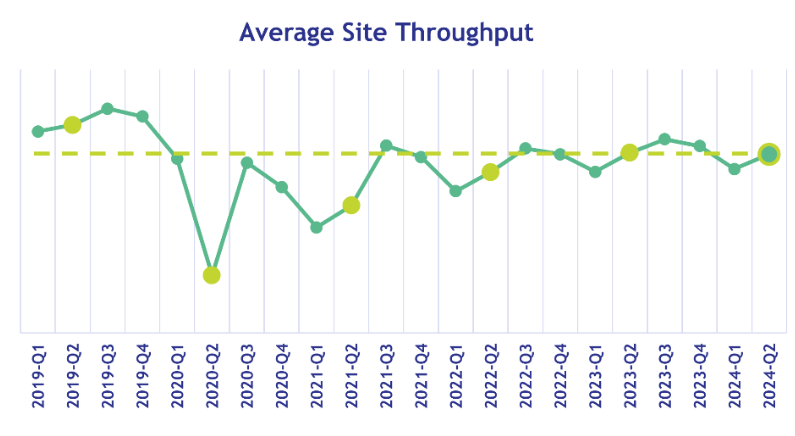

The average site throughput sales at Canadian gasoline stations in the second quarter was 0.4% lower compared to a year ago and 6.2% lower than in the second quarter of 2019. Average site throughputs have improved since the second quarter of 2020, when lockdown measures to curb the spread of the coronavirus significantly reduced fuel sales. Since then, fuel sales have recovered but remain below pre-pandemic levels. Several reasons may have contributed to reduced fuel sales:

- higher fuel prices compared to a year ago, mainly due to higher crude oil prices and higher fuel taxes

- economic factors, including lower employment growth, lower GDP growth and higher unemployment compared to last year

- greater fuel efficiency of the fuel fleet as electric vehicles make up a larger percentage of the fleet and older, less fuel-efficient gas-powered vehicles are retired

- work-from-home trends are higher compared to before the pandemic

Understand market trends in more than 400 markets and towns in Canada with Kalibrate’s newly released half-year data.

Submit your request for volume data here.

To serve you better, in the last year we have ten added new markets:

- Kimberley, British Columbia

- Balgonie, Saskatchewan

- Enfield, Nova Scotia

- Lumsden, Saskatchewan

- Lunenburg, Nova Scotia

- Mount Uniacke, Nova Scotia

- Plessisville, Quebec

- Rawdon, Quebec

- Ste Julienne, Quebec

- Ste Sophie, Quebec

- Highway A20 (Drummondville, Quebec to Quebec City, Quebec)

Market coverage of volume data is available in various means – nationally, provincially, regionally, municipally, or by unique competitive area.

See a complete list of the markets we survey on our website here. Or use Kalibrate’s SiteSelect online mapping tool to find sites in the Canadian database.