When making real-estate decisions that will allow you to meet your strategic and financial goals, you need to maintain a big-picture view of the market, your retail network’s place within that market and the performance of individual sites in your network. With millions of dollars on the line, how do you ensure you make decisions that will maximize your return on investment, across each site and the network as a whole?

What to consider when looking to optimize capital spend

1. Forecast outcomes with a market planning tool

Instead of relying on your gut feel and manual processes, use data, modeling and forecasting to make knowledgeable, more calculated decisions with a tool that allows you to simulate real-estate investment decisions and predict their outcomes. A smart market planning tool using machine learning algorithms can help you gain that big-picture perspective to optimize your capital spend, minimize risks and achieve total site and network profitability.

2. Identify opportunities for growth

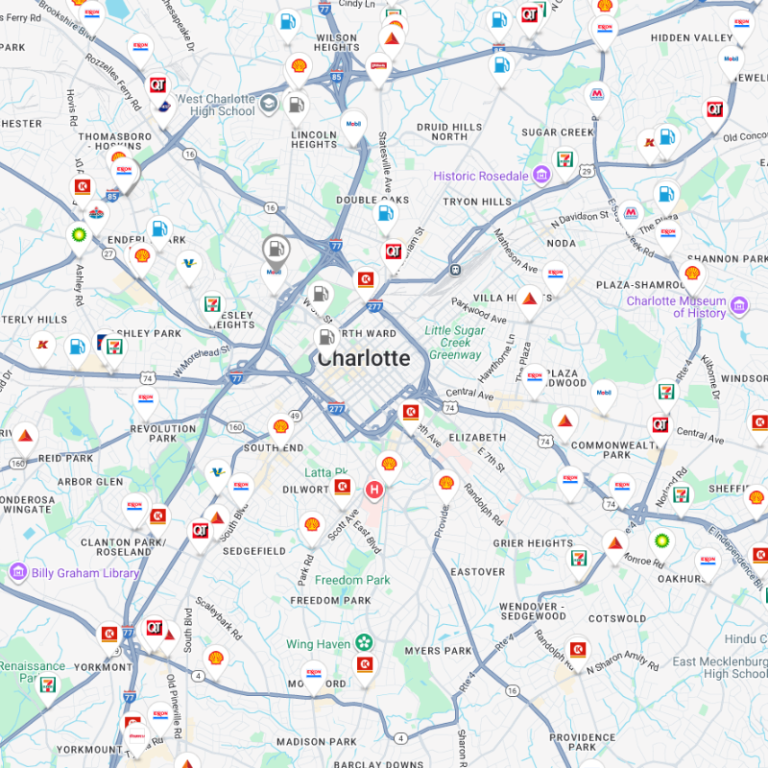

Benchmarking the many elements of fuel and convenience retail success — including market, location and facilities — can help you identify where your strengths and weaknesses lie. An effective market planning tool will allow you to measure your current competitive level relative to your competition.

Conduct analysis to identify sites that are not meeting their full volume potential. Sites with high potential and poor performance levels are the ones you may want to invest in for real-estate changes. Expanding the forecourt or adding new pumps to these sites could bring them back up to speed, ensuring a better return on investment.

3. Determine your goals

Once you’ve identified the sites that are in the best position for improvement opportunities, you need to determine the ‘drivers’ with the most potential at each site, i.e. using the data, figure out which changes would have the highest return on investment. Should you increase the size of the store? Refurbish the forecourt? Alter the brand? How do these changes tie in with your overall strategy and goals for your network? Remember, you only have a limited amount of capital, so you must choose the investments that have the highest potential for gain.

4. Consider market restrictions

You may have high hopes for certain real-estate changes, but ultimately, you’ll always have to work within certain constraints and restrictions. Once you’ve identified the real-estate changes that meet your goals, ask yourself: How realistic are those changes? For example, if you want to increase the size of the store, is there enough land available to actually do that? If you want to put up a new sign, are there state restrictions that will limit the height of that sign?

Having a little bit of flexibility in those constraints may give you a better outcome, so consider all of your options before making a decision. If space restrictions will not allow you to increase the size of the store to 6000 square feet, what if you only increase it to 5000 square feet? Would that have the same effect?

5. Avoid cannibalization

In order to make smart real-estate decisions, you have to be able to manage the bigger picture — a real-estate change may seem to have a high return for one site, but it could steal volume or sales from other sites in your network. When you have multiple sites in one area, how do you make sure that the gain from those changes doesn’t negatively impact your other sites?

Automate for success and optimal returns

Imagine having to run hundreds, even thousands, of simulations and computations within your predictive market planning tool to understand the impact of the potentially millions of different combinations of changes to the drivers, constraints, cannibalization impacts, and how they all tie into your overall goals – what were the lottery odds again?

Now imagine if you could automate the selection of the optimal real-estate changes across each site and the network, within your overall constraints, with a tool that could suggest how to allocate the available capital to improve network performance. And, with careful planning, this tool could help you optimize your real-estate investment without losing revenue in the long run. In the end, you are able to develop a retail network with great facilities, strategic positioning and maximum total profitability.

Any real-estate investment, from building a new site to refurbishing the forecourt of an existing site, can run up into the millions of dollars. Using data, sophisticated optimization models and careful market planning, you can gain a high level of confidence in knowing that certain real-estate investments will result in a high return. If you’re ready to learn more, start right now by speaking with a location planning expert.