Third‑party delivery is no longer a niche convenience channel but is a material and growing share of restaurant sales. For many brands, delivery now represents a double‑digit percentage of revenue, yet it remains one of the least understood parts of the business. While operators typically know how much of their sales come from third‑party delivery, they often lack clarity on a more fundamental question:

Who are these delivery customers, where are they coming from, and how does delivery change the economic and spatial footprint of the restaurant?

This blind spot matters.

Decisions around site selection, trade area definition, cannibalization risk, and impact forecasting all depend on accurately understanding customer behavior. Third‑party delivery introduces a fundamentally different set of consumer trade‑offs – convenience, distance, fees, speed, and fulfillment constraints – that cannot be analyzed using traditional in‑store assumptions.

At Kalibrate, we’ve developed a new methodology to bring clarity to this challenge.

The core insight: Delivery customers behave differently

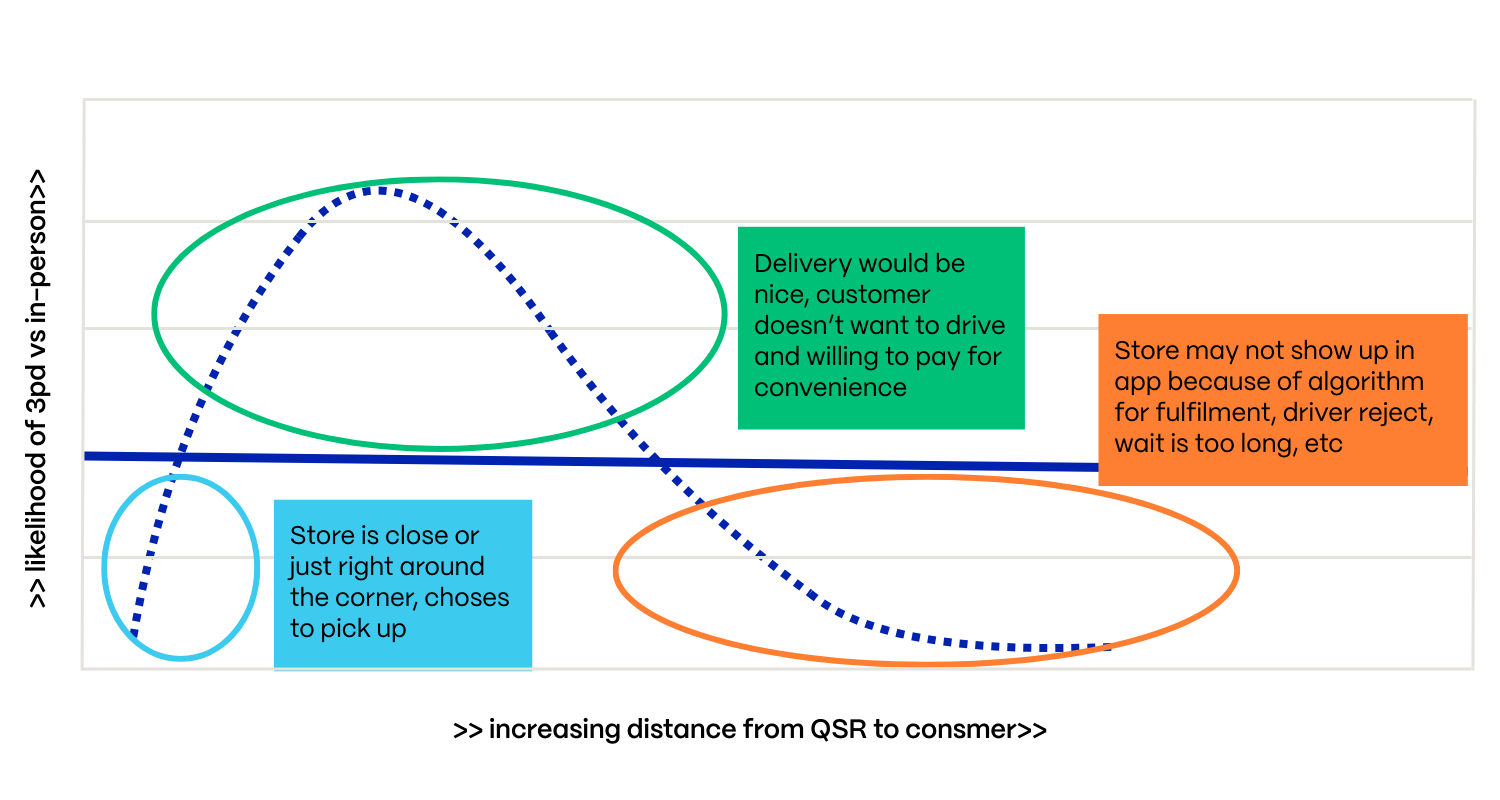

At the heart of our approach is a simple but powerful insight: the relationship between distance and demand looks very different for delivery customers than it does for in‑person diners.

Historically, restaurant demand followed a familiar pattern—customers closer to the store visit more frequently, and likelihood of visit declines steadily with distance. This logic underpins most traditional trade area and impact models.

Delivery disrupts this dynamic.

Across hundreds of brands and thousands of locations, we observe consistent behavioral patterns:

- Very close customers are less likely to choose third‑party delivery, as the cost and friction of delivery outweigh the convenience.

- Mid‑range customers—those who are far enough away to feel friction but still within a reasonable delivery radius—show a stronger relative preference for delivery.

- Distant customers eventually drop off again due to awareness limits, app algorithms, fulfillment constraints, driver rejection, and food quality concerns.

The result is a distinct “delivery sweet spot”—a geographic zone where delivery is disproportionately likely relative to in‑person visits.

Importantly, this pattern holds across urban, suburban, and lower‑density environments, with the shape of the curve adjusting naturally based on density.

The problem operators face: Flying blind

Ironically, third‑party delivery has reintroduced a problem the industry thought it had solved.

Before mobile location data, understanding customer origins required expensive intercept surveys or imperfect loyalty programs. Mobility data transformed that process, giving operators a clear view of in‑person demand.

Third‑party delivery has created a new “fog of war.” Because delivery platforms rarely share granular customer location data, most operators know their delivery sales mix—but not their delivery customer geography.

Without this insight, brands risk:

- Misjudging cannibalization between stores

- Under‑ or over‑estimating the impact of new locations

- Applying in‑store trade area assumptions to delivery sales

- Making site decisions with incomplete demand signals

Kalibrate’s methodology: Rebalancing in‑person demand to reveal delivery demand

Our approach bridges this gap by combining observed in‑person behavior with empirically derived delivery behavior patterns. At a high level, the methodology works as follows:

- Start with what is known: Clients provide the split between in‑person and third‑party delivery sales at the store level.

- Leverage proven in‑person demand distributions: Using mobility‑based data, we understand where in‑person customers originate at a highly granular geographic level.

- Rebalance demand spatially: The model redistributes delivery demand across the trade area, expanding it in some zones and contracting it in others to reflect preferences for delivery.

The result is a modeled delivery demand surface that answers a previously unanswerable question:

“If X% of my sales are delivery, where are those sales actually coming from?”

This is not a replacement for direct third‑party data when available—it is the next‑best, behaviorally grounded alternative.

Why this matters

By isolating and modeling third‑party delivery demand separately, operators gain sharper insight into:

- True trade area driven by delivery

- Cannibalization risk between proximate locations

- Impact assessments for new store openings or closures

- Market prioritization based on delivery‑heavy demand zones

- More accurate forecasting in a multi‑channel world

Understanding how delivery demand behaves—not just how much there is—has become essential.

Kalibrate’s methodology brings that understanding into focus, enabling operators to plan with confidence in an increasingly complex channel mix.