One of the success stories of service retail in recent years is the booming market for car wash. With private equity firms investing significant sums and several major acquisitions, we’ve seen a number of chains scale rapidly.

To explore how they’re expanding and consider some of the strategies behind their expansions, with the help of our partners at ChainXY, we looked at three chains’ growth from 2021 to mid-2023.

“We have seen tremendous growth and interest in car wash brands over the last two years having added over 88 chains into our database.”

Oszkar Breti (CRO, ChainXY)

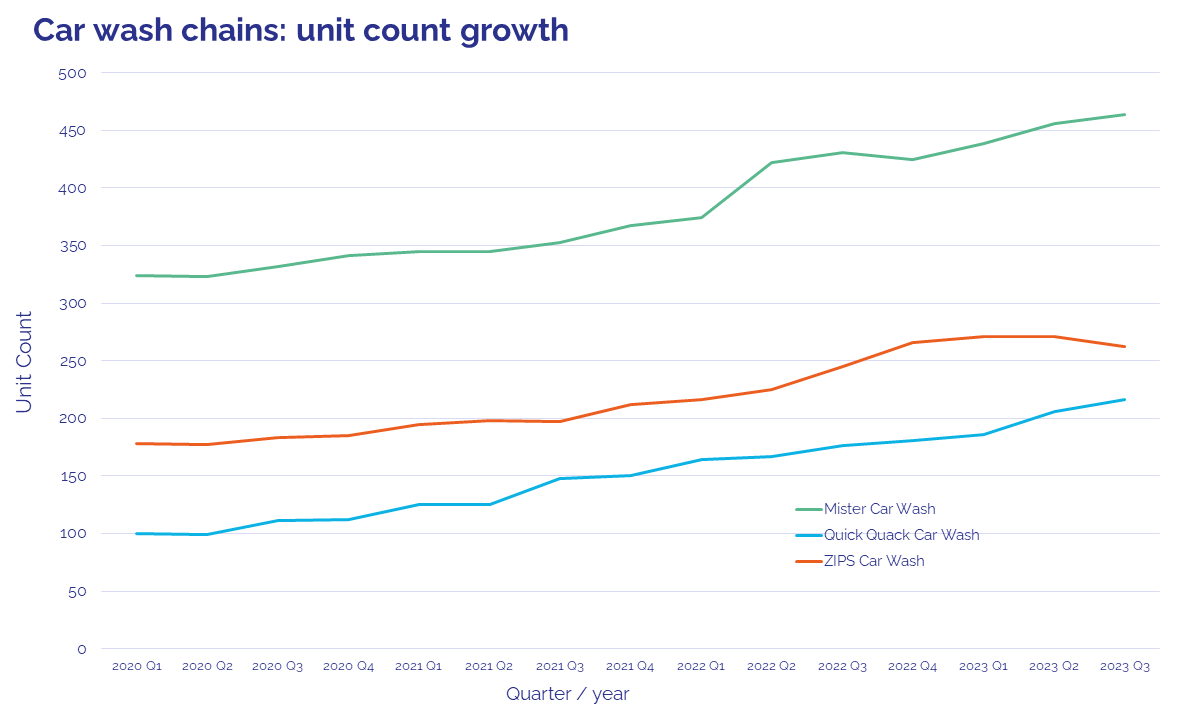

Here’s how the unit count of three market leaders has grown from the first quarter of 2021 to the middle of last year.

Mister Car Wash

Founded in Houston, TX in 1969, Mister Car Wash has grown to become the largest operator in the US. In 2014, it was acquired by Car Wash Partners Inc alongside Autawash, Car Wash USA Express, and Goo-Goo Express Wash to create a network of over 200 locations. ChainXY data indicated over 450 locations with the Mister Car Wash brand by the end of the second quarter of 2023.

“We began tracking Mister Car Wash back in 2018 and have seen them scale incredibly well, adding more locations consecutively year over year and continuing to do so into 2024.”

Oszkar Breti (CRO, ChainXY)

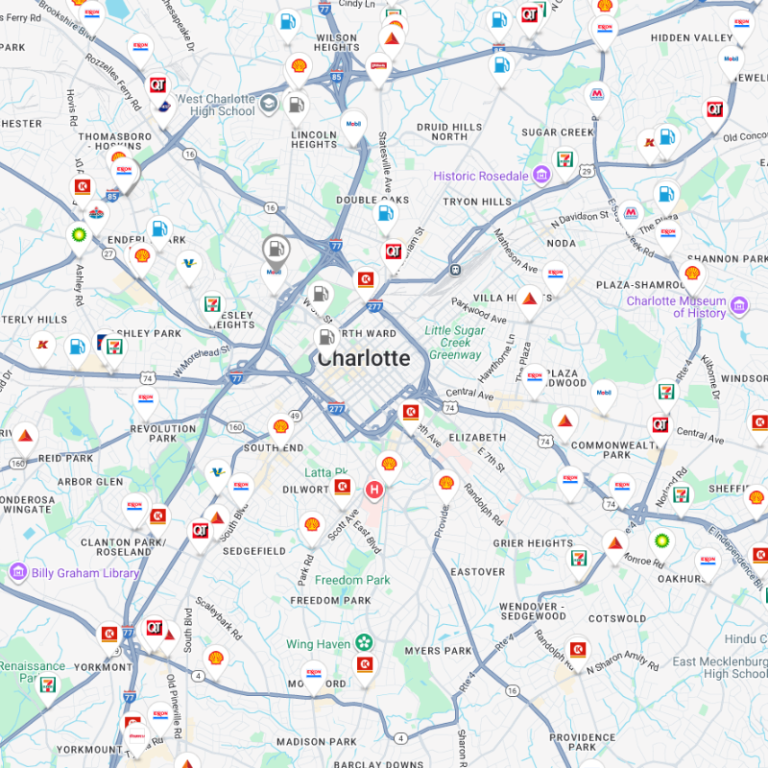

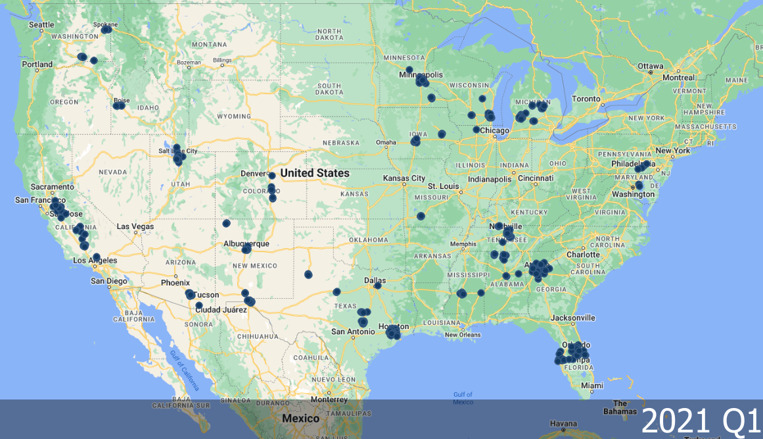

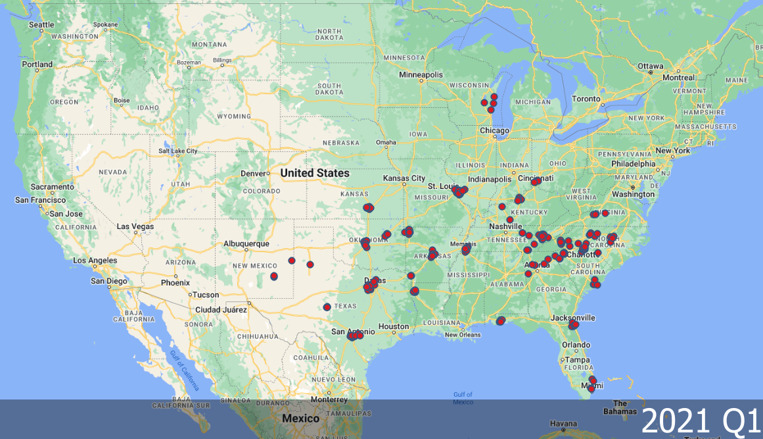

Here’s Mister Car Wash’s locations at the start of 2021 with strong presences in Houston, Atlanta, Orlando, Salt Lake City, Tampa Bay, and over in San Jose, California on the West Coast. That said, they have a presence in a majority of states.

Let’s see how they’ve expanded through to 2023.

Expansion has been largely focused in existing markets with expansion north east in Florida in 2021 and southwards from 2022. The Minneapolis market has grown too with several new sites located to the east of Los Angeles – further south in the state than the brand has ventured before.

The expansion has mainly focused on adding units where the brands has significant presence or entries to neighboring markets. There are a handful of reasons brands take this approach to expansion. Analysis of their competition may reveal more.

Zips Car Wash

Let’s take a look at another chain. Zips was founded in 2004 with two locations in Arkansas. Since then, it’s seen rapid growth.

From its home markets, by 2021, Zips had expanded in every direction into neighboring markets with a significant footprint in Texas in Dallas and San Antonio, and the major cities in the Carolinas.

Noticeably, no sites have been opened in the locality of Houston – the home market of Mister Car Wash, suggesting Zips recognized the strength of the competitor may pose challenges to entry.

Here’s how Zips unit count grew during the period Q1 2021 to Q2 2023.

New market expansion has been slightly more aggressive than Mister Car Wash. With significant number of openings around Orlando and Tampa in 2022 going head-to-head with Mister. Elsewhere, opening in Salt Lake City also sees them compete more directly with Mister, while new market entry in Chicago is focused close to the city, where Mister do not have a footprint.

Zips also added new units down the east coast of South Carolina and strengthened its position across the Carolinas generally.

We probably characterize Zips’ expansion as bold but considered. The chain has clearly leaned on insight to understand where its white space potential exists and where a particularly strong regional competitor could impact its route to critical mass.

“We have seen Zips more than double their store count since 2018. They are a powerhouse when it comes to developing new locations without seeing many closures.”

Oszkar Breti (CRO, ChainXY)

Quick Quack Car Wash

Also founded in 2004, Quick Quack Car Wash stared as a single unit in Utah in the name Splash & Dash Car Wash. By 2021, it had over 160 sites and reached 220 sites by 2023.

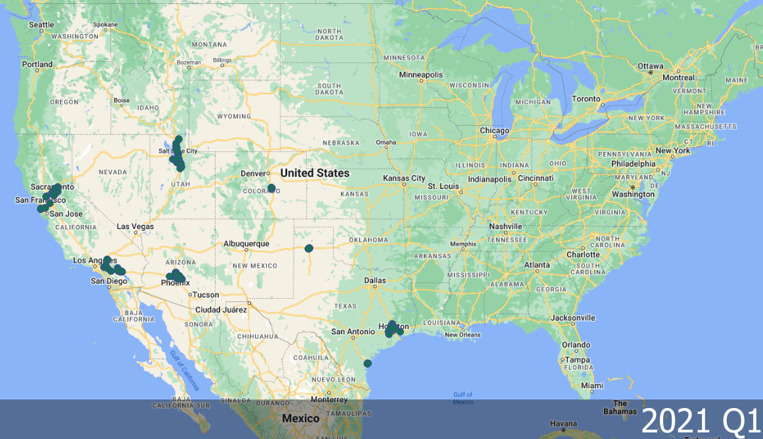

Let’s take a look at what its Q1 2021 network.

Contrasting the previous two chains, Quick Quack operates in more granular geographies with the largest part of the portfolio concentrated around Salt Lake City, California, Phoenix, and Houston.

So how did that change?

The growth strategy seems to be to controlled expansion within existing or neighboring markets, adding units where brand presence is largely established such as the Sacramento, San Francisco, San Jose, and Los Angeles markets. Notably, the chain avoided Bakersfield and the Route 5 area connecting its key markets. It’s possible that Mister Car Wash’s significant number of locations were seen as a barrier to entry.

A handful of locations were added on Route 15 through Utah – perhaps to serve its customers driving through the desert on their journeys to and from Vegas. That would make sense given the absence of other major competitors on the route.

Quick Quack also added locations at Corpus Christi and further south close to the border rather than entering neighboring San Antonio, where Mister has locations to the north and Zips has a footprint to the south.

Takeaways

What does the expansion of these three chains tell us about location planning and growth? There are lessons to be taken from each approach.

As strong believers in the value of data-driven decision making, we believe each of these chains was leveraging robust insight when planning their growth. When solidifying their position within existing markets, new units largely avoided their largest competitors at a granular level.

Where they did go head-to-head, the rate of entry was usually rapid suggested the chain understood its route to critical mass and brand impact would require aggressive volumes of openings. The car wash subscription model means chains need convenient locations – with limited wait times – making conservative market entries challenging. When assessing new markets, they need to make a splash(!).

“Having access to quality, accurate and up to date location data is essential to stay ahead of your competiton especially in a rapidly expanding car wash market.”

Oszkar Breti (CRO, ChainXY)

Whatever the retail concept, understanding your customer, the strengths and weaknesses of your competitors, market characteristics, and how that relates to location performance, is key to getting expansion right. The success of these car wash chains isn’t just down more customers wanting to keep their vehicle looking fresh – they’re allowing data to drive where they go and how quickly they go there. This approach means that risk is managed, and market entries are focused to the areas of greatest potential for success.