With the arrival of electric vehicles, public bodies and private enterprises globally are striving to understand the appropriate location strategy for EV charging facilities both today and as adoption grows in the future.

The UK government has committed to ending the sale of new petrol and diesel cars and vans by 2030. The impact of legislation, incentives, more EV models, improved range, and more environmentally conscious consumers, continues to drive greater levels of EV adoption.

Recognizing the scale of the challenge in effectively rolling out the EV infrastructure to meet the demand for charging, the UK government has released a new policy paper – Getting to the Point: Accelerating EV chargepoint rollout through geospatial data.

Data-first approaches

Kalibrate welcomes the UK government’s recognition that geospatial approaches are critical in optimizing the EV charger network. We strongly believe that the answer begins with quality data and then applying the appropriate models to this data to forecast which types of chargers and services are optimal for any given location.

The policy paper agrees, identifying four key challenges

- Challenge 1: Modelling future demand

- Challenge 2: Finding suitable sites

- Challenge 3: Creating a seamless consumer experience

- Challenge 4: Tracking rollout

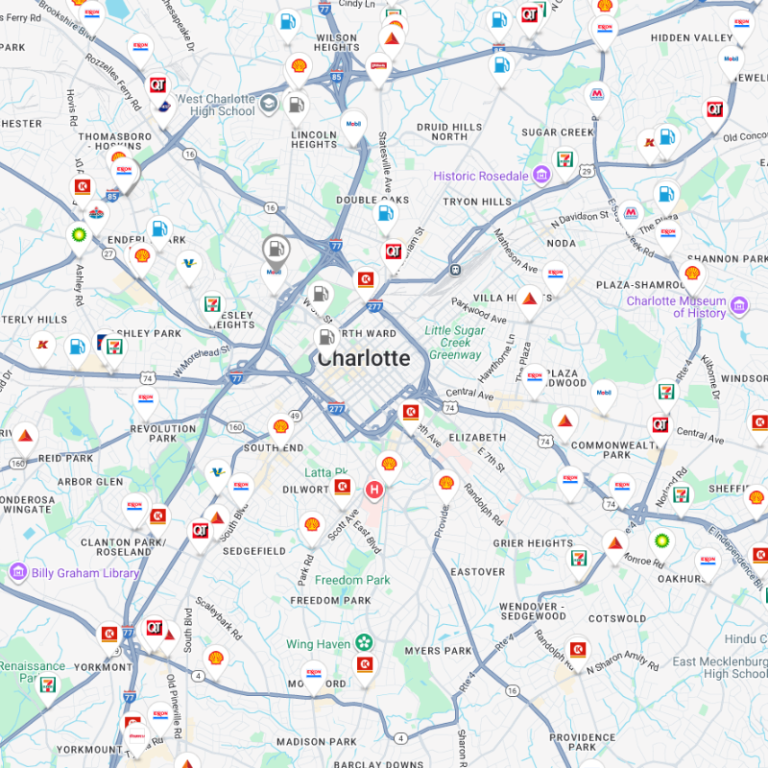

We would add that an initial challenge for many – including public bodies and private enterprises – is finding reliable data in the first instance. Aside from understanding the adoption curve at a granular level, demographic, traffic count, mobility, existing charger network, and electric substation supply data, are all needed to make any modeling process as robust as possible.

Early adopters vs late adopters

When we help retailers formulate the most appropriate EV charger rollout strategy for their portfolios, the shift in consumer preferences and behavior from the early to the later adoption phases is central to our analysis and advice. It’s encouraging that the policy paper recognizes this too.

“Modelling future demand needs to account for where people will live, how they will behave and travel, and how technological developments in the manufacture of electric vehicles, chargepoints, and charging will expand consumer choice.

“An additional complexity is that chargepoint availability itself creates demand. If motorists are to feel confident to transition to EVs, chargepoint rollout needs to stay ahead of demand. It is also likely that the preferences of EV early adopters will be different from late adopters.”

Both public and private operators need to keep timing, location, and consumer preference at the forefront of their thinking. Rolling out the right types of chargers, at the right locations, at the right time. Again, we are encouraged that the policy paper considers these factors.

“Areas with seasonal, tourism-related economic activity may need charging infrastructure next to retail and leisure destinations, capable of charging EVs very quickly. Residential areas with lots of flats and terraced housing, away from commercial activity, may need more on-street chargepoints capable of slower, overnight charging.

“Rapid or ultra-fast chargepoints may be in more demand in city centers than in more remote rural areas, as the former is likely to experience more onward journeys through their local area.

“…Without demand modeling, the public sector risks targeting public funds towards locations that the market will serve anyway, paying for chargepoints to be installed where there is no demand.”

This final point is also critical for retailers exploring EV charging. One of the key use cases we’ve worked on with our customers is ranking their location according to demand for charging through the adoption curve. As the policy paper identifies, the types of consumers, when they adopt EVs, and the journeys they take, are key factors in determining which locations should be prioritized for charger rollout.

You can read about Kalibrate’s work on the changing EV driver, how businesses are responding, and the role of data in our Electric Evolution report.

The policy paper should be commended for recognizing the central role geospatial insight will play in any successful charger rollout strategy. The paper highlights some of the most critical challenges not just for public bodies, but also for commercial organizations looking to draw EV drivers to their locations and build valuable relationships long into the future.