Make smarter fuel planning decisions with Kalibrate

Underpinned by advanced predictive modeling, Kalibrate Fuel Planning gives you total visibility over your fuel and convenience retail network

Ready to get started? Reach out to schedule a demo

Why choose Kalibrate Fuel Planning?

Advanced planning software to place your network ahead of the competititon

Forecast new site performance

Understand fuel volume potential as well as c-store, QSR, car wash, and EV charging.

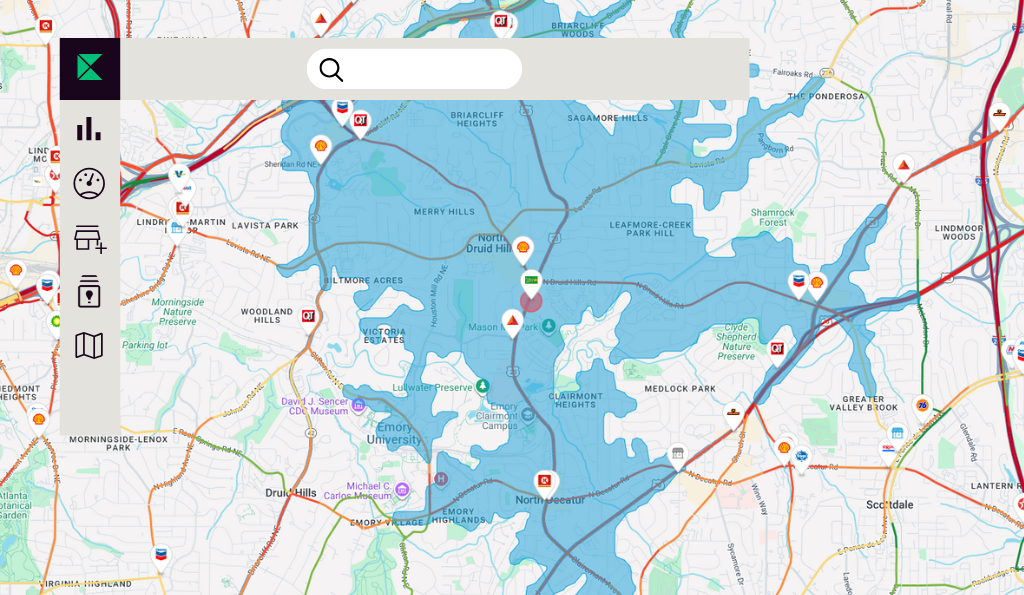

Identify untapped demand

See where your whitespace opportunities exist to grow and identify the best sites ahead of your competition.

Simulate network changes

Add pumps, open sites, close sites, invest in c-store? See how changes would deliver return on investment.

Build 3- and 5-year plans

Think strategically rather than tactically. Prioritize investment to projects that increase volumes and profitability and plan for the long term.

Kalibrate Fuel Planning key features

Kalibrate Fuel Planning key features

A comprehensive dataset

Kalibrate’s fuel and convenience dataset uncover the factors driving performance across your sites.

- Over 100 site characteristics gathered

- Characteristics cover all fueling and ancillary services

- A complete picture of your sites and their competitive environment

Ground truthed by our expert team, it’s the only dataset that captures the holistic performance across fuel, c-store, and QSR.

Site forecasting to identify potential

Kalibrate’s 7 Elements and modeling methodology to understand how a site is likely to perform before you invest or make changes.

- Discover the value of acquisition targets before you act

- Save time in the field by identifying hot spots worth your attention

- Respond intelligently to opportunities and competitive change

Proactively identify the best potential sites for growth and stay ahead of the competition.

Benchmark your performance

See how your sites compare to the competition on a site-by-site or network level. Identify sites that could capture more volume and use our insight to discover what actions to take.

- Understand market share and site share

- See when you’ve reached market saturation

- Discover where you have opportunities to grow

Knowing your market position is a vital capability when deciding where and when to invest.

Run simulations to model network scenarios

Apply Kalibrate’s fuel and convenience model when opening, closing, or upgrading sites. See how volumes would be impacted and manage cannibalization to grow market effectiveness.

- Model adding or removing pumps

- See the impact of adding or upgrading c-store

- Make holistic site decisions

Maximize the value of your forecourt by optimizing the full mix of revenue streams.

Client Stories

Ready to see more?

Contact our team to arrange a demo

Answer

Can I forecast fresh food, convenience store, and QSR as well as fuel?

Yes! Kalibrate Fuel Planning allow you to model fuel, c-store, restaurant

Understanding why customers come to your locations (i.e. what the volume magnets are) is a major output of the tool. Once you understand the reasons why some sites work and others don’t, you can start to model changes at each site to maximize performance.

Answer

Can Kalibrate use my proprietary site and brand data and use that in the modeling process?

Yes, as long as the client data correlates to site performance. Otherwise, this data might only be use for informational and graphical purposes.

Answer

Do I need a network planning tool if I don’t intend to build new sites?

Forecasting the potential of new-to-industry sites is a key use case for Kalibrate Fuel Planning, but it’s not the only one.

You can also use the tool for network optimization, mergers and acquisitions, network rationalization, and reacting to market changes.

Most compellingly, Kalibrate Fuel Planning can simulate combinations of these scenarios, for example, the arrival of a new competitor, alongside the rebrand of an acquired site, and the divestment of another site nearby.

Answer

How does Kalibrate gather the market data?

We utilize the most appropriate data collection technique in each situation, in order to produce an accurate, reliable network planning model in each market.

In most markets, we send our own people into the field to conduct on-site surveys. In other markets, we work with third parties.