Canadian 2020 National Retail Petroleum Site Census — Executive summary

The 2020 National Retail Petroleum Site Census, researched and published by Kalibrate, is a comprehensive enumeration of Canada’s petroleum retail outlet population. This is a unique study: there’s no other single industry or governmental source of such information.

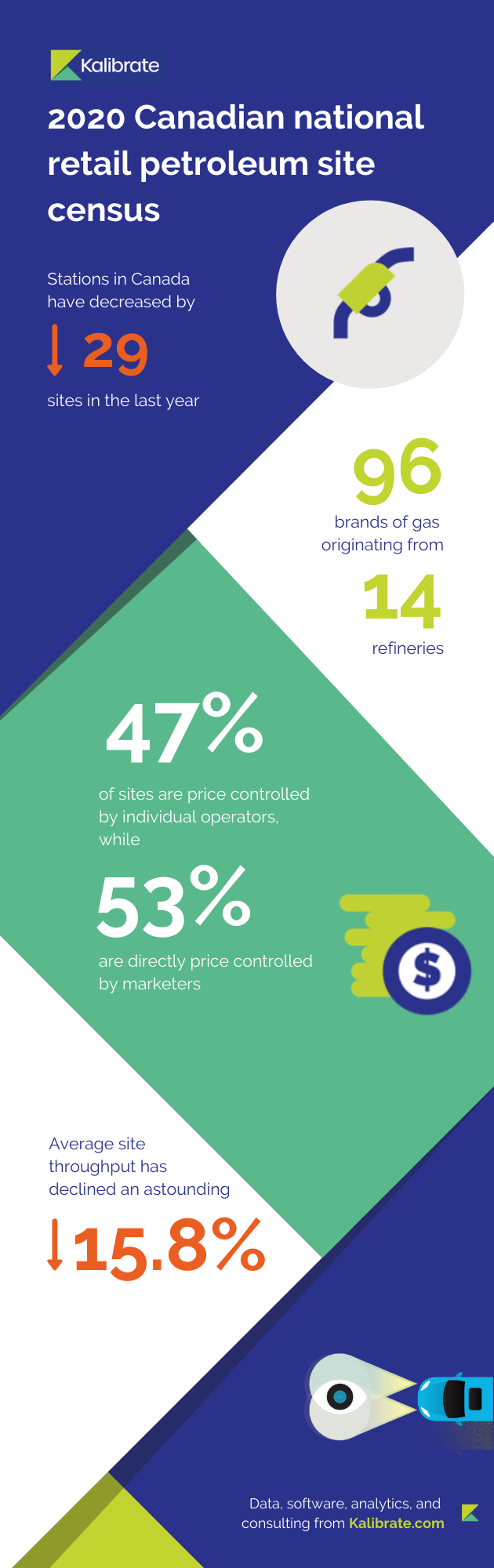

As of December 31, 2020, 11,908 retail gasoline stations were operating in Canada or 3.1 outlets for every 10,000 people. This is a decrease of 29 sites over last year’s survey result, marking a decade in which the number of sites in Canada has varied little – on a net basis declining just 5.9% over that time. This follows the previous two decades in which the number of Canadian retail gas stations fell by nearly 40%.

Diversity in site operation

The census illustrates a continued diversity in brands of gasoline in Canada (we documented 96 different “brands” of gas). However, the refined products sold by these brands originate primarily from just 14 refineries in Canada, operated by nine refining organizations (six of which are integrated refiner-marketers). The fuel brands represented by these refining organizations account for just over 60% of all branded fuel sites in Canada, virtually unchanged in the last decade.

Increasingly, the posted brand at a gas station is becoming less indicative of the marketer relationship or ownership at that site. In 2020, nearly 40% of the fuel marketers in Canada were operating portions of their network under a brand owned by another company, representing 38% of stations in Canada, up from just over 18% a decade ago. These marketers typically operate under a branded supply agreement with the brand owner (often a refiner such as Shell or Esso), and benefits from the brand recognition, marketing support, and loyalty programs of the established brand.

In total, we identified 68 distinct companies marketing gasoline in Canada. Of these 68 companies, 59 market at least a portion of their fuels under their own brands, representing 51% of Canadian stations, down from 68% of sites a decade ago.

Pump price control

Nearly half of the sites in Canada (5,600) are price-controlled by individual operators (retailers or dealers), while 6,300 sites are directly price-controlled by refiner or non-refiner marketers, selling fuel through their controlled networks. The brands owned by the three “major” oil companies (Suncor, Esso and Shell), appear at 42% of stations across Canada; however, only 11% come under their direct price control.

In 2020, the number of gas stations falling under the price control of the refiner-marketers in Canada was virtually unchanged from 2019 at 21%. Still, this was down from 27% a decade ago, attributable primarily to Imperial Oil’s divestment of nearly 500 retail operations in 2016, and more recently (in 2019) when the Prince George refinery in British Columbia changed ownership from Husky Energy to Tidewater Midstream & Infrastructure Ltd., a company not involved in fuel marketing. Husky Energy still has over 400 retail sites in its Canadian fuel network and maintains some Canadian refining presence (an upgrader plant and asphalt refinery in Lloydminster), but the company is no longer directly involved in the production of gasoline in Canada.

Outlet features and offerings

This report also measures the market representation of several site features and offerings: the type of pump service (full, self, or split), convenience store size, car washes, fast food, automotive service, and diesel offerings. Additionally, we have measured the representation of electric vehicle charging stations at gasoline stations in Canada.

The provision of goods or services other than gasoline is vital to the competitiveness and viability of retail gasoline outlets. Research has shown that the gross margin on gasoline itself is rarely sufficient to provide for the operating costs and reasonable return on the operation of these facilities. This has proven to be especially true in 2020, a year that experienced a significant decline in petroleum demand due to travel restrictions to curb the spread of the COVID-19 virus. After steadily climbing for the last three decades, the average site throughput at Canadian sites in 2020 declined an astounding 15.8% to 3.3 million litres annually.

For unrivaled insight into the Canadian petroleum retail market,

purchase the full report

Purchase the full report

Read more articles about:

Fuel pricingSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related posts

Location intelligence

A guide to data centralization in retail real estate

Data centralization gives retail real estate teams a single, reliable source of truth, improving site decisions,...

Location intelligence

White space analysis: How to tap into hidden revenue streams

One of the most important considerations of a growing operator is "how many profitable locations can be supported?"....