In this blog series, we take a closer look at how our team supports our clients in achieving their strategic objectives. In some organizations, it might be going ‘above and beyond’ to get the job done – but we just call it ‘the Kalibrate Standard’.

This edition features Elizabeth Butler, Product Manager of Competitive Insights.

Tell us a little about your role.

I’m the Product Manager for Competitive Insights. I’ve been in this role for about five months, but I’ve been with Kalibrate for nearly 15 years.

Most of my career has been in analytics, with a few detours into other roles, so I bring a deep understanding of how clients interact with our tools. That hands-on experience helps guide how we shape Competitive Insights, especially as we look to compete with other mobility data solutions in the market. It’s a challenging space, but one I enjoy working in.

How does your role interact with the rest of the team?

Being on the product side means I field a lot of questions, not just about Competitive Insights, but about product strategy in general.

My day-to-day mostly revolves around Competitive Insights, managing roadmaps, explaining data nuances, and collaborating with AZIRA (our mobility data partner) on everything from geofencing coverage to data accuracy.

What types of problems are the clients you work with trying to solve?

Clients are using Competitive Insights to understand how individual sites perform, who their customers are, and where else those customers shop. That site-level clarity is powerful, but we’re increasingly being asked to roll those insights up to the brand level.

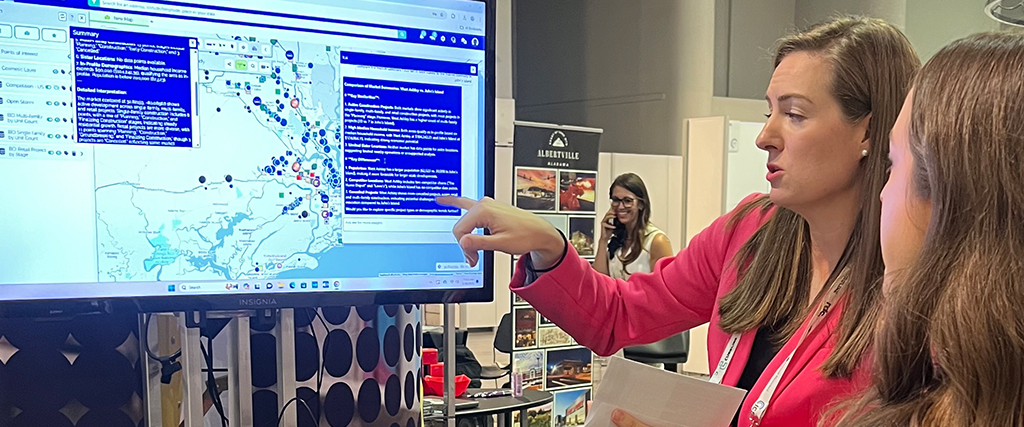

For example, at ICSC, one of our clients, a convenience store brand, wanted to know which QSRs they should co-locate with based on their actual customer behavior. Not just defaulting to the most popular QSRs, but using data to identify the best brand for co-location based on where their customers are already going. That’s the kind of question Competitive Insights answers in seconds.

Give us an example of a particularly challenging client question.

One of the key challenges facing brokers and real estate firms today, especially small to mid-size brokerages, is the need for reliable, high-quality foot traffic and mobility data. Whether they’re working on behalf of landlords to lease retail spaces or representing tenants looking for optimal locations, these firms require detailed insights into how people move and behave in specific trade areas. Historically, access to this kind of data has been limited to larger firms with bigger budgets or required costly custom analysis, putting smaller players at a disadvantage.

And how did you solve that?

We’ve configured our Competitive Insights platform, and its suite of reports, to provide an affordable, self-serve software and data solution for small to mid-size brokerages. The platform delivers location intelligence that helps users quickly understand who is visiting a site, where they’re coming from, how long they stay, and how it compares to nearby competitors. This levels the playing field by enabling firms of all sizes to make data-driven recommendations, justify leasing decisions, and better support their clients with confidence and speed. In our most recent release we’ve included a Key Insights report where the user can now select individual reports and chose to combine the selected reports into one single pdf output or individual pdf outputs.

Where do you see the future of location intelligence and Competitive Insights evolving?

AI is going to play a huge role, though probably not in the way people expect. Right now, AI isn’t great at generating accurate numbers, but it is very good at interpreting large datasets. That’s where I see the biggest opportunity.

One of my goals is to use AI to help clients understand massive amounts of cross-shop data. Imagine clicking on a shopping center and instantly seeing which brand would be the best fit for a vacant space based on who shops nearby. Maybe there’s a Whole Foods, a Starbucks, and a CAVA, and AI can recognize that a boutique pet food store like Hollywood Feed would thrive there.

This isn’t about guessing what will go into a retail space, but about using real consumer behavior to make smarter, data-driven recommendations. We’re also pushing Competitive Insights to do more at the brand level, not just the site level, so clients can compare Publix to Kroger in Atlanta, for example, and see who’s winning.

The future is all about smarter tools, cleaner dashboards, and better storytelling from the data.