Beyond demographics: How psychographic data enhances retail site selection

Site selection has evolved far beyond simply finding a location with high visibility and heavy foot traffic.

Today’s retailers face the challenge of understanding increasingly complex consumer behaviors and preferences that vary dramatically across different markets and demographic segments. The solution lies in developing comprehensive customer profiles that go beyond surface-level demographics to capture the deeper motivations and spending patterns that truly drive sales performance.

There are a wide range of factors that retailers and restaurants consider when evaluating potential locations for new outlets, including:

- Population

- Household characteristics

- Convenience of the location

- Competition

Statistical modelers and data analysts will quantify the impact that each characteristic has on store sales performance and incorporate those findings into a sales forecasting model.

Quantifying the impact of household characteristics on store sales performance is referred to as developing a customer profile, or quantifying the relative contribution of households to store performance based on their characteristics. Kalibrate has found that using both demographic and psychographic characteristics together provides a powerful tool to best quantify the synergistic benefits of those characteristics.

Demographics represent the characteristics of a population base that are categorized by distinct criteria, such as income, age, and educational attainment. Demographic data is collected by the U.S. Bureau of the Census every ten years for the entire U.S., and is supplemented annually by the American Community Survey of approximately 3.5 million households.

Synergos Technologies and other demographic data vendors leverage this and other data sources to provide updated estimates and projections of population and other demographic data.

Psychographic data

Psychographics, on the other hand, classify people based on their attitudes, aspirations, and actions. Two neighbors may have the same age, same income level, and even live next door to one another, yet spend their money in very different ways.

Psychographic data vendors compile a wide range of relevant information to categorize households into specific categories. LandScape reliable consumer survey data with proprietary indicators to paint a comprehensive picture of household preferences, motivations, and behaviors.

LandScape allows users to move beyond static demographic traits by revealing how consumers actually live:

- What they buy

- How they bank

- Where they travel

- How they vote

With lifestyle and environmental indicators, LandScape captures nuances like health habits, political engagement, environmental affinities, and adoption of new technologies. This rich, multi-dimensional view helps retailers and analysts understand not only who their customers are, but why they buy—offering powerful insights that can drive smarter site selection, more targeted marketing, and stronger brand alignment.

Use case for a national sporting goods store

Kalibrate recently developed a customer profile and built a predictive sales forecasting model for a national outdoor sporting goods store. In order to best quantify the impact of household characteristics on store sales, Kalibrate used both PopStats demographic data and LandScape psychographic data to develop the customer profile.

The psychographic data enabled the client to fully understand those household characteristics that provided the most meaningful contribution to store sales, and represented one of the key contributors to the sales forecasting model. This insight on key contributions gives guidance when market planning and real estate teams are looking at specific locations.

In addition, the results can be of significant value to marketing departments, to help focus on those consumers most likely to become future customers.

The integration of demographic and psychographic data represents a best practice approach to site selection and market analysis. Rather than relying on broad assumptions about consumer behavior, this data-driven approach enables retailers to make precise, evidence-based decisions that align with actual customer preferences and spending patterns.

As consumer behavior continues to evolve and markets become increasingly fragmented, the businesses who invest in comprehensive customer profiling will be best positioned to identify high-performing locations, optimize their store network, and ultimately drive sustainable growth in a competitive marketplace.

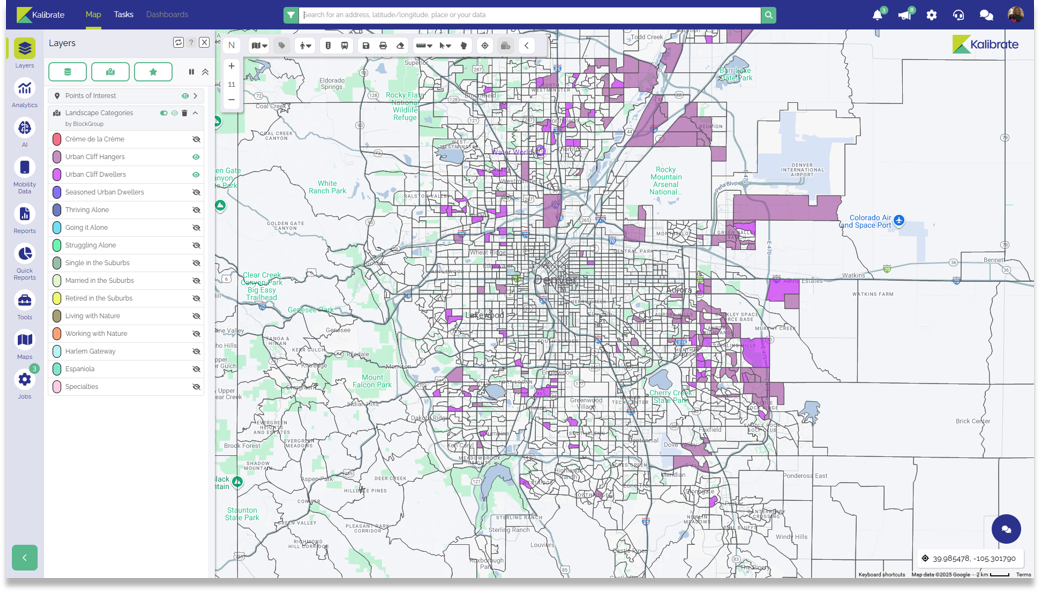

In this screenshot from the Kalibrate Location Intelligence platform, two segment classes are shown in the Denver market.

Urban Cliff Climbers in Denver Metro

These are Denver’s younger working-class neighborhoods where 20 and 30-somethings are “in pursuit of their individual dreams” and building comfortable middle-class urban lifestyles. They’re willing to forgo college for on-the-job training and value practical skills over formal education, representing the entrepreneurial spirit of building success through hard work rather than credentials.

Urban Cliff Dwellers in Denver Metro

These represent Denver’s established working-class families enjoying “the creature comforts of middle class Americana” with a decade of mortgage equity built up. They’re focused on classic family stability – thinking about trendy clothing for teens, saving for an additional family car, and college funds – embodying traditional working-class values of steady progress and family investment.

Curious to know what a customer profile looks like for your business? Contact us to learn more.

Read more articles about:

Location intelligenceSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related posts

Location intelligence

Forman Mills accelerates growth with the Kalibrate Location Intelligence platform

The value apparel and home goods retailer selects Kalibrate to to support its national expansion strategy.

Location intelligence

The Kalibrate news round-up: November 2025

In this monthly feature, we look across the industry and mainstream news to uncover stories of note that we think are...