At a time when fuel volumes in many global regions remain below pre-pandemic levels — and in some cases continue to decline — this growth is a welcome sign of resilience.

Kalibrate collects and analyzes volumetric sales and site attribute data from over 7,000 retail gasoline locations across Canada. This proprietary data offers a comprehensive view into national and regional market performance and helps retailers make more confident decisions.

National highlights: year-over-year growth across the board

In Q1 2025, retail gasoline volumes rose by 3.1% compared to the same period in 2024. Diesel volumes at retail gasoline stations also saw impressive gains, up 6.1% year-over-year. This growth is particularly significant in the current context, as many fuel retailers worldwide are still seeing volumes fall short of 2019 benchmarks.

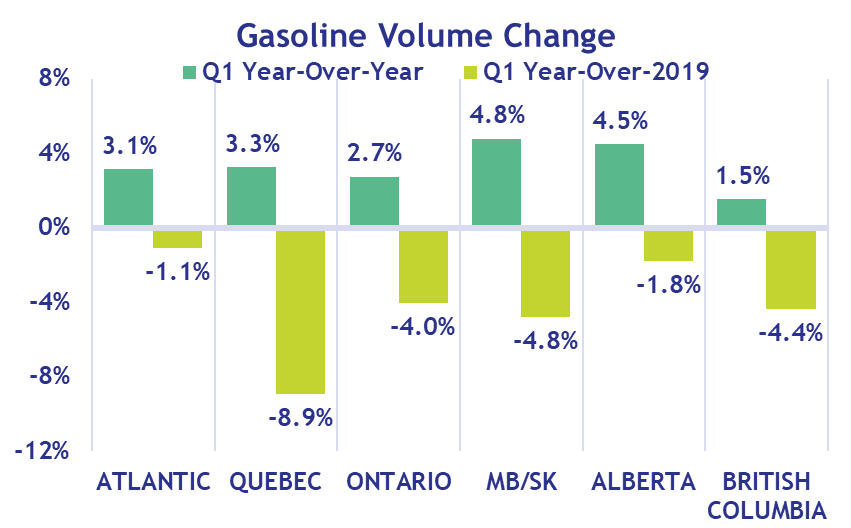

Regionally, all parts of Canada experienced gasoline volume growth. Manitoba and Saskatchewan led the way with a 4.8% increase, while British Columbia posted a more modest 1.5% gain. Despite being the lowest, BC’s growth is still notable given the West Coast’s evolving fuel landscape.

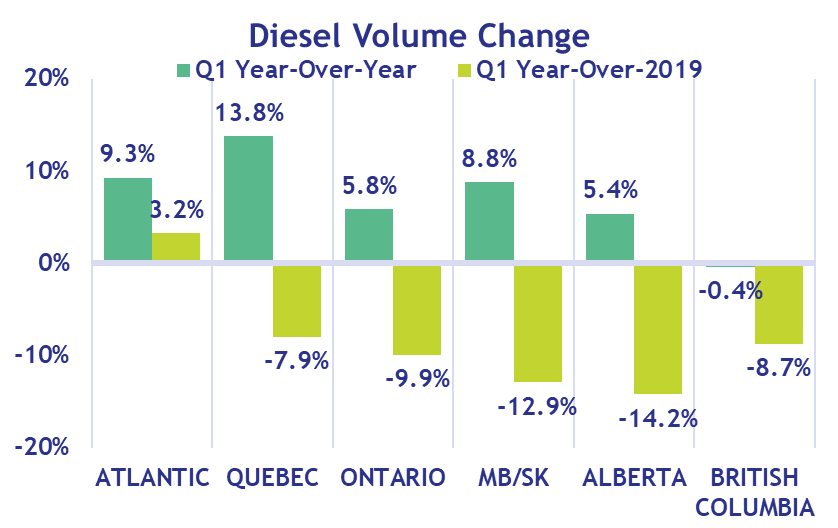

Diesel demand at retail gasoline stations also increased across most of the country, with Quebec standing out at 13.8% year-over-year growth, and Atlantic Canada following closely at 9.3%, while British Columbia saw a small decline in diesel volumes of 0.4%. Diesel demand at retail gasoline stations is more elastic, with additional alternatives available through bulk and cardlock fueling channels, along with the growing use of renewable diesel, particularly along the West Coast.

A slow but steady return to pre-COVID levels

While Q1 2025 results are encouraging, the longer-term picture still reflects the impact of COVID-19. When comparing current volumes to Q1 2019, some regions are nearing a full recovery. Atlantic Canada’s gasoline volumes are now just 1.1% below pre-pandemic levels, and Alberta is close behind at 1.8% below. Quebec, however, remains further from recovery, with gasoline volumes still 8.9% below Q1 2019.

On the diesel side, Atlantic Canada is the only region that has surpassed its pre-pandemic volumes, now 3.2% above Q1 2019 levels. Other provinces still have ground to cover, with Alberta showing the largest gap at -14.2%.

Data-driven insights for fuel retailers in Canada

Kalibrate’s Canadian dataset offers valuable insights into volume trends, regional differences, and emerging opportunities. Our Q1 2025 report includes data from more than 400 cities and towns across the country.

Explore the full list of surveyed markets, or use Kalibrate’s Site Select online mapping tool to find sites in the Canadian database.

Data can be accessed through:

- Ad hoc data packages – hand pick the sites, markets, and frequency of the data you need.

- Site level data packages – prepay for quarterly or annual data at lower rates.

- Kalibrate Market Intelligence subscription – access a fully customizable, interactive display of volumetric, station attribute, and spot pricing data

Ready to take the next step? Submit your request for volume data here.