Kalibrate regularly surveys major markets globally, collecting over 100 site attributes at every fuel and convenience location within the target geography.

Covering the factors driving gasoline, c-store and ancillary services performance, our market survey data is totally unique. It is the only dataset that captures a holistic picture of the fuel and convenience landscape within the subject market.

This blog looks at Charlotte, North Carolina in the US, but our analysis is available on-demand in markets globally.

Gasoline: Site Share vs Market Share

Opportunities for optimization for the oil majors

QuikTrip outperforms all of its competitors capturing a large amount of market share relative to its network size.

With Exxon, Shell, and BP slightly unperforming in market share relative to site share, the oil majors have room for improvement to challenge QuikTrip’s strength.

Harris Teeter’s performance shows the strength of puling power of grocery.

Gasoline: Market Effectiveness

Market Effectiveness measures how effective a brand is as a retailer compared to competition.

It is a calculation of Market Share divided by Site Share.

- An effectiveness of 1.0 indicates that the brand is performing at the minimum given the investment

- Less than a 1.0 is an indicator that sites are underperforming

- More than a 1.0 means the brand is achieving more market share than expected

C-store: Site Share vs Market Share

Bigger is usually better in Charlotte as the largest brands by site share also enjoy the strongest share. Mid size networks have room for improvement, while Shop Rite shows smaller can be just as impactful with a relatively smaller unit size.

C-store: Market Effectiveness

QuikTrip again leads the way with all the rest with opportunities to improve. Many of the chains in the market have effectiveness scores around 1.0, showing no obvious challenger to QuickTrip in terms of overall market effectiveness. No brand is particularly strong or weak.

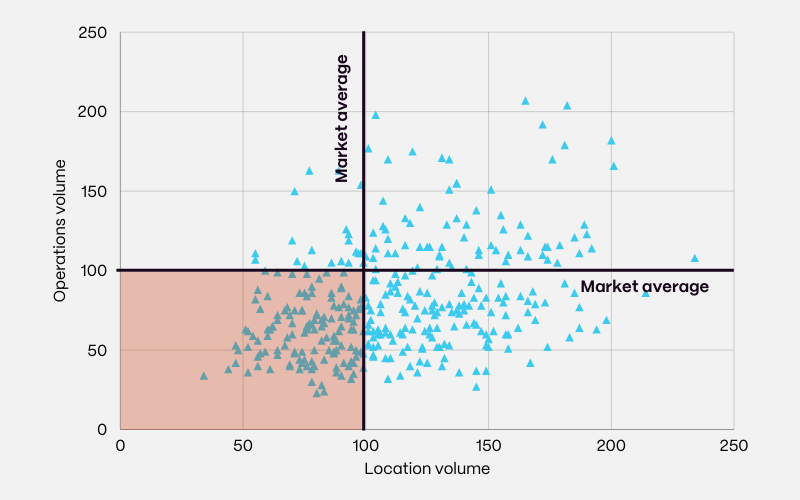

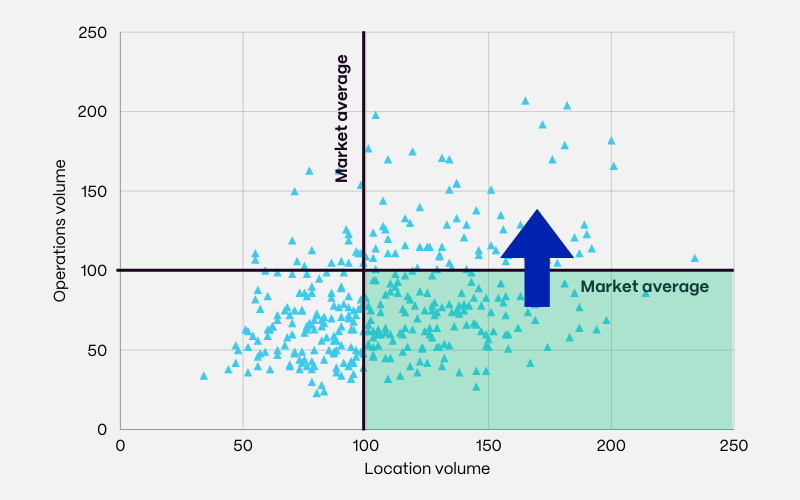

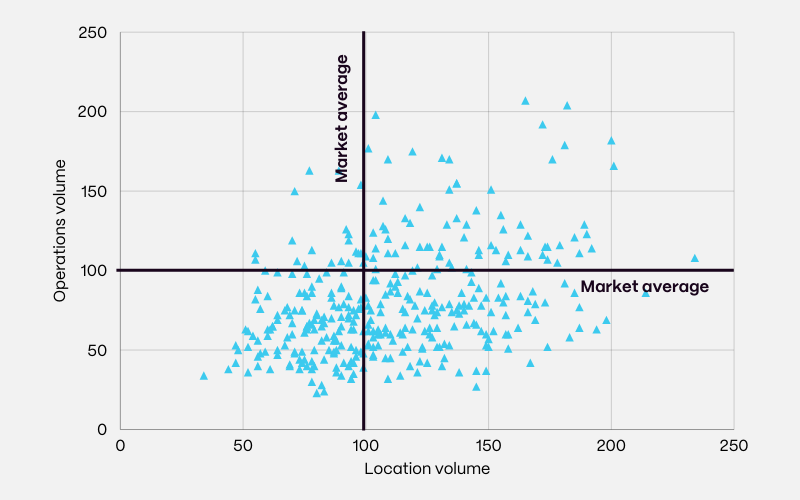

PPQ Analysis

Performance Potential Quadrants (PPQ) break down a network or entire market into one of four categories based on the location strength and actual volume.

Sites with low potential and low performance might be considered candidates for closure.

Low performance, high potential sites should be addressed with urgency – they hold the key to unlocking greater market share and strategic growth opportunities.

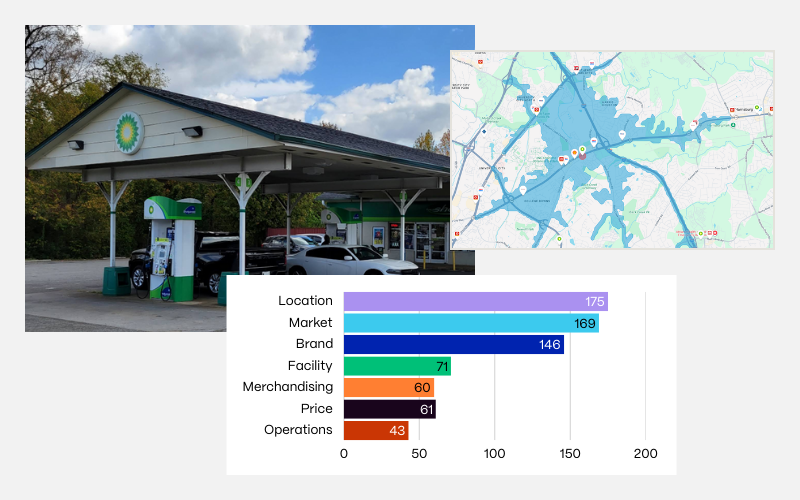

A practical example from Charlotte, NC

To the Northeast of the city, this BP site has excellent market and location potential, but it’s unperforming. This site is a great candidate for targeted investment as all indicators point to untapped opportunity to grow volumes.

How to access the full dataset

You can access our Charlotte market study through the following channels:

- Fuel Site Analysis: The industry standard report to understand gas station feasibility including volume, c-store, and QSR forecasts.

- Raw data purchase: Access to over 100 site characteristics across fuel, c-store and ancillary services, ready to deploy in your choice of GIS.

- Critical insights package: A detailed insights package provides retailers with a complete picture of your network and competitor network performance.

- Kalibrate Fuel Planning: Deploy your data and access all insights within our industry-leading planning tool, and Kalibrate’s proprietary fuel and convenience forecasting model.