand how seasonal retailers like Spirit Halloween can transform foot traffic in your town and city shopping centers? Contact the team today to see how our local intelligence insights can help you identify trends, measure performance, and unlock new opportunities for growth.

Read more articles about:

Location intelligenceSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related posts

Location intelligence

The Kalibrate news round-up: November 2025

In this monthly feature, we look across the industry and mainstream news to uncover stories of note that we think are...

Location intelligence

A guide to data centralization in retail real estate

Data centralization gives retail real estate teams a single, reliable source of truth, improving site decisions,...