The idea of mobility hubs is not a new one; the idea has developed in Europe and the USA over the last 20 years. Mobility hubs as a concept have spanned fuel-first style travel centers, park-and-ride, or locations for connecting different types of public and private transportation.

In each instance, the growth of electric vehicles (EVs) will cause significant disruption – and, for those that understand the shift, opportunity.

The fuel focused mobility hubs that we have seen until recently have evolved from traditional gas stations with the additions of convenience, quality food offers, and, more recently, EV charging. Fuel remains one of the key products in driving profitability of the locations today, but with the emergence of EV, it’s inevitable that gasoline demand will decline over time.

The future of mobility hubs is not just fuel pumps with a smattering of semi-complementary retail offers. Mobility hubs have the potential to be the backbone of customers’ journeys regardless of their mode of transportation. Not only this, but they can serve as a community hub, serving a wide range of local consumers’ needs.

Legislative interventions such as clean air zones will increase the demand for EVs – but they will also mean a growth in demand for transport connectivity. Fuel stations place locational convenience front and center of their strategy – but the requirements of consumers visiting some fuel stations (particularly around urban settings) will shift as the mix of transportation methods diversifies.

Over the last few years, a new generation of mobility hubs has emerged, pioneered by forward-thinking organizations looking to connect and enable sustainable forms of transportation. EV charging stations, public transportation links, and last-mile services, such as ride share and e-bikes, have developed alongside targeted retail offerings to cater for new demand generated as part of the greater shift in how people move. Some of these locations offer traditional fuels, but a growing number do not.

Here, we’ll focus on how the mobility hub could evolve in the context of fuel retailers, retailers that include EV charging as part of their mix, and charging-first concepts.

Fuel retailers

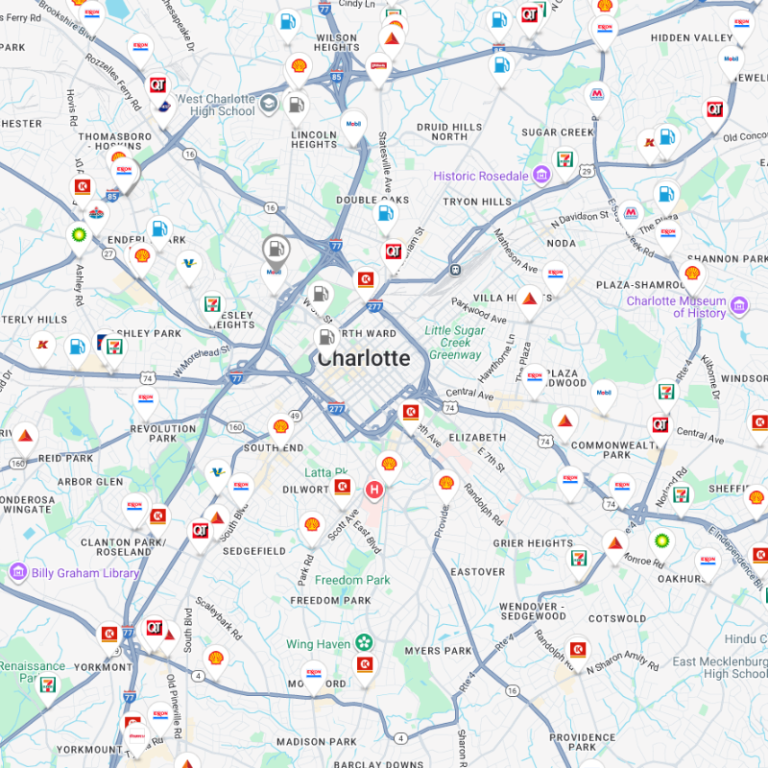

Kalibrate supports clients in more than 75 countries around the world and in almost every one, we’re having conversations with fuel retailers around the transition from running a network of traditional service stations to mobility hubs.

Many of these retailers have started to capitalize on underutilized space at their locations to offer additional services. Convenience, food, and EV are the most common additions to their larger locations with obvious potential. New flagship locations have a very different look and feel with a more balanced offer across fuel, non-fuel and EV charging. Some are going as far as demolishing existing locations and rebuilding with a questionable return on investment.

To truly understand the long-term potential of an existing fuel network, as well as sites in the development pipeline, we need to fundamentally rethink everything we know about what makes a site successful.

EV adoption rates will vary significantly from one town/city/state to the next, so understanding potential EV demand and fuel decline over time at a site level is critical in prioritizing the right investment. As EV demand increases, consumer habits will change. Today a driver may rely on their local fuel station to refill their vehicle, tomorrow they may primarily charge at home or use workplace and destination chargers.

Fuel retailers should prioritize not only which sites to invest in as mobility hubs, but also which have short-term fuel demand decline and limited future potential as potential divestment candidates.

When looking at a potential mobility hub investment it’s important to not just build for today, but to plan for the future. As an example, it may make sense to have six pumps, a convenience store, and two rapid EV chargers today, but in five years, typically less than the time to return on investment, demand may have changed to such a point where two pumps, a bank of 18 ultra-rapid EV chargers and a lounge-style seating area with quality food offer is the most appropriate offering.

Retailers outside of fuel

Retailers today are just getting started with EV charging, but innovators are demonstrating the potential impact EV facilities could have when attracting customers to their locations. Electric vehicles have the potential to be charged almost anywhere, and at-location charging services can drive additional revenue streams.

The shift from ICE to EV is rewriting how people move around. Those that can charge at home are unlikely to frequent their local fuel station as they did when driving an ICE vehicle. When not on the road, those that do not have charging facilities at home will gravitate towards convenient ultra-rapid chargers near their homes or at a destination such as a local grocery stores, where they can make effective use of their time whilst charging. In addition to this, natural stop points on longer journeys will change and the opportunity opens for mobility hubs where fuel stations are not located today.

This opens a significant opportunity for retailers to develop mobility hubs, however there are relatively small number of locations where mobility hubs make sense today. In the obvious locations where there is high EV adoption and high traffic (vehicular or footfall), retailers are beginning to develop their own mobility hub offer. However, some of these retailers are building for today and not necessarily considering future growth.

As EV adoption grows demand will increase and if there’s one thing EV drivers don’t like, it’s queuing to charge. Having sufficient chargers to support future demand, or at the very least having the power supply and space in place to add additional chargers over time, will ultimately determine the long-term success of the location.

Charging-first EV hubs

For EV-first style mobility hubs – those where EV charging in the primary pull factor – understanding EV adoption is even more critical. So too is understanding onward journeys – especially connections to other types of transit and they onwards trips taken by customers. Knowing the customer is even more vital too – because EV-first hubs will need to understand the right ancillary services to differentiate their site from others.

How Kalibrate helps

Regardless of whether you are a fuel retailer or not, the fundamentals of developing a successful mobility hub, offering are the same.

- Trade area analysis – MMD and trade area rules

- Data – demographics, segmentation, traffic count, foot traffic/mobility

- Understanding current and future potential – early adopters/early majority & charging preference

- Understanding where there is not (divestment or no action) short-term fuel demand decline (fuel retailers only), locations where a high percentage of customers can and do charge at home in non-transient locations